Starting on May 1, I began restricting my regular portfolio updates to paid subscribers. However, I’ve decided to publish a free review at the end of each quarter.

Today, we’re diving into how my portfolio looks at the end of H1 2025, as well as everything I’ve done so far this year.

For reference, here’s how my performance has been:

2024 Returns: +173%

2025 YTD Returns: +26.7% (it would be +40.0% at constant currency, but as a European, the EUR/USD fluctuations have acted as a headwind for my portfolio)

Since inception (01/01/2024): +245.9% vs. SPY +32.4%

I’m proud to outperform the market by a wide margin since I started publicly tracking my transactions.

Without further delay, let’s get started.

My Current Portfolio

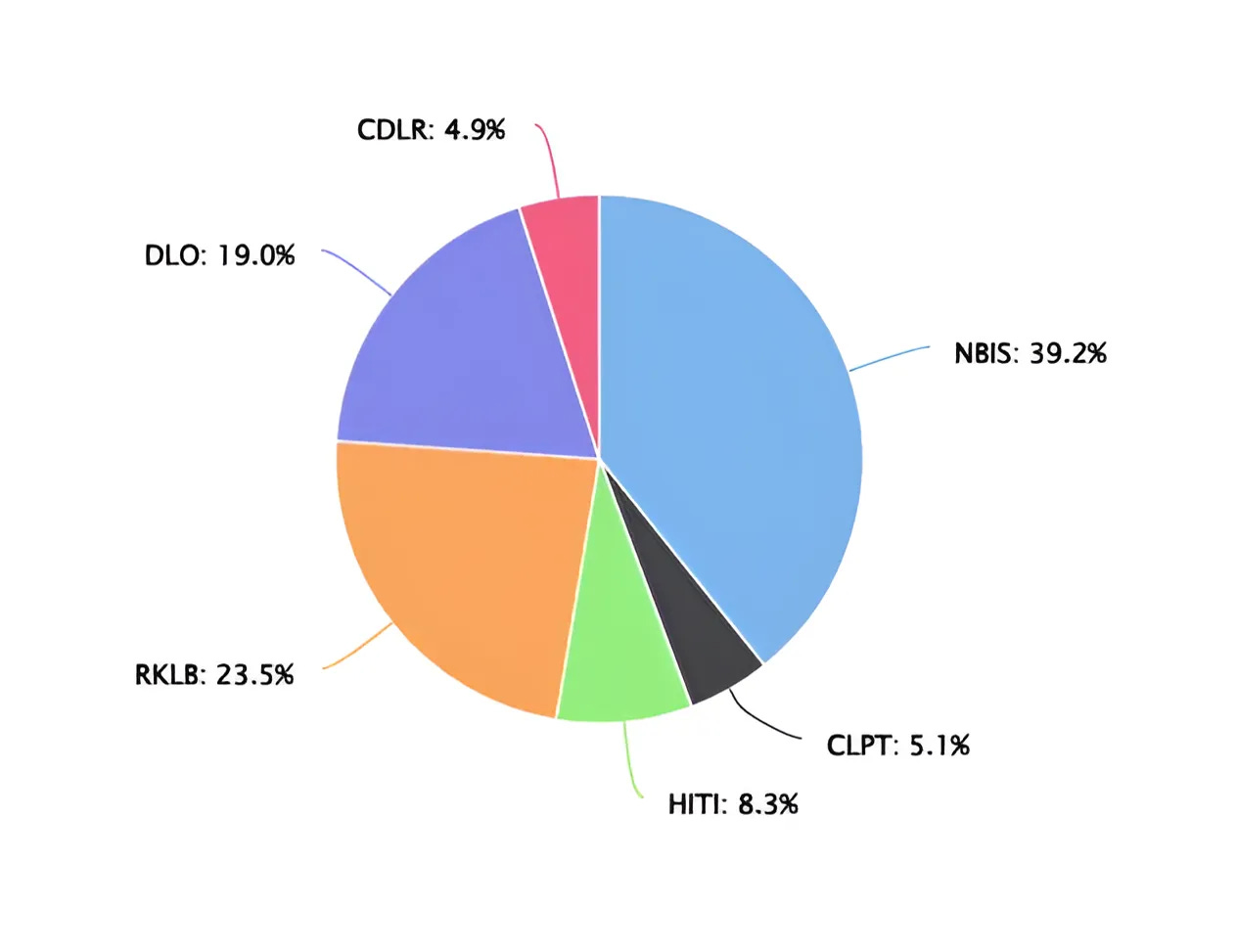

Nebius Group (NBIS) – 39.2%

Average cost: $25.67/shareRocket Lab (RKLB) – 23.5%

Average cost: $4.82/shareDLocal (DLO) – 19.0%

Average cost: $10.09/shareHigh Tide (HITI) – 8.3%

Average cost: $1.69/shareClearpoint Neuro (CLPT) – 5.1%

Average cost: $12.70/shareCadeler S/A (CDLR) – 4.9%

Average cost: $20.28/share

This is how I started the year:

HITI — 42.86% @ $1.86

RKLB — 25.36% @ $4.82

HIMS — 25.10% @ $10.07

REAX — 6.68% @ $5.17

As you can see, there are a lot of changes to discuss (most of which I’ve already explained, but I’ll use this H1 review to condense everything).

H1 2025 Summary

Why did I sell REAX?

As I mentioned before, REAX was a lower-conviction play for me. While I remained confident in its long-term potential, I had much more conviction in NBIS — and that really paid off.

I also discovered something in REAX’s cash flow statement that made me reassess the valuation. Customer deposits were being added to operating cash flow, which inflated the FCF figure without reflecting real cash generation. I had seen that line before but mistakenly believed it was being subtracted. While it was indeed deducted in Q3, the YTD numbers revealed that it accounted for nearly a third of operating cash flow. This adjustment made REAX’s valuation less attractive, even though I still believe the company has long-term potential.

After reviewing their latest results, I don’t regret the decision. A key part of my thesis was the ability to improve gross margins through ancillary services and The Real Wallet, and progress on that front hasn’t been particularly strong.

Despite realizing an 18% loss, reallocating that capital to NBIS turned out to be a fantastic decision.

Why did I sell HIMS?

This was my most controversial decision. I started trimming my position at $60/share, with my final trim at $26. My average selling price was around $40 — nearly 300% returns from my original $10.07 cost basis.

Initially, I trimmed the position to de-risk and reallocate capital to higher-conviction ideas at better valuations like NBIS and DLO. But eventually, I decided to exit completely because I was no longer comfortable holding it. I chose to lock in what were the best absolute gains of my investing life.

As I previously explained, the main reason I sold was HIMS' approach to compounded GLP-1s, which introduces significant litigation risk. At the time, many laughed at the decision, especially when HIMS announced a partnership with Novo Nordisk just weeks later — triggering a rally of over 100%. I acknowledged that the partnership did reduce litigation risk and that’s why the stock exploded, but I also said something felt off and that the partnership could be cancelled in the future. That’s exactly what happened.

Do I regret selling HIMS? No — especially now that I see Andrew Dudum doubling down on this fight. Regardless of what some shareholders say, HIMS is entering a legal grey area by using the 503A exemption as a loophole to bypass semaglutide’s patent. If it were that easy to bypass patents, it would set a dangerous precedent and remove the incentive for drug discovery. That’s why I’m not comfortable with HIMS’ approach.

Of course, until a court makes a ruling, the legality of this strategy is subjective. I don’t blame anyone for staying long. But I believe Andrew hasn’t been fully transparent with shareholders, and that breaks my trust. On the last earnings call, he claimed HIMS is “as blue-chip as it gets” when it comes to legal matters — which clearly isn’t true. Otherwise, why aren’t competitors doing the same?

Also, there’s another question I keep coming back to: if the core business isn’t slowing down, as management has repeatedly claimed, and there are many other verticals to pursue, why the urgency to push compounded GLP-1s? Something doesn’t add up. And I have a rule: never let an investment cost you sleep at night.

That said, I continue to cheer for the company. I know many of you invested based on my research, and I still believe the long-term thesis could play out, but I’m concerned about the potential damage from this legal battle.

That cash was reallocated to NBIS in the low $20s and DLO in the low $8s, so I really can’t complain.

Why did I trim HITI so much?

Many of you know I have a long history with HITI. I still love the company and its leadership, and I’m very grateful I had the chance to interview Raj Grover in person earlier this year.

It went from being my largest position to just 8% of my portfolio, and I don’t regret that — it significantly improved my overall returns.

I still believe HITI is very cheap and has clear multibagger potential, but this sector has shown time and time again that no matter how good the management team is, external factors can be brutal.

One key factor behind the trim was how management was handling issues in the e-commerce segment. As I’ve said many times, I believe the best decision would be to divest that segment and focus on the core business and medical cannabis expansion in Germany. That, combined with renewed pressure from Canada’s illicit market, led me to think the short term wouldn’t be great for HITI. As such, holding such a large position would mean missing out on big opportunities elsewhere — like NBIS and DLO — and I’m glad I made the switch.

In my opinion, the last quarterly results were pretty good. Feel free to read my detailed review here.

Note: My average cost decreased from $1.86 to $1.69 because I sold and re-entered at a lower level. That transaction was communicated in advance.

New Positions – NBIS, DLO, CLPT, and CDLR

I’ve written several detailed articles covering each of these companies. Feel free to check those out if you want to understand the investment thesis behind each position.

Plans for Each of My Holdings

NBIS: I’m not selling or trimming any shares, at least for now. There are many catalysts yet to materialize, and the valuation still seems far from overextended, IMO. It’s obviously not as cheap as when I was accumulating at $20/share, but the reason I went so heavily into this position was exactly because of its asymmetric potential. I always thought that even if it doubled, it would remain cheap — and I haven’t changed my mind. I plan to update my Valuation Model soon, but I’d like more clarity on Avride’s valuation first, so I’ve been patiently waiting for the expected third-party investment.

RKLB: I’ve said this many times, but I’ll say it again: I have never sold a single share of RKLB, and I don’t plan to anytime soon. This is a company I want to own for many years to come, as I sincerely believe this is just the beginning of a fairy-tale story. Here’s what I said in my Q1 earnings review, which still perfectly captures my view:

“Number crunchers may call Rocket Lab overvalued based on traditional multiples — I used to think the same before digging deeper into the company and the sector. But this isn’t a typical earnings story. You're not buying next year’s financials — you’re investing in a future giant of the trillion-dollar space economy. The moat Rocket Lab is building is massively underrated, and in my view, it’s worth tens of billions on its own.”

DLO: In my honest opinion, DLO remains one of the best opportunities in the market right now, with a very attractive risk-reward profile. It also has a bonus: it could benefit from tailwinds related to the uncertainty around tariffs, giving me some diversification outside of US equities. I have no intention of selling my position anytime soon. I’m very confident in Pedro Arnt’s leadership, and as I explained in my last article about the company, I believe this stock has clear potential to yield 400%+ returns over the next five years. Finally, after digging deeper into AZA Finance, I believe it will be a brilliant acquisition that will not only strengthen DLO’s position in Africa and Asia but also enhance its capabilities in stablecoins — an area of growing importance.

HITI: I’m not currently adding to my position because I don’t expect near-term momentum in the broader cannabis sector and still want to see more clarity on the Germany rollout. That said, I’m far more comfortable with this holding now (after the recent Q2 results) and have no intention of selling. At today’s valuation, HITI remains incredibly cheap, and I remain confident that the company’s future is bright.

CLPT: Today, I added more shares of CLPT, bringing my average cost down to $12.70/share. The more I learn about the neurological field, the more I value CLPT’s importance. As I’ve said before, this remains a higher-risk investment, but one with asymmetric upside potential if it plays out. I see it as an investment in the neurological field’s development as a whole — one that doesn’t depend entirely on any single FDA approval. However, it should be noted that the most important upcoming catalyst is the data from AMT-130, a drug being developed by QURE that uses Clearpoint’s platform for direct brain delivery. Things could get volatile in either direction based on those results, but analysts seem confident about them. I plan to hold this position for at least a few years. It will take time before this becomes visible in the financials, but I believe the market has yet to recognize the company’s potential.

CDLR: Before buying CLPT, this was my most recent position, started in March of this year. The investment thesis remains firmly on track, and the company has been executing as expected. I still think it’s an absolute bargain at these levels and feel very comfortable owning it — especially since it’s less correlated with my other holdings and has lower volatility. That said, CDLR is one of the holdings I’d be most willing to sacrifice if I ever need to raise cash. A few reasons: First, a large part of my portfolio is already tied to a capital-intensive industry (via NBIS), and I’ve always avoided heavy exposure to such businesses, as they typically carry more risk — especially here, since CDLR is funding its vessel expansion through debt. Second, being an ADR stock makes it less likely to experience rapid multiple expansions, as many investors can’t easily trade it. Finally, Trump’s stance on wind energy has weighed on sector sentiment (today was a good example), even though only about 10% of CDLR’s backlog comes from North America. The overall sector was already experiencing sentiment headwinds, and although the company’s operations remain solid, this only reinforces them.

To be clear, I still believe CDLR is a great long-term opportunity at current levels. However, if I ever need cash for a different opportunity, I will likely trim it first — especially since its portfolio weighting has shrunk to a very small position. That could always change as things progress.

Final Thoughts

I’m very happy with my portfolio’s performance so far. Despite the headwinds from EUR/USD fluctuations, I’ve managed to deliver strong YTD returns while outperforming the market by a wide margin. Of course, no investor is perfect — some decisions turned out better than others, but I don’t regret any of them. Each choice has been part of a thoughtful process and learning experience.

It’s important for everyone to understand that my portfolio is a high-beta one. Being young and comfortable with volatility allows me to take on more risk, which might not be suitable for most investors. I strongly encourage you to tailor your own portfolio to your personal risk tolerance and financial situation, and always do your own research before making any investment decisions. In my case, I’m not trying to minimize volatility, but to maximize returns with calculated risks — and the reality is that I sleep well holding every single one of my investments.

If you want to receive regular portfolio updates throughout the quarters, feel free to upgrade your subscription to the paid tier.

We also have an active Discord community where members share insights and discuss ideas. I’d love to see you there.

I truly appreciate your support. A year ago, I never thought I’d be in the position I am today, and that’s all because of you. You guys are changing my life, and I want to continue to deserve your appreciation.

Best regards,

M. V. Cunha

Thank you for the valuable sharing.

Wonderful. Thank you.