Copper Explained: The Coming Shortage and Four Small-Caps to Watch

After studying the rare earth elements (REEs) space back in April 2025, I think now is a good time to do the same with copper.

While most investors are focused on the recent surge in gold and silver prices, copper is quietly becoming one of the most important materials in the global economy. Unlike precious metals, copper’s story is not driven by inflation hedging or macro fear, but by real, physical demand tied to how economies are evolving.

Copper is a foundational industrial metal. It is used extensively in construction, power grids, transportation infrastructure, and manufacturing, largely because of its high electrical conductivity, durability, and reliability. Once copper is installed in infrastructure, it is expensive and difficult to replace, and there are very few materials that can substitute it at scale without sacrificing efficiency.

This makes copper demand closely linked to long-term infrastructure buildouts, rather than short-term consumption trends. Historically, copper has been viewed as a cyclical commodity, but today it sits at the center of several secular trends that are reshaping global demand.

Demand: Structural, Not Cyclical

The most important driver of copper demand is electrification. As economies transition away from fossil fuels, electricity usage is rising across transportation, heating, and industrial processes. Expanding and upgrading power grids requires large amounts of copper, from transmission lines and transformers to substations and local distribution networks.

Electric vehicles further reinforce this trend. A battery uses several times more copper than a traditional internal combustion engine car, due to wiring, motors, inverters, and charging systems. When charging infrastructure is included, the copper intensity of EV adoption increases even further.

Renewable energy adds another layer. Wind turbines and solar installations are significantly more copper-intensive than conventional power generation, and they also require additional grid investment to manage intermittency and connect new capacity to demand centers.

More recently, the rapid buildout of data centers and AI infrastructure has become an incremental but meaningful source of demand. These facilities are extremely power-hungry and require substantial copper for electrical systems, cooling, and grid connectivity. As AI workloads scale, so does the need for reliable and efficient power delivery.

Taken together, these trends create a broad, diversified, and long-lasting demand profile for copper. Demand can still fluctuate in the short term, but the underlying trajectory is being shaped by forces that are likely to persist for decades.

Supply: The Real Bottleneck

While demand is supported by strong secular tailwinds, copper supply faces a very different reality.

Developing a new copper mine is a long and complex process. From discovery to production, timelines often stretch beyond a decade. Even when deposits are known, permitting, environmental approvals, financing, and infrastructure requirements significantly slow down development. As a result, supply cannot respond quickly to rising demand or higher prices.

At the same time, many of the world’s existing copper mines are dealing with declining ore grades. Lower-grade ore means more material must be mined and processed to produce the same amount of copper, increasing costs and limiting effective supply growth. This is a structural issue and difficult to reverse.

Years of underinvestment have made the situation worse. After the last commodity supercycle, capital spending across the mining sector fell sharply. Copper projects were delayed, cancelled, or downsized, leaving the industry with a thin pipeline just as demand is accelerating.

Geopolitical and jurisdictional risks also matter. A large share of global copper supply comes from a small number of countries, particularly in Latin America, where political uncertainty, regulatory changes, and community opposition can disrupt or delay production.

The Copper Deficit

When rising demand meets constrained supply, the result is a tightening market.

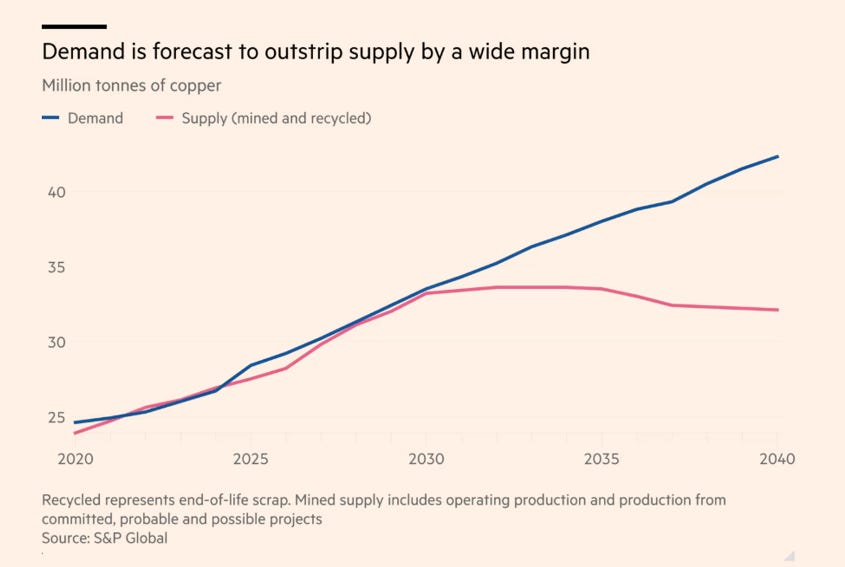

Multiple industry forecasts now expect a global copper supply shortfall to emerge in the coming years, with deficits widening as the decade progresses. While exact numbers differ, the direction is consistent: demand is growing faster than new supply can realistically come online.

The chart above illustrates this dynamic clearly. Once persistent deficits appear, they tend to worsen over time, because supply responses lag demand by many years. Unlike some commodities, copper is difficult to substitute at scale, and recycling alone is unlikely to close the gap.

Historically, sustained copper deficits have required higher prices to rebalance the market. Higher prices are needed not only to encourage new investment, but also to justify developing lower-grade deposits and more complex projects.

This is why copper is increasingly viewed as a strategic metal, rather than just a cyclical one, and why the coming years could look very different from past cycles.

Four Stocks To Watch

The safest way to gain exposure to this setup is through a copper ETF or by owning large, diversified miners. That approach makes sense for many investors.

As you know, however, I usually focus on finding better risk-reward opportunities in small-cap stocks, and that’s what I tried to do here as well.

Before getting into the list, it’s important to note that I’m not an expert in the field, and this is not meant to be a deep analysis of each project. Instead, what follows is a high-level overview of a few companies that stand out based on asset quality, jurisdiction, valuation, and upcoming catalysts.

I looked at dozens of copper-related small caps, and then narrowed things down to a shortlist of four interesting companies.

I also want to make two things clear:

I don’t own any of these companies, nor do I have any direct exposure to copper itself. I studied the sector a few months ago, but never took a position and missed a large part of the rally.

I’m not sure I’d feel comfortable buying right now, especially if gold and silver are close to a short-term top, which could pull other commodities down as well.

That said, I do believe the long-term copper thesis makes perfect sense.

Without further delays, here’s a list of four interesting small-cap copper stocks (in no particular order).

1. Taseko Mines (TGB / TKO.TO)

Taseko Mines stands out from most small-cap copper companies because it is already producing copper today, while also setting up a meaningful second growth engine for the years ahead. This makes it a much less speculative way to gain exposure to the copper thesis.

The company’s core operating asset is the Gibraltar mine in British Columbia, a large open-pit copper mine that has been in operation for many years. Gibraltar produces ~120-130M pounds of copper per year and generates recurring cash flow, providing Taseko with financial stability that most copper developers simply don’t have.

Alongside Gibraltar, the company is bringing Florence Copper in Arizona into production. Florence uses an in-situ recovery (ISR) method to produce copper cathodes, which avoids open-pit mining and results in a much smaller surface footprint and significantly lower operating costs.

Once fully ramped up, Florence is expected to produce ~80-85M pounds of copper per year, with C1 cash costs of roughly $1.10 per pound, placing it among the lowest-cost copper operations in North America. Commercial production is expected to begin in 2026, with full ramp-up occurring over the following year.

This combination of current production at Gibraltar and near-term, low-cost growth from Florence is relatively rare among smaller copper stocks and materially improves the company’s risk-reward.

Geography also plays an important role. Taseko’s assets are located entirely in North America, primarily in Canada and the United States. In a world where copper supply is becoming increasingly strategic, operating in stable, rule-of-law jurisdictions (compared to South America, where many copper mines are located) reduces political risk and enhances the long-term attractiveness of the company’s asset base.

From a valuation perspective, Taseko is materially different from most names on this list. At a market cap of roughly C$3.2B, the company is already being valued as a producer, but still appears to be trading at reasonable multiples, even after the recent rally in copper-related equities. As Florence ramps up and reaches steady-state production, analysts estimate that Taseko could be generating ~C$750M in annual EBITDA by 2027. Put simply, this implies the stock is trading at ~4-5x 2027 EBITDA estimates.

For a copper producer with long-life assets, operations entirely in North America, and a clear, visible path to higher production and lower costs, those multiples look quite attractive, especially in the context of a structurally tighter copper market. However, it’s worth mentioning that results will always depend on several external factors, with the price of copper being the most important. But if you’re gaining exposure, it’s because you believe the expected supply shortage will ultimately translate into higher prices over the long term.

FCF is where the story becomes more compelling. As Florence ramps up, a much larger share of EBITDA should convert into sustainable FCF, given the project’s low operating costs and limited sustaining capital requirements. This gives Taseko the ability to self-fund growth, reduce leverage, or return capital to shareholders, rather than relying on external financing.

Execution at Florence will be critical over the next 12-24 months, but unlike development-stage companies, investors here are not relying on distant production timelines or optimistic assumptions to justify the valuation.

Overall, Taseko offers a lower-risk way to play the copper shortage thesis when compared to other small/mid-caps, combining real production today with visible earnings growth and strong FCF potential in the near future. Even after the recent rally, the valuation doesn’t seem demanding by any means.

2. Magna Mining (NICU.V / MGMNF)

Magna Mining is a stock I started researching a few months ago but never ended up buying. Since then, shares are up more than 100%.

This is not a traditional copper developer. Instead of building a single large greenfield project, the company is assembling a multi-asset operating platform in the Sudbury mining district in Canada, one of the most established and productive base-metal regions in the world.

Sudbury has been mined for more than a century and benefits from existing infrastructure, processing facilities, skilled labor, and permitting frameworks. For Magna, this allows growth to come from restarting and optimizing past-producing assets, rather than spending many years permitting and constructing new mines from scratch. This approach can significantly reduce capital intensity and shorten timelines.

Magna’s current operating asset is McCreedy West, where the company is already producing copper. This is, again, an important distinction versus most small-cap copper names: Magna has real operations today, not just plans.

Recent results highlight that the ramp-up is progressing. In Q4 2025, McCreedy West produced 84,953 tons of ore from the 700 Copper Zone at an average grade of 1.31% copper, alongside meaningful by-product grades in nickel, platinum, palladium, gold, and silver. Production increased 13% QoQ.

More importantly, these improvements are structural rather than temporary. Underground development reached 1,688 feet during the quarter, and diamond drilling footage increased 91% versus Q3, providing better access to higher-quality stopes and improving mine flexibility. Management has indicated that a Life-of-Mine plan and maiden reserve estimate for McCreedy West are expected shortly, alongside updated 2026 guidance.

Magna is entering a clear inflection point, with revenues expected to more than double in 2026 to roughly C$145M, and then grow even further to ~C$390M in 2027 (with solid margins), as mining rates increase and grades improve. If execution continues as planned, the company should move much closer to sustained profitability over the next 12-24 months.

Beyond McCreedy West, Magna controls several additional assets in Sudbury, including Levack, Crean Hill, Podolsky, and others, many of which were previously producing mines. These assets provide multiple paths to growth, all within the same mining camp. Because infrastructure is largely shared, incremental expansion can be pursued at lower marginal capital cost than standalone projects.

From a valuation perspective, even after the recent rally, Magna remains relatively small, with a market cap of under C$900M. When viewed against the company’s rapidly improving revenue profile and expanding asset base, the stock does not appear expensive for a company transitioning from early ramp-up toward a multi-asset producer model.

Magna also offers exposure to nickel and precious metals alongside copper, which adds another layer of optionality. The polymetallic nature of Sudbury deposits gives management flexibility to emphasize the most attractive metals depending on market conditions, something that was evident in Q4 as higher precious-metal grades boosted economics during a period of strong prices.

The investment case remains execution-driven, and operational setbacks could still impact results. However, this is also why the opportunity exists. The company is moving from a development narrative to an operating and growth narrative, and that transition often drives meaningful re-ratings if execution continues to improve. At the same time, it also doesn’t carry the same risk as companies years away from real production.

Overall, Magna is already ramping up production, showing tangible operational progress, and doing so through a differentiated business model that focuses on restarting and scaling assets inside a proven mining district rather than building new mines from scratch. If execution continues as planned and the company truly reaches the expected operational inflection point, the current valuation could still prove attractive even after the recent rally. Magna stands out as one of my favorite picks below a $1B market cap.

3. Talon Metals (TLO.TO / TLOFF)

Talon Metals is not a pure-play copper company, but it earns a place on this list because it offers meaningful copper exposure alongside nickel and other critical minerals, combined with some firm-specific de-risking events that materially change its risk profile.

The foundation of Talon’s story remains the Tamarack Nickel-Copper-Cobalt Project in Minnesota. Tamarack is a high-grade sulphide system where nickel is the primary metal, but copper is a material co-product, alongside cobalt and platinum group metals.

A big shift in the Talon story came in late 2025, when the company acquired the Eagle Mine and Humboldt Mill in Michigan from Lundin Mining. This transaction transformed Talon from a single-asset developer into a multi-asset U.S. nickel-copper company with an operating mine, processing infrastructure, and near-term cash flow.

Eagle is currently the only operating primary nickel mine in the United States. Strategically, this is a major de-risking event. It brings real operating cash flow, execution credibility, and technical expertise into Talon’s portfolio, materially reducing reliance on capital markets compared to earlier-stage developers.

Management has been clear that cash flow from Eagle is intended to be reinvested into: 1) extending Eagle’s mine life, 2) accelerating exploration across Michigan and Minnesota, 3) advancing permitting and engineering at Tamarack, and 4) reducing long-term reliance on equity financing.

In simple terms, Talon is shifting toward a self-funded growth model, which is rare for a company at this stage.

Another key pillar of the investment case is strategic backing. Talon operates Tamarack in partnership with Rio Tinto, which holds a minority interest with the option to increase its stake. Beyond capital, this partnership brings world-class technical expertise in sulphide nickel-copper systems and downstream processing. Talon also has a long-term offtake agreement with Tesla, committing 75,000 tonnes of nickel-in-concentrate, directly tying the project into the U.S. EV supply chain.

On the public-sector side, Talon has secured over $100M in U.S. government funding, including a $114.8M Department of Energy grant to support the Beulah Minerals Processing Facility in North Dakota, alongside additional funding from the Department of Defense and the Defense Logistics Agency. This level of federal support reflects the strategic importance of domestic nickel and copper supply.

Talon just completed a 1-for-10 reverse share consolidation in early 2026. While reverse splits are often viewed negatively, in this context the move appears clearly aimed at meeting Nasdaq uplisting requirements. A Nasdaq listing would materially improve liquidity, broaden the investor base, and increase institutional accessibility.

At this stage, Talon is extremely challenging to value using traditional multiples, but the key point is that the company now has multiple value drivers.

However, it’s also important to be clear about timelines. While Talon now generates operating cash flow from the Eagle Mine, its main long-term growth project, Tamarack, is not expected to begin generating revenues until 2028. This is precisely why the Eagle Mine acquisition was such an important de-risking step. Without Eagle, Talon would still be a pre-revenue developer reliant on external financing to advance Tamarack.

Overall, Talon Metals represents a non-traditional way to express the copper thesis. It is not the cleanest or simplest copper exposure on this list, but it offers optionality at the intersection of copper, nickel, and U.S. critical-minerals policy. A potential Nasdaq listing would also likely be a strong catalyst.

4. Arizona Sonoran Copper (ASCU.TO / ASCUF)

Arizona Sonoran Copper is advancing the Cactus Project, a large copper development located in Arizona, one of the most established and mining-friendly copper jurisdictions in the United States.

Cactus is designed as a long-life open-pit copper mine producing copper cathodes through conventional heap leach and SX/EW processing. This is a widely used and well-understood production method, which materially reduces technical risk compared to more complex processing routes. In an industry where execution issues are common, simplicity is a meaningful advantage.

Jurisdiction is a core part of the investment case. Arizona has a long history of copper mining, and Cactus is located on private land under a state-led permitting framework, with no federal nexus. Compared to many large copper projects globally, this significantly reduces geopolitical and regulatory uncertainty and provides better visibility on timelines.

From a scale perspective, Cactus is a pretty valuable asset. According to the most recent Pre-Feasibility Study, the project hosts over 5B pounds of copper in mineral reserves, with an expected mine life of more than 20 years. Average annual copper production during the first decade is projected at roughly 220-230M pounds, which would place Cactus among the larger copper cathode producers in the United States once in operation.

Capital efficiency is one of the project’s strongest attributes. Initial CapEx is estimated at ~$1B, translating into an industry-leading capital intensity of around $10,900 per tonne of annual copper production. Operating costs are also competitive. Life-of-mine C1 cash costs are estimated at roughly $1.30-1.35 per pound, placing Cactus toward the lower end of the global copper cost curve. As a result, the project offers strong operating leverage to copper prices.

From a valuation perspective, Arizona Sonoran is still a pre-production developer and does not generate revenue. Based on the PFS, however, Cactus carries an estimated after-tax NPV (8%) of ~$2.3B at a $4.25/lb copper price (quite conservative), with an after-tax IRR of ~23%. In simple terms, this means the project’s estimated value is more than 2.5x the company’s current market cap of ~$900M, highlighting how much uncertainty the market is still pricing in around execution.

In that context, the project is expected to generate meaningful FCF once in operation. The PFS outlines life-of-mine FCF of ~$7B, with annual FCF of ~$350-400M during the first decade at the base copper price (going as high as $750M+ in subsequent years). This highlights the long-term cash-generating potential of the asset if it reaches production.

Importantly, the project is supported by strong strategic investors, including Hudbay as a major shareholder and Nuton (a Rio Tinto venture) as a strategic partner, which adds credibility to both the technical and financing pathways.

Catalysts ahead include the completion of a Definitive Feasibility Study, continued progress on permitting, and ultimately a construction decision. All of these are expected to materialize in 2026.

That said, investors should be aware that first production is not expected until 2029, which makes Arizona a long-duration, development-stage investment rather than a near-term cash flow story. Over that time frame, timelines can slip, capital markets conditions can change, and copper prices can go through multiple cycles, all of which can influence valuation well before the project reaches production.

This means the stock is likely to be driven less by quarterly results and more by execution milestones. Periods of weaker sentiment toward commodities or mining stocks could create volatility, even if the long-term fundamentals remain intact.

Overall, Arizona Sonoran seems to represent a quality copper development opportunity, offering exposure to a tightening copper market through a large, long-life, and capital-efficient asset in a Tier-1 jurisdiction. The upside is meaningful if the project advances as planned, but the investment case is best suited for patient investors who are comfortable with the risks inherent in pre-production mining projects and multi-year timelines.

Disclaimer: This article is for informational purposes only and reflects my personal opinions. It does not constitute financial advice, and nothing in this article should be interpreted as a recommendation to buy or sell any security. You should conduct your own research and consider your financial situation and risk tolerance before making any investment decisions.

Risks

While the long-term outlook for copper is supported by strong structural trends, investing in copper-related stocks still comes with meaningful risks.

The most obvious risk is cyclicality. Copper is an industrial metal, and demand can weaken during global economic slowdowns. Even if the long-term supply-demand balance is tightening, prices can remain volatile in the short term, especially during recessions or periods of risk-off sentiment.

Another risk is timing. Many of the expected supply deficits are projected to emerge later in the decade. In the meantime, copper prices can overshoot, undershoot, or move sideways for extended periods. Patience is required here.

There is also funding risk, particularly for smaller companies. Developers and early-stage producers often rely on equity or debt financing to advance projects. If capital markets tighten or investor sentiment toward commodities turns negative, even high-quality assets can struggle to attract funding on attractive terms. I don’t think that will happen with any of these companies, though.

On the supply side, higher prices could eventually incentivize new investment. While long lead times limit how fast supply can respond, a stronger-than-expected wave of new projects or expansions could delay or reduce the severity of projected deficits.

Finally, there are firm-specific execution risks. Mining is a complex business, and delays, cost overruns, operational issues, or permitting challenges can materially impact outcomes, even in favorable commodity environments.

All in all, the copper thesis may be compelling over the long term, but investors should expect volatility and be selective.

Final Thoughts

The thesis for copper and the risk of a structural supply shortage over the coming years is, in my view, fairly clear and straightforward. Demand is being driven by long-term trends, while supply remains structurally constrained.

That said, after the massive rally across copper-related stocks and other commodities like gold and silver, I don’t feel particularly comfortable initiating new positions at current levels. I’m keeping these four companies on my watchlist, waiting for better entry points or clearer confirmation that the next leg of the cycle is still ahead.

When looking at the four names, I find it useful to think of them in two distinct pairs.

On one side, Taseko Mines and Magna Mining both offer exposure to copper through operating assets and visible revenue streams, which reduces reliance on long-dated assumptions. Between the two, Magna stands out to me because of its multi-asset platform, differentiated business model, and the fact that it appears to be approaching a genuine operational inflection point, with production ramping up and revenues expected to scale meaningfully. That combination creates a risk-reward profile that I find particularly attractive.

On the other side, Arizona Sonoran and Talon Metals are more strategic, longer-duration stories, with meaningful cash flow still several years away. These companies are inherently more volatile and require patience. Between them, Talon stands out because it has become materially de-risked over the past year, most notably through the acquisition of the Eagle Mine, which adds operating cash flow, infrastructure, and execution credibility. Combined with important partnerships, government support, and clear firm-specific catalysts, I feel Talon is more attractive as an investment. However, as I explained earlier, Talon isn’t really a pure play on copper, whereas Arizona is.

All in all, I’m staying disciplined and focused on risk-reward rather than momentum. Copper remains a compelling long-term theme, but selectivity and timing matter. I’ll continue to monitor these companies closely and will update you if conditions change or if a setup becomes compelling enough to act on.

Bonus: A Critical Metal Investors Should Know About

Everyone has been talking about REEs, gold, silver, and now copper. But there’s one critical mineral that remains largely overlooked by investors, despite its growing strategic importance. Here’s a short overview: