Three Small Caps I’m Watching (Part 2/3): Zeta Global

This is Part 2 of a three-part mini-series.

The initial plan was to write a single article with an overview of three small-cap stocks I've been watching, allowing you to choose which one to dive deeper into.

However, I quickly realized I have a hard time keeping overviews short.

After asking my subscribers for feedback, I decided to change course and write a separate article for each company, offering a more in-depth analysis (but not as deep as usual).

At the end, I’ll run a poll for paid subscribers to see which one I should explore further.

The second one is Zeta Global (ZETA).

Introduction

Zeta Global (ZETA) is a New York–based marketing technology company founded in 2007 by David A. Steinberg and former Apple CEO John Sculley. The company provides a cloud-based platform that helps enterprises personalize customer experiences across digital channels by combining AI, identity resolution, and behavioral data at scale. Zeta’s software suite is built around its Zeta Marketing Platform (ZMP), which enables clients to unify, segment, and activate consumer data in real time across email, social, web, and connected TV.

What sets Zeta apart is its proprietary Data Cloud, a vast identity graph covering over 245M U.S. individuals, and the company’s ability to use deterministic signals to predict intent. By integrating first-party and third-party data into actionable insights, Zeta empowers businesses to reduce customer acquisition costs, improve retention, and increase lifetime value.

Zeta primarily targets large enterprises with complex customer journeys, offering an alternative to walled-garden ad platforms like Google and Meta. It has gained particular traction in verticals such as retail, financial services, and healthcare, where personalization and compliance are critical.

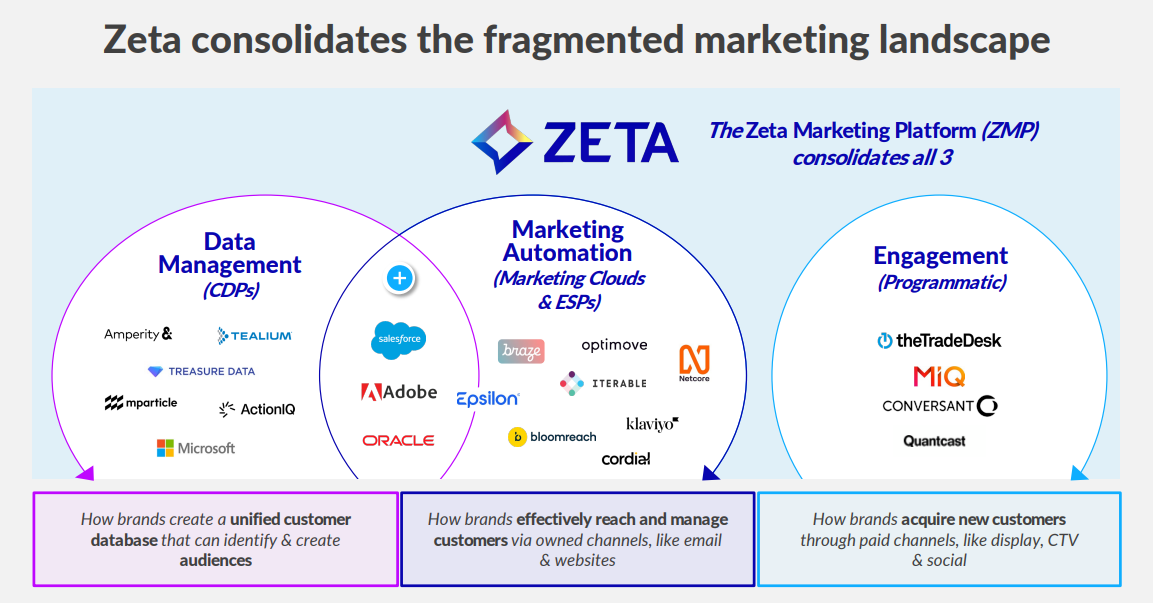

With digital marketing becoming increasingly performance-driven, and the phaseout of third-party cookies reshaping how brands target and measure users, Zeta’s unified approach to data, AI, and omnichannel orchestration positions it well to gain market share in a highly fragmented martech landscape.

Business Model

Zeta Global is a software company that helps large businesses manage the full customer journey, from first contact to long-term loyalty. Its main product, the Zeta Marketing Platform (ZMP), combines customer data, AI, and marketing tools into one system. This setup helps brands deliver personalized messages across multiple digital channels more efficiently and with better results.

A key strength of Zeta is how closely it connects its large consumer database with its built-in AI tools. This allows companies to reach the right people, at the right time, with the right message, across email, mobile, web, ads, and more.

A Data-First Platform: The Zeta Data Cloud

Zeta has built one of the largest consumer databases in the industry, with information on over 245M people in the U.S. and 535M globally. Each profile includes over 2,500 data points, such as purchase history, interests, and online behavior. This data helps companies understand what their customers want and how to reach them.

Thanks to its acquisition of LiveIntent, Zeta’s database now includes even more verified, first-party data, meaning it relies less on third-party cookies, which are being phased out. The company processes over a trillion signals each month and uses them to build hundreds of ready-to-use audience segments.

ZMP Core Architecture: A Fully Integrated Stack

Zeta’s platform consists of three core software modules, which can be used individually or in combination, depending on the client’s needs:

CDP+ (Customer Data Platform):

Acts as the system of record for all consumer information. Now enhanced by LiveIntent, CDP+ offers real-time identity resolution and cross-device tracking. It enables enterprises to unify disparate data sources (internal and third-party) into a single, actionable customer profile. Built with schema flexibility, the system is easily customizable without extensive pre-configuration.

ESP (Email Service Provider):

Zeta Messaging is the company’s omnichannel engagement engine. It provides full-cycle campaign orchestration, from segmentation and personalization to delivery and measurement, across email, mobile, and web channels. AI capabilities dynamically adjust message content, frequency, and timing based on real-time consumer behavior and predicted intent.

DSP (Demand-Side Platform):

Zeta’s DSP activates personalized media campaigns across desktop, mobile, social, and CTV. Anchored in first-party identity resolution (not cookies), the DSP leverages Zeta’s own publisher network and LiveIntent’s inventory to optimize media spend, improve attribution accuracy, and enable closed-loop reporting. This helps Zeta deliver people-based marketing across the open internet at scale.

Agile Intelligence Suite: The Brain of ZMP

AI is native to Zeta’s platform. The company applies a combination of generative AI, machine learning, and natural language processing to convert raw signals into predictive insights and marketing outcomes.

Its Agile Intelligence suite (formerly Opportunity Explorer) provides five modules that generate real-time, actionable insights across customer, market, competitor, location, and audience dimensions:

Automated ingestion of structured and unstructured data;

Dynamic creation of GenAI-driven workflows and campaigns;

Real-time recommendation of next-best actions for both marketers and consumers;

Forecasting of behavior and intent at an individual and segment level;

Campaign optimization across channels with automated content and audience suggestions.

This creates a “flywheel effect”, where Zeta's system continuously learns from every engagement, refining targeting precision and improving ROI over time.

Omnichannel Execution: One Platform, All Channels

Zeta allows enterprises to deploy marketing programs across virtually every addressable channel, including:

Email

SMS

Social media

Connected TV (CTV)

Programmatic display

Website personalization

In-app messaging

Chat interfaces

These channels are not bolted on as third-party integrations, but natively integrated within the ZMP, enabling real-time audience targeting, consistent messaging, and synchronized engagement across devices.

Infrastructure & Privacy by Design

ZMP is hosted on a hybrid cloud architecture, combining public cloud providers (AWS, Azure, Google Cloud) with Zeta’s own private cloud (VMware, Kubernetes, Docker). This enables flexible workload orchestration and cost optimization at scale.

The company also puts a strong focus on privacy, security, and responsible AI use. It has:

Built-in consent management;

AI systems that monitor data use and compliance;

A dedicated team for privacy and policy;

Secure identity protection features.

These measures position Zeta well in a regulatory environment that increasingly prioritizes user control and data transparency.

Full-Stack Control and Long-Term Leverage

Zeta’s full-stack control allows it to capture value across the entire marketing workflow: data ingestion, intelligence creation, and omnichannel execution. This vertically integrated approach reduces the need for third-party point solutions and enables Zeta to offer superior performance at a lower total cost of ownership.

Moreover, Zeta’s relationships with large ad agencies, including 5 of the largest agency holding companies, create a multiplier effect. A single agency client can introduce hundreds of downstream brands into the ZMP ecosystem, enabling significant wallet share expansion over time without a proportional increase in sales headcount.

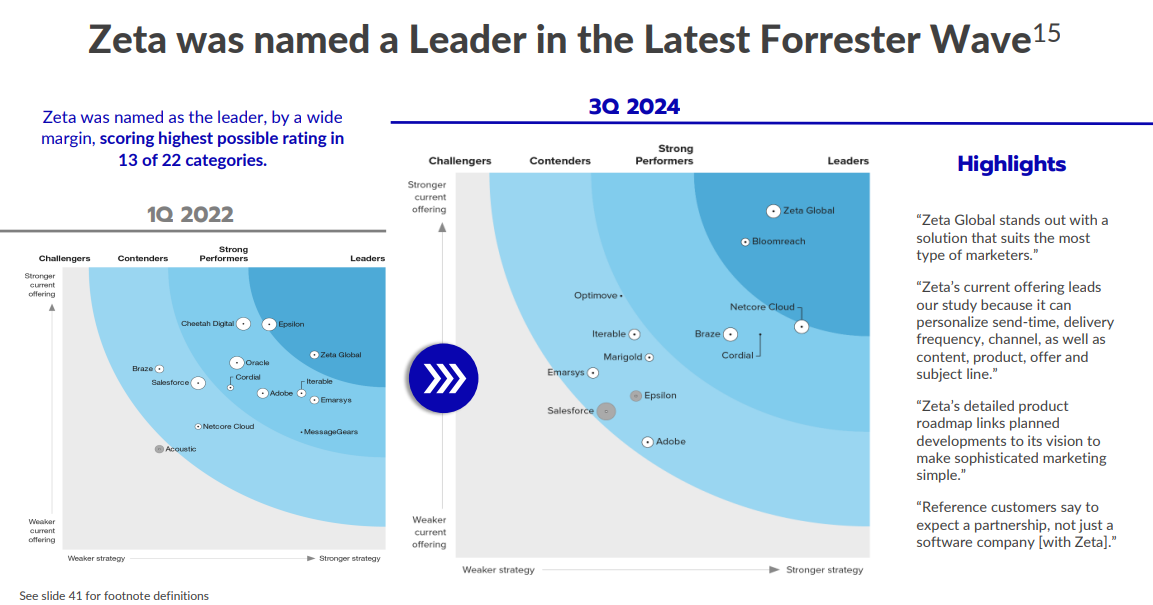

Validation from Third-Party Studies

Zeta Global was named a Leader in the 3Q 2024 Forrester Wave for Enterprise Marketing Platforms, achieving the highest possible score in 13 of 22 categories. Compared to its 1Q 2022 positioning, Zeta significantly widened its lead over peers, demonstrating both a stronger current offering and a more strategic product roadmap.

Forrester highlighted Zeta’s ability to personalize every aspect of marketing, including send time, channel, content, and offer, and praised its commitment to making sophisticated marketing easier for users. Reference customers also noted Zeta’s role as a true partner, not just a software vendor.

This recognition further validates Zeta’s competitive edge in data-driven, AI-powered marketing at scale.

Wrapping It All Up

In simpler terms, Zeta Global offers a powerful all-in-one marketing platform that helps big companies find, understand, and talk to their customers more effectively. What makes Zeta stand out is how it combines three things most competitors keep separate: a massive dataset of real people, advanced AI that turns that data into actionable insights, and tools to reach customers across nearly every digital channel, all under one roof.

Whether it's sending personalized emails, buying ads on CTV, or analyzing what customers are likely to do next, Zeta’s system is designed to automate and optimize the entire process. Because everything is built in-house, not stitched together from outside tools, the experience is faster, smarter, and more cost-effective for enterprise marketers.

In a world where data privacy rules are tightening and third-party cookies are going away, Zeta’s first-party data approach and AI-driven execution give it a major edge. And thanks to strong partnerships with leading ad agencies, the company has a unique path to scale, turning a single client relationship into hundreds of downstream opportunities.

At its core, Zeta is making sophisticated marketing simpler, smarter, and more connected.

Growth Strategy

Zeta Global’s growth strategy is centered on expanding platform adoption, increasing customer value, and strengthening its position in the evolving digital marketing landscape. The company leverages its AI-driven platform, extensive data assets, and enterprise relationships to support both organic and strategic growth across five key areas:

1. Deeper Penetration Within the Existing Customer Base

Zeta serves clients across a wide range of industries and continues to see significant opportunity to grow revenue from within its current accounts. This includes:

Cross-selling additional ZMP modules such as DSP, ESP, and Agile Intelligence;

Unlocking more value from customer data through Zeta’s analytics and AI tools;

Introducing new features that expand use cases and increase platform stickiness.

Scaled customers (spending $100K+ annually), particularly large enterprises with complex marketing needs, represent a long runway for further share-of-wallet growth.

2. Acquisition of New Scaled Customers

To drive net new revenue, Zeta is focused on acquiring additional scaled customers and converting more of them into super-scaled customers (>$1M annual spend). Key initiatives supporting this include:

Ongoing investment in the sales and customer success organizations;

Enhancements to go-to-market strategy and lead targeting;

Use of the Agile Intelligence suite to demonstrate ROI and shorten sales cycles.

Zeta’s growing presence in industries like retail, financial services, and healthcare positions it well to attract more large-scale clients.

3. Continuous Product Innovation

With over 500 engineers and data scientists, Zeta continues to invest heavily in platform innovation to stay ahead of the rapidly changing marketing technology landscape. Areas of focus include:

Advancements in GenAI and ML for campaign creation and automation;

Expansion of the proprietary and third-party datasets feeding the platform;

Enhanced real-time personalization tools and marketing intelligence features.

These innovations support long-term customer retention and increase the breadth of problems Zeta can solve for enterprise marketers.

4. Expansion of Strategic Partnerships and Sales Capacity

Zeta maintains deep relationships with leading global advertising agencies and enterprise partners. To scale these channels more effectively, the company is:

Building a more sophisticated sales operation with a focus on opportunity development and conversion;

Expanding its ability to support indirect distribution and co-sell models;

Strengthening collaboration with agency holding companies that can introduce hundreds of downstream brands to the ZMP.

This strategy amplifies Zeta’s reach without requiring equivalent expansion in direct sales resources.

5. International Expansion

While the U.S. remains Zeta’s core market, the company is selectively expanding into international regions, particularly in Europe. These efforts are often aligned with existing U.S.-based clients who operate globally, allowing for efficient geographic expansion without significant upfront investment.

All in all, Zeta’s growth strategy is built on expanding platform usage among current customers, acquiring new high-value accounts, driving continuous innovation, scaling through partnerships, and extending its reach internationally.

Numbers

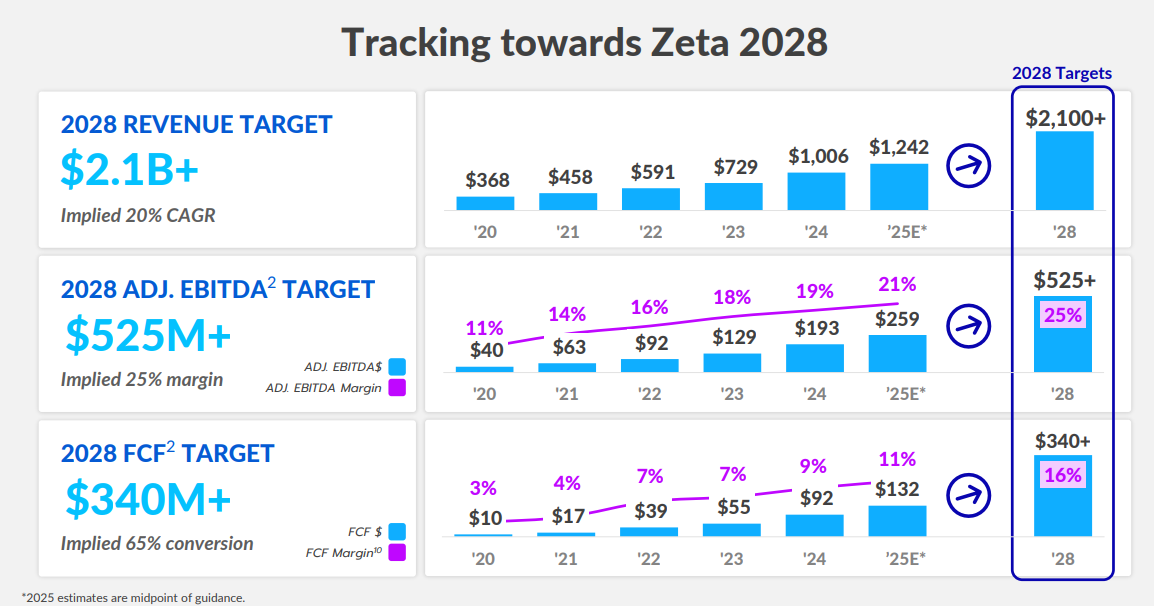

Zeta Global continues to deliver strong top-line growth alongside improving profitability and cash generation.

Revenue in Q1 2025 reached $264M, up 36% YoY, with 26% organic growth when excluding LiveIntent. This marked the 15th consecutive “beat and raise” quarter, supported by broad-based strength (six of Zeta’s top ten industry verticals grew more than 20% YoY)

The number of Scaled Customers (spending $100K+ annually) rose to 548, up 19% YoY. Within this group, Super Scaled Customers (>$1M annual spend) increased 10% YoY.

Average revenue per scaled customer (ARPU) climbed to $467K, up 12% YoY, while ARPU for Super Scaled Customers reached $1.4M.

Importantly, customers who have been on the platform for more than three years are now spending nearly 3x more than newer cohorts, which means they become more valuable over time.

Profitability continues to trend higher. Adjusted EBITDA came in at $46.7M, up 53% YoY, with margins expanding 200 bps to 17.7%, the highest Q1 margin in company history. Management expects further leverage, guiding FY 2025 adjusted EBITDA to $258.5M at a 20.8% margin.

FCF was $28.2M in Q1, compared to $15.1M in the prior-year period (FCF margins went from 7.7% to 10.7% YoY). Zeta is on track to generate $132M in FCF for FY 2025. The balance sheet remains healthy, with $157M in net cash at quarter-end.

Stock-based compensation continues to decline as a percentage of revenue, with FY 2025 expected at $190M (down from $195M in 2024). Share count dilution is projected to fall to 4–6% in 2025 and 3–4% in 2026. The company also repurchased $25M of stock in Q1 and an additional $21M in April.

This is important because it addresses a factor that has been heavily criticized by investors: in recent years, ZETA has significantly diluted its shareholders. While it’s true that the company has managed to increase its FCF/share during this time, the expected slowdown in dilution is a key development to watch.

Looking further out, Zeta’s 2028 targets call for:

$2.1B+ revenue (~20% CAGR from 2024)

25%+ adjusted EBITDA margin (~$525M+)

$340M+ FCF (~65% EBITDA-to-FCF conversion)

These goals are underpinned by continued scaled customer growth, rising ARPU, deeper agency relationships, and operating leverage as the platform matures.

All in all, there’s little to fault Zeta for when it comes to execution over the past few years. While analysts haven’t always read the company perfectly, Zeta has consistently managed investor expectations through prudent guidance, delivering on (and often exceeding) its targets. Today, the business is arguably stronger than ever.

Valuation

Since this is meant to be a high-level overview rather than a deep dive, I won’t build a full valuation model. Still, it’s worth running some quick numbers to gauge whether Zeta looks attractively priced.

Based on management’s 2028 targets, the stock trades at:

Less than 7x 2028 adj. EBITDA

Less than 11x 2028 FCF

Given Zeta’s consistent track record of exceeding guidance, there’s a reasonable chance it will outperform these targets, which would push these multiples even lower.

As I often say: if a business needs a detailed DCF just to justify its current price, it probably isn’t cheap enough.

From where I stand, Zeta does look cheap if it can deliver on its stated goals. I haven’t yet gone deep enough into the business or the sector to assign a high conviction level, but the track record certainly points in the right direction.

That said, while I find the current valuation attractive, I don’t view it as the “obvious bargain” some investors claim. I’ve even seen people argue that Zeta could 10x in a few years, which feels overly optimistic. Using a 20x exit multiple on 2028 FCF suggests roughly a doubling of the current market cap. After factoring in inevitable dilution, that’s less than 100% upside over the next 2–3 years. A higher exit multiple, say 30x, would improve the return profile, but still doesn’t scream “multi‑bagger” in such a short timeframe.

In short, Zeta appears to be trading at appealing multiples and could realistically deliver 20%+ annualized returns in the next few years if it executes well. But, IMO, it’s not the no‑brainer opportunity that some make it out to be. I could definitely be wrong, though.

If I decide to do a deep dive, I’ll build a more detailed model to better quantify the upside potential.

Main Risks

While Zeta’s execution has been impressive, investors should remain mindful of several risks that could influence its growth trajectory and market perception.

1. Competitive Pressure

The marketing technology and adtech space is fiercely competitive, with giants like Google, Meta, Salesforce, and Adobe offering overlapping solutions. These incumbents have vast datasets, entrenched enterprise relationships, and substantial R&D budgets. For Zeta, sustained success hinges on its ability to out-innovate larger rivals, maintain its technology lead, and deliver measurable ROI for clients. Any perceived loss of differentiation could slow new customer wins or lead to higher churn.

2. Sensitivity to Economic Slowdowns

Although Zeta has posted strong growth every year, the company remains exposed to the health of enterprise marketing budgets. In economic downturns, businesses often pull back on discretionary spending, and advertising is frequently among the first areas to be trimmed. A broad slowdown in sectors like retail, travel, or financial services could moderate Zeta’s growth, even if its market share continues to expand.

3. Lingering Impact of the 2024 Short Report

In 2024, Zeta was the subject of a short-seller report titled “Shams, Scams, and Spam”, which caused a steep single-day share price drop and raised concerns among investors. Management strongly denied the allegations, insiders purchased shares, and the company has since continued to deliver strong results. Nonetheless, such events can have lasting reputational effects, increase share price volatility, and potentially draw unwanted legal or regulatory attention.

Overall, these risks underscore the importance of sustained innovation, operational resilience, and transparent investor communication. Zeta’s ability to continue outperforming will depend not just on its platform’s strengths, but also on how effectively it navigates these challenges.

As I said in Part 1 of this mini-series, these are just what I consider to be three of the most important fundamental risks. If I end up doing a deeper dive on the company, I will certainly include more.

Conclusion

At first glance, ZETA also looks like it could be a compelling opportunity. After digging in, I think it’s a much more solid business than I initially expected. The setup is attractive: consistent growth and execution, clear operating leverage, SBC trending down as a percentage of revenue, and participation in a sector benefiting from powerful secular tailwinds and a massive addressable market.

I can see why investors are getting excited. Still, it’s important to keep valuations in perspective. Yes, the stock appears cheap, but I think it’s overly optimistic to expect a 10x return in just a few years. For my own portfolio, I’m looking for asymmetric opportunities, and while Zeta offers plenty to like, I’m not quite ready to put it in that category.

That said, Zeta could still deliver meaningful long-term returns for investors, provided it continues to navigate competitive pressures, potential macro headwinds, and lingering reputational risks effectively.

Again, I want to be clear that I find the current valuation attractive, just not attractive enough for me personally.

I’ll definitely be keeping it on my radar.

That's it! Thank you so much for reading.

Disclaimer: As of this writing, M. V. Cunha does NOT hold a position in Zeta Global.

Good summary n conclusions, thank you. IMO the most risk lies with the goliaths of this industry as in Meta & Google who will be working very hard to stay on top of the marketing ladder. At the same time, it is possible that Zeta may attract a bid premium, and maybe from Ad agencies, if they are perceived to continue their leadership in the industry. Maybe an exciting opportunity but has enuf risks too in the near term.