This article was originally posted on X as a thread on January 20, 2025.

Nancy Pelosi just bought $50k-$100k in call options for TEM.

It’s unusual for her to invest in small-cap stocks, so now everyone is wondering what’s so special about it... Luckily, I was already preparing an article about the company.

Here's an extensive summary of TEM’s investment thesis.

Every article I write is available for free.

If you decide to voluntarily pay for the subscription, I truly appreciate your support!

Introduction

Tempus AI is a cutting-edge precision medicine company founded in 2015 by Eric Lefkofsky. The inspiration for Tempus arose from Lefkofsky’s personal life — his wife’s battle with breast cancer revealed how limited the role of technology was in shaping her care. Determined to change this, Lefkofsky set out to integrate advanced technology into healthcare, addressing a critical gap in the industry.

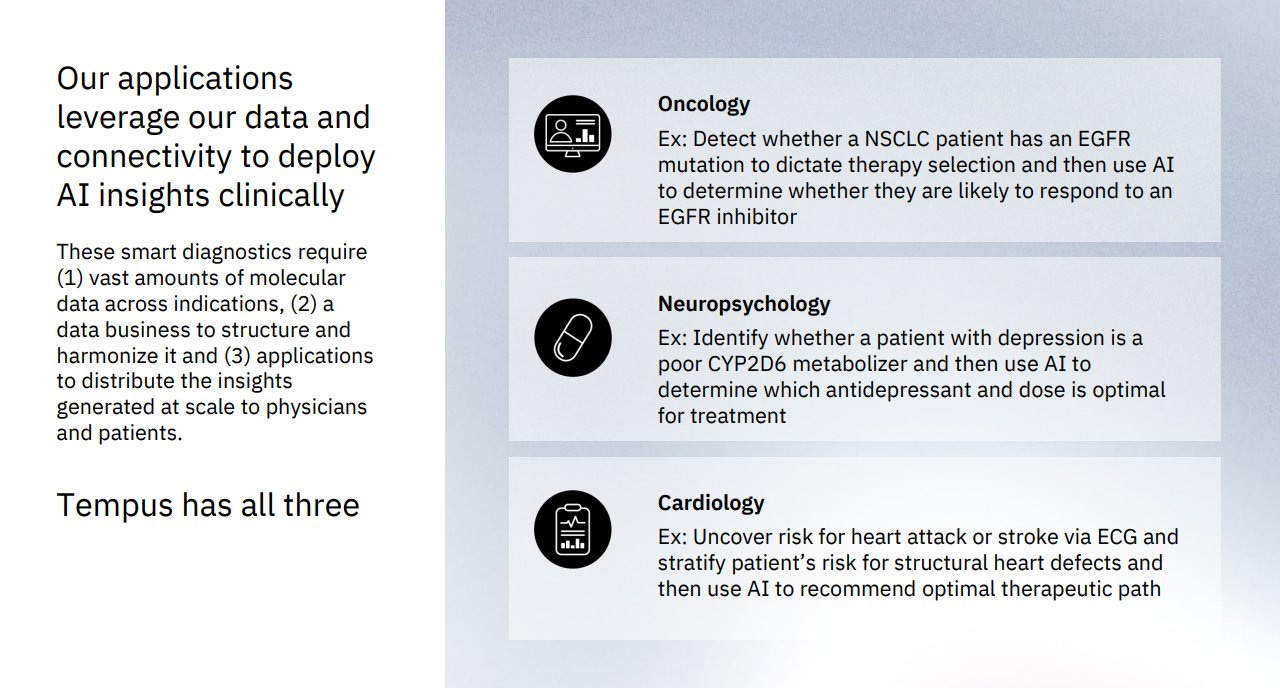

At its core, TEM leverages AI to analyze vast amounts of clinical, imaging and molecular data. Its goal is ambitious yet clear: to revolutionize healthcare by enabling personalized treatment decisions, advancing drug discovery, and facilitating earlier and more accurate disease diagnoses.

Tempus AI initially focused only on oncology, enabling doctors to deliver tailored treatments for cancer patients. This “intelligent diagnostics” model proved so effective that the company expanded its efforts into other critical areas, such as neuropsychology and cardiology.

Today, TEM’s technology empowers thousands of physicians and life science companies, making a tangible difference in patients' lives.

The Booming Market for AI in Healthcare

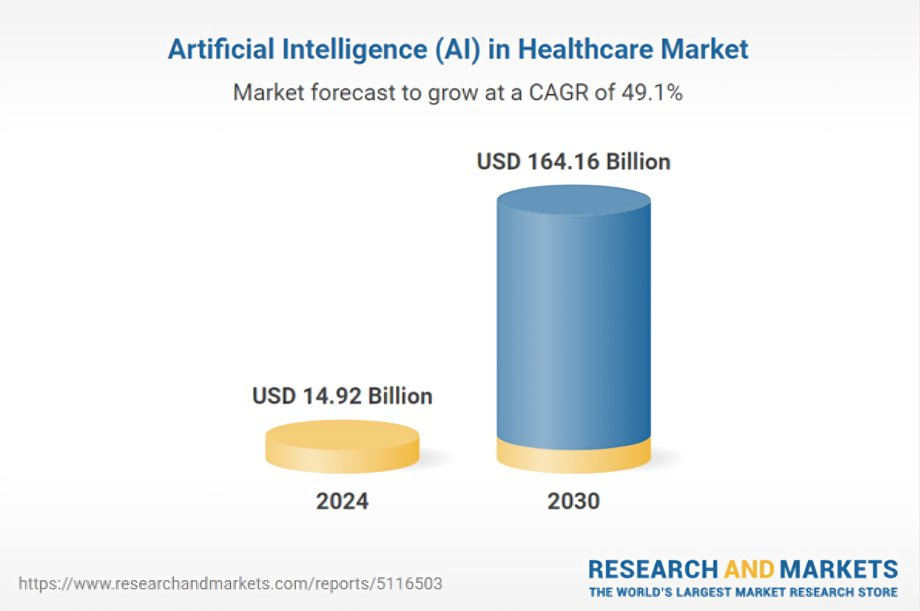

The global AI in healthcare market is experiencing unprecedented growth, projected to expand from $15B in 2024 to a staggering $164B by 2030, representing a CAGR of 49.1%.

This explosive growth is driven by several factors, including:

• Increased Investments: Significant public and private sector funding is accelerating the adoption of AI technologies in healthcare.

• Rapid AI Proliferation: The integration of AI into healthcare systems is transforming diagnostics, treatment planning, and patient outcomes.

• Focus on Human-Aware AI Systems: Advances in AI technology are enabling more personalized and human-centered solutions, which are crucial in the healthcare domain.

Tempus AI is uniquely positioned to capitalize on some of these trends. With its AI-powered precision medicine platform, TEM is not only a pioneer in embedding AI into healthcare workflows but also a leader in driving real-world impact.

How Does Tempus AI Make Money?

TEM operates a highly integrated and scalable business model built on three primary product lines: Genomics, Data, and AI Applications. These segments are interconnected, creating a "closed-loop" system where each reinforces the others, driving network effects and long-term sustainability.

Here’s how they work:

1) Genomics: Diagnostic Testing

Tempus AI runs advanced diagnostic tests, including Next Generation Sequencing (NGS), PCR profiling, and molecular genotyping, for healthcare providers, pharmaceutical companies, and researchers.

• These tests generate molecular and clinical data, which is structured and de-identified before being added to TEM’s proprietary database.

• Revenue is derived from insurance reimbursements or direct payments for these tests.

2 and 3) Data & Services: Licensing and AI Applications

The data collected from Genomics tests is commercialized through licensing agreements with pharmaceutical and biotechnology companies.

• De-identified, multimodal records: Tempus licenses this database to partners, enabling them to drive drug discovery and development.

In addition to providing the data, TEM develops AI-driven diagnostics and clinical decision support tools to improve patient care and optimize treatment outcomes.

• Insights and Trials: Tempus provides analytical tools and services to derive actionable insights, match patients to clinical trials, and inform therapeutic development.

This segment transforms raw data into a valuable resource for life sciences, generating significant recurring revenue.

The Closed-Loop Advantage

TEM’s business model thrives on network effects:

• The more patients Tempus sequences, the more data it collects.

• This additional data enhances its insights, boosting the value of its Data and AI Applications segments.

• In turn, these improvements attract more partners and providers, driving further adoption of its Genomics services.

This closed-loop system not only compounds the value of TEM’s offerings but also enables sustainable investment into its platform, creating a competitive moat.

TEM’s platform breaks down data silos in healthcare, connecting stakeholders — including physicians, diagnostic companies, and life science firms — through seamless data integration. By enabling data-driven decisions and facilitating collaboration, Tempus creates value at every step of the healthcare ecosystem, ensuring multiple monetization opportunities.

Each of these segments complements the others, forming a cohesive and scalable strategy to bring AI to healthcare at scale.

Let’s address each revenue source in more detail.

Genomics

TEM’s Genomics segment is at the core of its platform, delivering AI-enabled diagnostic tests that are not only smarter but also highly personalized.

These tests integrate contextualized results by leveraging clinical, molecular, and other data modalities, creating a truly intelligent diagnostic.

What Sets Tempus’ Diagnostics Apart?

• Contextualized Results: Tempus combines molecular profiling with clinical data, offering results tailored to the patient’s unique circumstances.

• Patient Comparisons: The company can analyze how similar patients responded to various treatments, enabling personalized care.

• Clinical Trial Matching: Its AI algorithms match patients to trials based on detailed inclusion and exclusion criteria, ensuring precision and speed.

• Algorithmic Insights: Tempus refines therapy selection by embedding purely AI-driven insights, making diagnostics far more actionable.

While a standard diagnostic provides raw results, an intelligent diagnostic knows who the patient is, their medical history, their previous treatments, and how they responded. This allows it to recontextualize findings, offering precision that traditional tests cannot achieve.

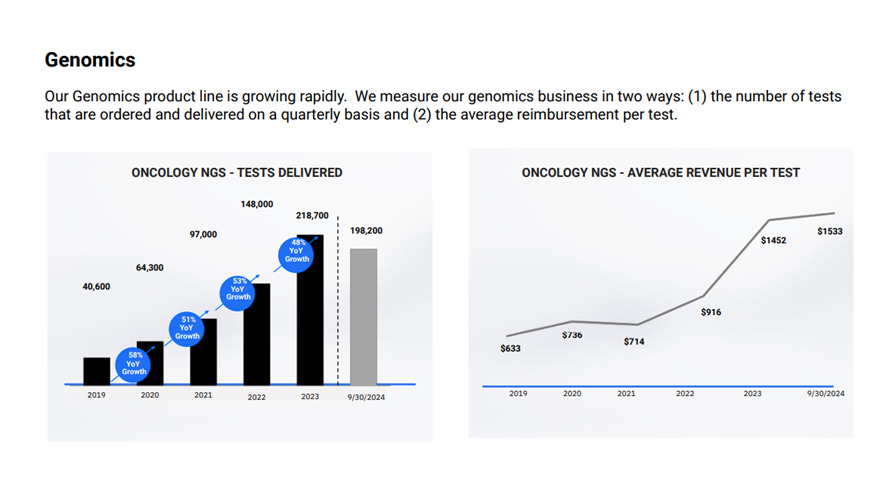

Financial Metrics

The Genomics segment grew ~30% YoY in 2024, with gross margins around 45-50%.

Last year, this segment accounted for >65% of TEM’s revenue, but in 2025 it'll likely be a larger portion because of Ambry Genetics' acquisition (check next section).

Pricing Power: The price per test is gradually increasing, showcasing TEM’s ability to deliver value and command higher rates over time.

Ambry Genetics Acquisition

In a move to strengthen its genomics segment and broaden its capabilities, Tempus AI recently acquired Ambry Genetics for $375M in cash and $225M in shares. This acquisition marks a strategic step in TEM’s journey to enhance its offerings, expand its footprint, and accelerate its path to profitability.

The acquisition of Ambry brings significant synergies across several dimensions:

• Hereditary Cancer Screening: Tempus has already been using Ambry as a supplier for its germline sequencing (xG) services, which assess inherited cancer risk. With this acquisition, TEM can integrate and expand hereditary risk screening for cancer patients, further enhancing its capabilities.

• Data and Analytics Augmentation: Ambry sequences ~400,000 patients annually, generating a wealth of data. By combining this with TEM’s existing datasets, the company can unlock deeper insights and bolster its data-driven offerings.

• Expansion into New Disease Areas: Ambry’s diverse product line enables Tempus to immediately enter additional categories, including pediatrics, rare diseases, cardiology, reproductive health, immunology, and more.

• Geographic Expansion: With significant lab facilities on the West Coast, Ambry adds valuable infrastructure to TEM’s network, increasing its operational footprint and improving service efficiency.

The Path to Profitability

This acquisition is not just about expanding capabilities, it’s a critical step toward financial sustainability. According to TEM’s Founder & CEO, the combined entity is projected to be both EBITDA and FCF by 2025.

This milestone will mark a significant shift for Tempus AI, validating its business model and long-term strategy.

The Ambry acquisition complements TEM’s closed-loop system, adding new dimensions to its genomics and data capabilities. It positions the company to lead not only in oncology but also in a range of other disease areas, enabling it to serve a broader spectrum of patients and healthcare providers.

Data & Services: Licensing and AI Applications

TEM’s Data & Services segment represents a high-margin, fast-growing revenue source that is poised to play an increasingly critical role in the company’s future.

This segment focuses on licensing its extensive libraries of de-identified clinical, molecular, and imaging data, alongside providing advanced analytics and AI tools to pharmaceutical and biotechnology companies.

What Makes Tempus’ Data Offering Unique?

• Largest Data Library: Tempus has the world’s most comprehensive collection of clinical, imaging, and molecular data. There are ~19M cancer patients in the U.S., TEM has 8.5M cases fully digested and 11M with collected data ready for analysis.

• Key Partnerships: Tempus collaborates with 19 of the 20 largest public pharmaceutical companies, highlighting its importance to the industry.

• Powerful Platform Tools: The company doesn’t just license data — it provides a platform for analysis. Its suite of analytic, cloud, and compute tools enables pharmaceutical companies to derive actionable insights from the data.

Financial Metrics

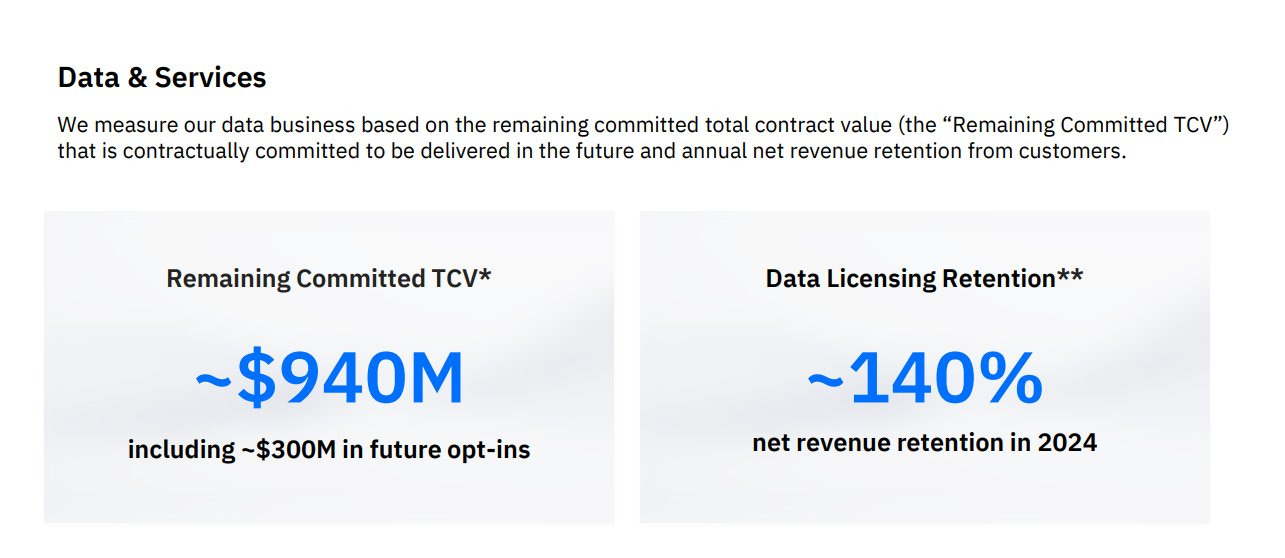

The Data & Services segment has become a significant driver of Tempus’s growth. It grew ~45% in 2024, with gross margins around 75-80%.

• Contracts in Hand: As of Q3 2024, Tempus has signed contracts with a total remaining value exceeding $900M, with the majority expected to be realized over the next several years.

• Customer Retention: Tempus’s ability to deepen relationships with customers is reflected in its Net Revenue Retention (NRR): 125% in 2023, increasing to 140% in 2024. Customers often progress from licensing discrete datasets to signing multi-year strategic collaborations, showcasing TEM’s value and indispensability.

The Power of a Connected Platform

TEM’s platform amplifies the value of its data through its integration with the healthcare ecosystem:

• Bidirectional Data Flow: Tempus’s “data pipes” connect with over 2,500 institutions, enabling the seamless flow of information from hospitals to TEM and back, with actionable insights delivered in days.

• Network Effects: With over 65% of Academic Medical Centers and 50% of oncologists in the U.S. using TEM’s platform, its ecosystem continues to expand, enhancing the quality and breadth of its datasets.

The combination of unparalleled data resources, cutting-edge AI tools, and strong partnerships positions Tempus as a leader in this high-margin sector. As Data & Services scales, it is expected to drive significant operating leverage and profitability for the company, ensuring its importance in the future of precision medicine and drug discovery.

AI Applications Is A "Nascent" Product Line

While Tempus is viewed as a leader in integrating AI into healthcare, its AI Applications product line is still in its early days.

This segment, which focuses on algorithmic diagnostics and clinical decision support tools, is currently reported within the broader Data & Services category due to its relatively small contribution to revenue.

Current Numbers

• 9M 2024 Revenue: $7.5M (1.5% of total revenue)

• 2023 Revenue: $5.5M (1.0% of total revenue)

• 2022 Revenue: $1.4M (0.4% of total revenue)

AI Applications represent a significant long-term opportunity, potentially transforming how diagnostics are delivered and expanding the company’s TAM. The company is actively developing additional algorithms, which, if successful, could drive exponential growth in this segment.

Tempus has been methodically laying the groundwork for AI Applications by building a strong moat: The World's Largest Dataset + Expanding Network Effects.

Outlook for 2025

Tempus AI recently attended J.P. Morgan's Annual Healthcare Conference and guided this year's numbers:

• Revenue to be ~$1.23B, growing by >75% YoY

• Adj. EBITDA and FCF to be positive

One point worth noting about the >75% YoY revenue growth guidance for this year: In 2024, the combined entity of Tempus and Ambry Genetics generated approximately $1B in sales. Therefore, the organic growth projected for 2025 is about 25%.

While this is still strong, especially considering it’s coupled with operating leverage, it’s not as impressive as it may initially appear.

Potential Catalysts

• Selling Pressure After Lockup IPO Expiration: The expiration of the lockup period following its IPO has created downward pressure on the stock. As this selling pressure begins to subside, its price action should become more favorable.

• Institutional Ownership Growth: Institutional investors currently own ~38% of TEM, which is relatively low for a company of its size and growth potential. As more institutions recognize the value of TEM’s platform and its role in the healthcare ecosystem, this number is expected to increase, which could provide a strong catalyst for price appreciation.

• Improving Margins: TEM is approaching an inflection point where its margins are poised to improve significantly. As its high-margin Data & Services and AI Applications segments scale, and as it integrates Ambry Genetics into its platform, the company should see an increase in profitability.

• Expansion Beyond Oncology: TEM has already made strides in expanding its reach beyond oncology into areas like neuropsychology, cardiology, and rare diseases, opening up new revenue streams. With its robust platform, Tempus is well-positioned to make further inroads into additional healthcare areas.

• Potential Reimbursement for AI Applications: One of the most exciting catalysts for TEM’s growth in the long term lies in the future reimbursement of its AI applications. As regulators begin to recognize the tremendous potential of AI to improve patient outcomes, TEM’s AI-driven diagnostics and decision-support tools could qualify for reimbursement, providing a major revenue boost. The CEO is optimistic about this potential, and if realized, it could become a significant driver of growth in the coming years.

Insiders' Alignment

If you follow me, you know that I always look for companies where the Founder is still the CEO and remains the largest individual shareholder. This alignment between the company's leadership and shareholders is crucial for long-term success, as it ensures that management is motivated to drive value for all stakeholders.

At Tempus, Founder and CEO Eric Lefkofsky holds over 20% of the company, demonstrating a strong personal stake in its future. Overall, insiders own ~35% of the company, further aligning their interests with those of shareholders.

Importantly, TEM has two interesting investors: Google and Novo Nordisk. Google owns around 1% of the company, while Novo Nordisk holds 2.5%. These high-caliber investors add credibility to Tempus, reinforcing its position in the healthcare and AI space.

Valuation

I haven’t pulled the trigger on TEM yet, primarily because it’s a challenging company to value. After the lockup IPO expiration, I thought the stock could drop further to the $25-$30 range, so I was hoping for a bit more downside protection before making a move. After Pelosi's investment, that doesn't seem likely anymore.

I’m not a fan of using the P/S ratio as a metric because it doesn’t accurately reflect the company’s operating efficiencies, scalability, or other important factors.

I believe organic revenue growth (excluding the impact from Ambry Genetics) will accelerate in the coming years, particularly within the Data & Services segment, which should drive significant operating leverage. As this segment scales and becomes a larger portion of the business, it should push overall margins higher.

If TEM can achieve at least 20% terminal FCF margins, the company could look very cheap in the long term, especially considering its widening moat within a rapidly growing industry. Reaching this level of profitability doesn’t seem impossible at all, and it could unlock substantial upside for investors over the next several years.

Essentially, I don’t think TEM is a clear bargain at these levels based on its current numbers, but I also believe that if the company proves it can execute on its mission, then a $5.5B market cap will eventually be seen as mere nickels for such a valuable and life-saving ecosystem.

Final Thoughts

All in all, I believe Tempus will be one of the companies that stands to benefit the most from the growing trend of integrating AI into healthcare to improve patient outcomes. The company is uniquely positioned to capitalize on this shift, and its platform is paving the way for personalized, data-driven healthcare solutions.

I haven’t pulled the trigger yet because I was hoping to get in at a better valuation. However, with all the catalysts on the horizon and word spreading quickly about TEM’s potential, that moment might never come.

I’ll continue to evaluate how the company performs over the next few weeks to determine if it’s the right time to open a position. After studying TEM for over a month, I’m definitely fascinated by its long-term prospects, and I’m closely watching how it executes on its ambitious mission.

Note: As mentioned, I’ve only been researching TEM for about a month, so I’m far from an expert on the company or the industry. If I’ve made any mistakes or overlooked important details, please feel free to correct me.

That’s it! I hope you found this article useful.

Tempus AI is a fascinating company, and I believe it’s one you should definitely keep on your radar.

Great article! I'm waiting for 5.5-6B market Cap to start a position, I really like what the company is doing to improve use of AI in Healthcare sector