Rocket Lab (RKLB) Q3 2024 Earnings Call Takeaways

This article was originally posted on X as a thread on November 13, 2024.

I spent a few hours reviewing Rocket Lab’s Q3 results and conference call, but I finally did it. Here's my extensive Earnings Call summary.

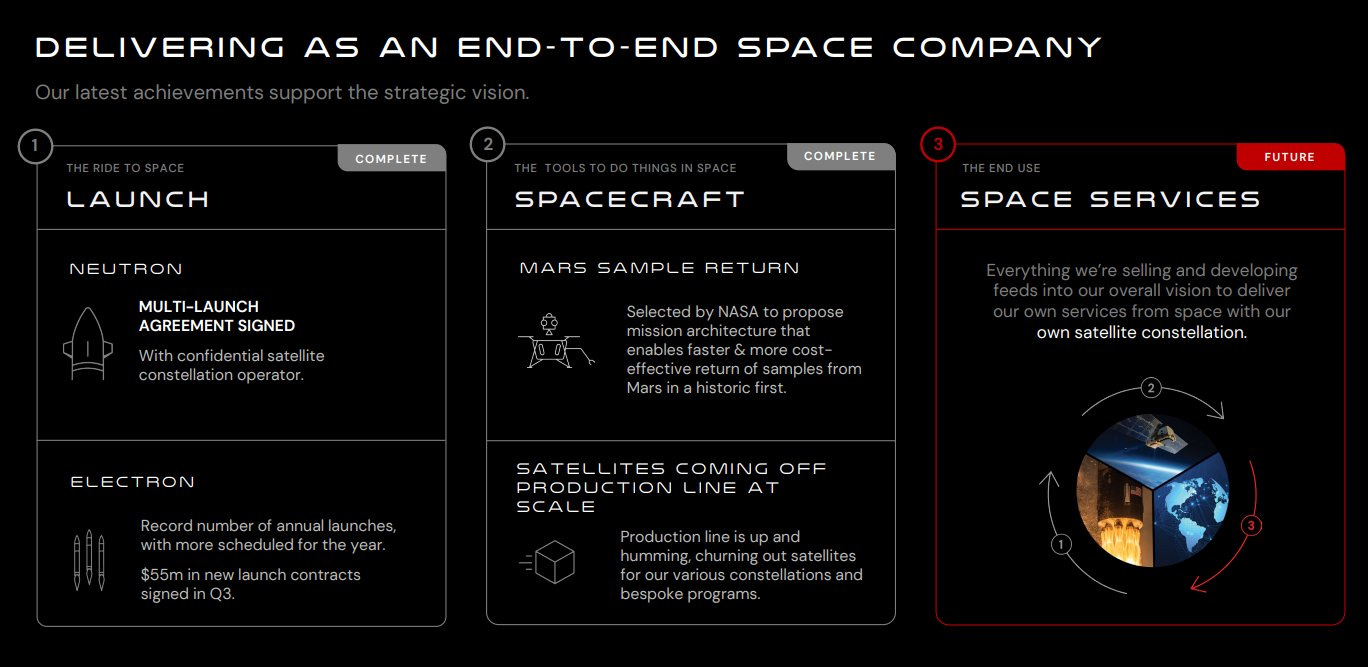

Peter Beck, Founder & CEO of RKLB, began by grounding the discussion in Rocket Lab’s overarching mission: establishing itself as a comprehensive "end-to-end" space company.

The company’s dual capability — providing both launch services and in-orbit spacecraft production — sets it up to enter and lead a large, diverse market in space applications.

Each successful mission and each new spacecraft is part of Rocket Lab’s vision to hold the "keys to space" through autonomous capabilities in both transport and operational aspects of space infrastructure.

Phase 1 and 2 Progress

Rocket Lab's Phase 1 and 2 objectives, which center on strengthening rocket and spacecraft technologies, are firmly in place, positioning the company to build its own constellations for high-demand services in space.

Peter Beck highlighted that in Q3, the company took significant steps forward in these areas:

• Neutron Rocket Development: Rocket Lab signed a multi-launch deal with a commercial constellation operator for its upcoming Neutron rocket. Peter Beck emphasized a selective approach in pursuing Neutron’s commercial contracts to secure high-value partnerships.

• Electron Rocket Successes: On the smaller rocket front, Rocket Lab successfully launched multiple Electron missions during Q3. Additionally, they secured $55M in new launch contracts, reflecting sustained demand for small launch capabilities and confirming Electron’s strong market position.

• Mars Sample Return Contract: One highlight is Rocket Lab’s selection by NASA to conduct a study for the Mars Sample Return project. This mission, aiming to retrieve samples from Mars, has been deemed costly and time-consuming in its current architecture. NASA sought innovative, cost-effective proposals to expedite the mission, and RKLB was selected to contribute with a proposal.

• Spacecraft Production Capabilities: Rocket Lab’s Long Beach production line is scaling up to meet demand, producing spacecraft at an accelerated pace to meet a backlog of over 40 spacecraft orders. This capability reflects the company’s objective to rapidly and efficiently manufacture space systems for both external clients and internal projects.

As I already explained, the company’s ultimate ambition is to operate its own satellite constellations. The robust foundation the company has built in both launch services and space systems is critical to realizing this goal.

Moving to Electron's key updates for the quarter...

RKLB’s Electron rocket reached a significant milestone in Q3, achieving 12 missions for the year, setting a new annual launch record. This places Electron among the top-performing rockets globally, with only SpaceX's Falcon 9 and China's Long March rockets surpassing its launch cadence. Electron is now recognized as one of the most globally significant rockets in operation today, further solidifying its position in the commercial space industry.

However, Rocket Lab’s success isn’t just measured by launch frequency — it’s also about financial sustainability. In Q3, the company secured $55M in new Electron launch contracts. What stands out, though, is the notable 60% increase in the average sales price compared to when Electron first began flying. This price growth reflects the increasing demand for Electron’s services, a clear indication that Rocket Lab has developed a proven and scalable product that customers truly need.

During Q3, Electron executed three missions for three separate commercial constellation operators, all of which were part of multi-launch contracts with repeat customers. This consistent demand highlights Electron’s critical role in enabling small satellite operators to maintain control over their launch schedules and mission parameters — something that large rideshare missions simply cannot offer.

One of Electron’s competitive advantages is its rapid turnaround time between missions. In Q3, RKLB launched two missions back-to-back from Launch Complex 1 within just eight days of each other. Following Q3, RKLB set another record by launching a mission for a confidential constellation operator just 10 weeks after contract signing. This is a remarkable feat in an industry where the typical timeline from contract to launch can stretch up to a year. The ability to deliver missions at such speed helps satellite operators get their technology into orbit faster, accelerating their ability to test, generate revenue, or gather urgent data from space.

Peter Beck also emphasized the flexibility of Electron’s business model, which is designed to accommodate the unpredictable nature of the launch industry. Rocket Lab’s three launch sites and high manufacturing capacity allow it to quickly slot new customers in as launch gaps open up. This agility is crucial in a market where launch schedules are often delayed or shuffled. Additionally, Electron's business model is structured to mitigate the financial impact of delays. Rocket Lab collects up to 90% of the contract value before launch day, with revenue recognized upon launch. Therefore, even with occasional delays, the overall impact on the business is minimal.

In summary, Electron continues to gain momentum, driven by increased launch frequency and strong financial performance. With rising sales prices, flexible operations, and rapid launch capabilities, Electron is solidifying its position as the undisputed leader in the global small satellite launch market.

After this, Peter Beck addressed what the market really wanted to know — updates on the Neutron rocket.

1) Launch Agreements and Strategic Decisions

Rocket Lab has signed a launch agreement with a commercial constellation operator, marking a significant step for Neutron. This deal covers two early launches for the operator, and Peter Beck emphasized that the strong reputation RKLB has built through the success of Electron was key in securing these early contracts. The company has carefully selected its first customers for Neutron ("We're in the fortunate position to be able to choose who flies first"), allowing it to be strategic in its approach. Peter Beck expressed confidence that these two initial launches would lead to a long-term partnership, potentially deploying the customer's entire constellation in the future.

Unlike many companies that sign non-binding agreements or sell missions to fund development, Rocket Lab has been methodical about when it opens bookings for Neutron. Peter Beck underscored that the company is committed to delivering a real rocket to the market before finalizing contracts, ensuring a premium price for their services. As Neutron’s debut in 2025 draws closer, conversations with customers have become more refined, and demand for launch slots has started to mature.

2) Neutron’s Suitability for National Security and Space Force Programs

Peter Beck highlighted that Neutron has been designed with specific programs like the U.S. Space Force's National Security Space Launch (NSSL) program in mind. The Space Force recently released requests for proposals for the next round of NSSL missions, and Rocket Lab intends to compete for a share of up to $5.6B in national security launches. Neutron’s capacity to diversify and secure national security space access positions it as a strong contender in this sector.

RKLB’s proven track record with Electron in national security payloads is also a selling point for Neutron’s potential. The CEO emphasized that, with Electron, the company reached 50 launches faster than any other commercially developed rocket, which demonstrates the company’s capability to handle sensitive, high-priority missions efficiently. In line with this, government interest in Neutron is also growing. This quarter, the U.S. Air Force awarded Rocket Lab an $8M study contract to showcase its digital engineering skills through the Archimedes engine program, which is tied to the NSSL program.

3) Neutron’s Development and Technical Milestones

RKLB’s focus has shifted to the build and testing phase for Neutron, moving beyond the design phase. Several key milestones have been achieved, including:

• Reusable Fairing ("Hungry Hippo"): Rocket Lab is working on a novel, reusable captive fairing that stays attached to Neutron’s first stage throughout flight, only opening to release the payload and second stage. The fairing then returns to Earth with the first stage, enabling cost savings and reusability.

• Second Stage Testing: Neutron’s second stage has undergone its first Wet Dress Rehearsal (WDR) in a flight configuration, which included testing its pressurization and cold-flow operations. This test confirmed that the supporting infrastructure and flight hardware are ready for future missions.

• Archimedes Engine Testing: Rocket Lab’s Archimedes engine, designed for Neutron, has been progressing well through its test campaign. Test cadence has increased, and multiple engines have been tested. The goal is to refine the engine rapidly in preparation for Neutron’s first flight. Peter Beck emphasized that scaling engine production will be a key challenge for the program, but RKLB is on track to meet this demand.

4) Launch Infrastructure and Preparation

Peter Beck also highlighted the critical role of launch infrastructure in Neutron’s success. RKLB is utilizing its experience with Electron to ensure that Neutron’s launch sites are fully operational. At the Wallops Island site, a massive 165-ton steel launch mount is being installed, a crucial component for Neutron’s launch system. Additionally, the company completed the construction of a new assembly, integration, and test (AIT) building near the launch pad, which is a strategic advantage in minimizing logistics and costs.

Furthermore, two large 90,000-gallon propellant tanks were installed in Q3, underscoring the scale of Neutron’s operations compared to Electron. Having key infrastructure elements close to the launch pad will expedite the pre-launch processes and reduce logistical complexities.

All in all, Rocket Lab is making substantial progress with Neutron, with significant strategic partnerships and key technical milestones achieved. The company is positioning Neutron as a strong contender in both commercial and national security markets, with a focused approach to meeting the growing demand for medium-lift launches. With a solid foundation in place and a clear path forward, Neutron’s launch in 2025 is eagerly anticipated.

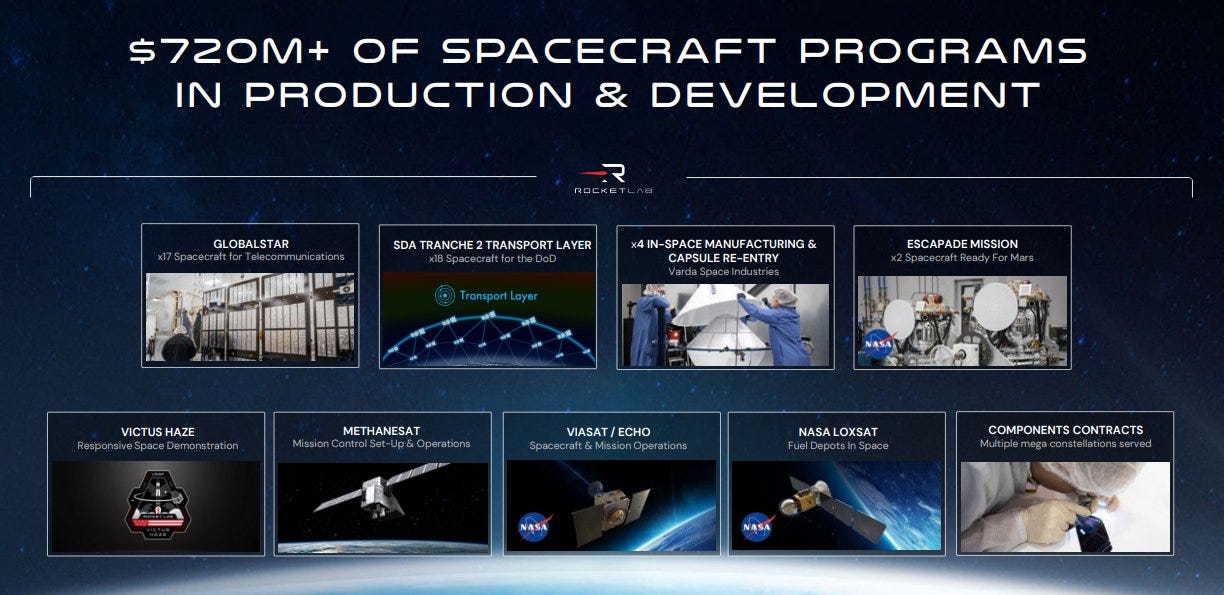

Moving to the Space Systems segment, it accounted for ~80% of Q3's revenue and grew by 81.2%. This growth reflects RKLB’s successful execution of numerous high-profile missions, government contracts, and expansion efforts. Here are the most important updates:

1) NASA Mars Sample Return Program

One of the most exciting updates is Rocket Lab’s selection to participate in NASA's Mars Sample Return Program. This ambitious mission aims to bring Martian soil samples back to Earth, and RKLB’s proposal could offer a faster, cost-effective alternative to NASA’s initial $11B plan, which projected sample retrieval by 2040. The company’s extensive experience in Mars technology — including contributions to the Mars Insight Lander, Ingenuity Helicopter, and Perseverance’s cruise stage — uniquely qualifies the company to deliver on such a challenging project. If Rocket Lab’s proposal advances, it could accelerate our understanding of Mars and lay the groundwork for human exploration.

2) Key Contracts and Mission Updates

• ESCAPADE Mars Mission: Rocket Lab completed and delivered two spacecraft for NASA’s ESCAPADE mission, designed to study Mars’s magnetosphere. While the mission is delayed due to the launch vehicle’s unavailability, RKLB’s team is on standby to support the new timeline once the launch date is confirmed.

• Space Development Agency (SDA) Transport Layer Constellation: Under a $500M prime contract, Rocket Lab is progressing on spacecraft for the SDA’s Tranche 2 Transport Layer Constellation. With the preliminary design phase completed, the team is preparing to assemble hardware. The success of this program positions the company to potentially secure additional contracts as the SDA plans to procure up to 200 satellites in 2025 for Tranche 3.

• Varda Space Industries Collaboration: Rocket Lab recently delivered two Pioneer-class satellites for Varda Space Industries, supporting their capsule retrieval missions. These satellites power and control the capsules as they re-enter Earth’s atmosphere. Following the successful Utah landing of Varda’s first mission, RKLB is preparing for the next mission, which will aim for re-entry in Australia, with additional missions in development.

3) Expanding Satellite Production and Vertical Integration

Rocket Lab is scaling up satellite production to meet increasing demand, and the company’s acquisition of Virgin Orbit’s facility has allowed it to expand without the expense and time of new construction. With the Space Systems team co-located in a single facility, RKLB has streamlined integration and production processes, enabling faster collaboration and response times. This vertical integration model, with its hands-on production efficiencies, enhances Rocket Lab’s ability to quickly deliver high-quality, cost-effective spacecraft across its portfolio.

In summary, the Space Systems segment is proving to be a growth engine, leveraging strategic infrastructure investments and mission diversity to advance its capabilities in high-impact, high-value markets. The division’s rapid expansion and execution on critical milestones highlight Rocket Lab’s potential as a leader in both commercial and government space programs.

Repeat after me: Rocket Lab is an END-TO-END space company.

After all these insightful updates across the business, Peter Beck highlighted a few personnel changes at the board and executive levels for the past quarter:

• Mike Griffin, after four years on RKLB’s board, has stepped down. His experience was instrumental in the company’s growth from a start-up to a global leader in launch and space systems, and the team expressed their gratitude for his service.

• Frank Klein has joined as Chief Operations Officer, bringing 30 years of manufacturing experience from companies like Daimler and Mercedes-Benz. His expertise will help scale Rocket Lab’s global production efforts.

• Former Lockheed Martin CFO Ken Possenriede has joined the board, adding valuable financial and aerospace experience as Rocket Lab continues its expansion.

Time for the Financial Highlights and Outlook from the company’s CFO, Adam Spice:

• Q3 2024 Revenue: Reached $105M, marking a 55% YoY increase, led by strong growth in the Space Systems segment, which contributed $83.9M, and steady revenue from Launch Services at $21M. Gross margins were also in line with guidance, with a GAAP gross margin of 26.7% and a non-GAAP gross margin of 31.3%.

• Backlog: The company’s total backlog reached $1.05B, an 80% increase YoY, largely due to their significant Space Development Agency contract. Roughly 50% of the backlog is expected to convert to revenue within the next 12 months. This number does NOT include Neutron's multi-launch agreement.

• Operating Expenses: GAAP operating expenses were $79.9M, up due to continued investment in Neutron development, as well as necessary increases in R&D and SG&A headcount. This increase was tied to both new hires and prototype development for Neutron.

• Cash Flow and Liquidity Position: Rocket Lab reported non-GAAP FCF usage of $41.9M, impacted by Neutron and Space Systems spending. They ended Q3 with a cash balance of $508M, positioning the company well to fund both organic growth and potential acquisitions.

• Q4 2024 Guidance: The company expects revenue between $125-135M, boosted by strong momentum in Space Systems and increased launch frequency. GAAP gross margin is expected to be 26-28%, with non-GAAP at 32-34%, reflecting efficiency improvements. Adjusted EBITDA loss is forecasted to range between $27M and $29M, with continued investment in Neutron anticipated.

Moving on to the Q&A session... Updates on Rocket Lab's Neutron development timeline and the recent multi-launch agreement:

• Neutron Launch Timeline: Peter Beck confirmed that Neutron’s first launch is still planned for mid-2025. The multi-launch agreement announced is set to start in mid-2026, aligning with the gradual ramp-up of Neutron’s launch cadence. Peter Beck also emphasized the importance of securing customer interest and launch slots well in advance to meet each mission's specific objectives and timelines.

• Significance of the Contract Announcement: CFO Adam Spice highlighted that this multi-launch deal represents a key milestone for Rocket Lab. Unlike typical new launch vehicles that often start with discounted contracts, Neutron benefits from RKLB’s established success with Electron. This strong track record gives them the leverage to secure contracts without needing to offer significant discounts.

Upcoming Milestones for Neutron

Peter Beck outlined three critical areas of focus:

• Launch Infrastructure: Progress includes significant developments at the launch site, with visible large-scale work like concrete foundations and steel structures being put in place.

• Vehicle Structure: This involves assembling major components such as tanks and fairings, as well as conducting end-to-end testing to ensure integration and performance.

• Archimedes Engine Testing: The team has reached a key milestone with a production engine surpassing 100% throttle. Now, the focus is on extensive test runs to further refine performance and reliability. Peter Beck stressed the importance of continuous testing to improve the engine’s capabilities over time.

Neutron’s Competitive Edge and 'Perfect Timing' for Market Entry

Peter Beck emphasized that Rocket Lab strategically chose their first early customer for Neutron, viewing them as an ideal fit for the vehicle’s debut phase.

Adam Spice highlighted that RKLB’s established reputation for reliable launches makes them an attractive option, especially as many other launch providers have their capacity already spoken for (likely referring to SpaceX). Additionally, the company’s position as a non-competitive partner is appealing to customers who prefer a provider without competing payloads. The CFO also stressed that the timing of Neutron’s entry into the market is perfect, with Rocket Lab ready to capitalize on the growing demand in a strong, expanding market.

When will Rocket Lab start deploying its own constellations?

Peter Beck explained that the road to Phase 3 — RKLB’s fully integrated space ecosystem — depends on achieving a high-cadence, reusable launch capability with Neutron.

He drew a parallel to Starlink, pointing out that while advanced spacecraft are crucial, it’s the affordability and frequency of launches, enabled by reusability, that will be the true game-changers.

Until Neutron establishes a reliable launch cadence, the deployment of Rocket Lab’s own constellations will remain a longer-term objective.

Insights from CFO Adam Spice on Neutron's cash flow dynamics:

Neutron’s launch service agreements (LSAs) are structured similarly to Electron’s, with deposits and milestone payments typically covering about 60% of the contract value before the rocket build begins. However, early Neutron launches are expected to require significant working capital, particularly as the company works toward full reusability.

The CFO Adam Spice acknowledged that initial Neutron launches may be cash-consuming but emphasized that, over time, efficiencies and reusability will help bring Neutron’s margins in line with Electron’s long-term financial model.

Neutron as a New Alternative or Replacement and its Launch Pricing and Timing

Peter Beck clarified that Neutron is positioned to both replace other providers and act as a new alternative in certain markets. Specifically, in the National Security Space Launch (NSSL) world, Rocket Lab is contributing new capacity, as seen in the NSSL Lane 1 Phase 3 award, where a single provider won the entire contract due to a lack of other options. Neutron aims to fill this gap by providing additional alternatives.

He was also asked about Neutron’s pricing, particularly whether it remains in the $50-55M range previously discussed. Peter Beck confirmed that this pricing is still valid for Neutron’s initial contracts and that these prices align with Rocket Lab’s expectations. As for timing, the launches are customer-driven, meaning that while Neutron’s first test flight is expected by mid-2025, the two dedicated missions scheduled for 2026 are driven by customer requests for those specific windows.

"We're planning one test launch in 2025, three launches in 2026, and five launches in 2027."

NSSL and Neutron's Role in 2025 and Beyond

Regarding the NSSL contract process, Peter Beck explained that Rocket Lab needs to demonstrate Neutron's ability to launch in 2025 to be "on-ramped" and eligible for bidding on task orders. However, while the company plans a test launch in 2025, no launch contracts are expected in that year. The first Neutron launches for NSSL would likely happen in 2026, with additional launches in 2027, depending on customer demand and available capacity.

Update on Neutron's development costs

During Q3, Rocket Lab’s total development spend for Neutron was just under $44M, slightly above the expected $40M quarterly spend. This brings the overall development cost in line with the company’s target.

Adam Spice highlighted that development costs will continue to rise as Rocket Lab nears Neutron’s first launch. R&D costs will continue to impact the P&L until the first test flight is completed. Afterward, the company expects a shift in the financial structure. The successful completion of Neutron’s first launch is seen as a key milestone that will cap initial R&D expenditures, allowing the company to transition into improving margins.

Rocket Lab remains confident that Neutron’s total development costs will stay within the original budget range of $250-300M, a figure they first projected over three years ago. The company emphasized that this budget is significantly lower compared to other medium and large launch vehicles, which typically cost billions and take a decade to develop. RKLB expects to set a new benchmark for capital efficiency and speed in bringing a new launch vehicle to market.

Scaling Neutron and Capacity Constraints

1) Scaling Challenges: Peter Beck addressed why RKLB is moving at a measured pace with Neutron’s development and scaling. He emphasized that while additional capital can support progress, the development process is constrained by the need to learn from actual flight tests. While some things can be tested on the ground, key variables only become apparent during flight. Refining the rocket and scaling production takes time, particularly because engine production is typically the longest lead time.

Rocket Lab is focusing on ramping up engine production early to reduce bottlenecks. However, every step is carefully planned to ensure quality and safety, especially since the rockets will carry paying customers' payloads. Therefore, the company is methodical with any changes, avoiding rushing and compromising quality.

2) Supply and Demand for Commercial Launches: In terms of market demand, Peter Beck acknowledged that RKLB is confident there is enough demand for Neutron once it can scale up. However, the priority is to avoid over-promising and under-delivering to customers. The challenge is scaling Neutron's production capacity quickly enough to meet that demand without jeopardizing the quality or the company's reputation. While the demand for commercial launches is high, the key issue remains how quickly Rocket Lab can scale Neutron’s operations to match that demand.

About the new U.S. administration's policy focus and its influence on Rocket Lab:

Peter Beck expressed optimism about the new administration's strong focus on space, viewing it as a positive for RKLB. A robust space policy could directly benefit the company, especially considering the emphasis on national security, a key component of Rocket Lab’s business.

The most encouraging policy shift Peter Beck highlighted is the administration's focus on transitioning government space missions from traditional contracting to commercial providers. This shift presents significant opportunities for RKLB, as the company is well-positioned to capitalize on the expanding commercial space market.

Organic and Inorganic Growth in Space Systems

Peter Beck shared his strategy for scaling its space systems business, highlighting a focus on both organic and inorganic growth.

• Organic Growth:

For organic growth, the company is continuously developing new products, including some spin-offs from existing programs and others aimed at new market opportunities. Rocket Lab takes a conservative approach to product announcements, preferring to introduce products only when they are fully developed and ready for market. This approach was seen with past releases, such as the reaction wheels and the HASTE mission, where the company launched products shortly after their announcement.

He also emphasized that Rocket Lab has already expanded its clean room capacity, utilizing its existing facilities to support organic growth. While specific details were not provided, the company is working to expand its capabilities across various areas to meet increasing demand.

• Inorganic Growth:

On the inorganic side, the company is actively exploring acquisitions but remains highly selective. Past acquisitions have been aimed at acquiring strong teams and market-leading products, helping RKLB expand into areas such as solar power, command and control software, and separation systems.

Looking ahead, the company has largely developed its satellite bus to fulfill end-to-end space system requirements but is still addressing a few gaps. One area where inorganic growth is likely needed is in payload capabilities. Currently, RKLB stops at the payload, but its broader ambition to offer on-orbit applications will benefit from developing internal payload capabilities.

Adam Spice pointed out that several interesting assets in the market could complement the company’s offerings. While Rocket Lab remains disciplined in its approach to acquisitions, it remains optimistic about finding the right opportunities. Once the right team, timing, and price align, RKLB expects to make acquisitions that will enhance its payload capabilities and support its on-orbit application goals.

Electron's Core Profitability & Launch Pricing/Volume Strategy

• Electron Core Profitability: The decline in the average selling price (ASP) for Electron over the past three quarters has been largely driven by customer launch timing. Some customers opt for bulk launch contracts, which reduce the price per launch. However, these bulk purchases help improve margins because RKLB can streamline processes across multiple launches, such as guidance and control (GNC) work, and use common components like payload adapter plates. Despite the lower ASP, improved production efficiencies in Electron’s manufacturing process have reduced costs, contributing to a rise in gross margins. The overall gross margin trend remains positive, even as ASP has decreased. RKLB is confident in its annual target of $7.5M for average ASP, with the current backlog priced higher at $8.2M per Electron launch.

• Launch Pricing & Volume Strategy: Some contracts include penalty clauses for missed launch dates, but charging penalties for delays — especially those caused by customer issues — could hurt long-term relationships. The service provided by Rocket Lab is bespoke and dedicated, and customers are willing to pay a premium for this level of service compared to cheaper ride-share launches.

Once customers enter Rocket Lab’s backlog and begin making payments, they tend to stay committed, even if launch dates change. While schedules may shift, cancellations are rare. Managing these shifts is part of the service model. When gaps occur in the launch schedule, RKLB works to fill them quickly, as seen in the previous quarter. Despite challenges with shifting launch dates, the company has not made major changes to pricing strategies to address delays, as the premium nature of the service and customer relationships remain central to the offering.

Gross Margin Contributions & Solar Progress

1) Gross Margin Contribution from Launch and Space Systems

The gross margin improvement has been consistent between the launch and space systems segments. Both areas are progressing along their respective margin improvement paths. The overall business mix is approximately 70% space systems and 30% launch, which influences the total gross margin calculation. The contributions from both segments remain aligned with their respective share of the business, meaning each is contributing in proportion to their size.

2) Solar Business Gross Margin Improvement

The solar business has been progressing, but at a slower pace than initially expected. When Rocket Lab acquired the solar business in early 2022, they set a target of achieving 30% non-GAAP gross margins within two years. While they are behind schedule, steady progress is being made. The main challenge has been the presence of a single large, low-margin contract inherited from the acquisition, which was part of a $150M backlog. This contract had essentially zero margin and has been a drag on overall performance.

However, as older contracts are replaced with newer ones that meet the target margin, the gross margin for the solar business is improving. This is becoming more evident, particularly in Q3, where the solar business showed stronger results. The team is more confident in reaching the target 30% gross margin for the solar business, although it is taking longer than originally anticipated. Similar to the launch business, the solar segment is fixed-cost-oriented, meaning better performance in terms of product shipments helps absorb overhead costs and improve margins.

Backlog & Growth in Non-Photon Space Systems Businesses

Rocket Lab’s non-photon space systems businesses, such as PSC and Sinclair, have been growing steadily. The components business within space systems is on track to grow by around 20%, and the team is confident that they will surpass this target. Sinclair, in particular, has experienced recent growth, driven largely by the mega constellation reaction wheel contract. This growth is fueled by both the expanding merchant market and internal demand from RKLB’s spacecraft manufacturing projects, such as SDA and MDA Global Star.

Sinclair’s growth is expected to continue into next year, while the solar business — especially with capacity dedicated to internal programs — is poised to perform strongly in 2025 and 2026. The components or subsystems business currently enjoys a healthy non-GAAP gross margin in the low to mid-40s, with room for further improvement. However, larger program contracts, such as those for bigger systems, have slightly lower margins in the 30% range. Overall, the segment’s growth trajectory remains healthy.

Mix Between In-House and Merchant Sales of Components

The mix of components sold internally versus externally varies across different business areas. For instance, the solar business currently sends about 90% of its components to the merchant market, with only 10% used internally. This external demand is driven by national security customers requiring high-precision systems. Similarly, the separation systems business leans more toward external sales than internal use, due to its wide application across various rockets.

"Before we close out today, I wanted to draw your attention to some upcoming conferences we’ll be attending. We look forward to sharing more exciting news and updates with you there."

— Peter Beck, Founder & CEO of Rocket Lab

Overall, this earnings call was very bullish and reinforced my confidence in Rocket Lab as a long-term investment.

Peter Beck and Adam Spice are always insightful speakers, and I believe there's no better way to truly understand this company than by tuning in to every interview and earnings call they provide.

Rocket Lab is making meaningful progress across all areas, and I'm particularly excited to learn more about its plans for Phase 3 of its end-to-end space ecosystem.

The space industry today is reminiscent of the early days of the internet, standing at a crucial point in its development. Rocket Lab is well-positioned to capitalize on this secular trend and will likely be one of the biggest beneficiaries in the years to come.

That's it! Thanks for reading! I hope you found this summary helpful.

Subscribe for more updates on RKLB — this is just the beginning of a beautiful story.