It’s been over two weeks since my last portfolio update, so it’s time for a fresh one.

As always, paid subscribers get real-time alerts whenever I buy, sell, or trim a position.

Important Communication:

Starting May 1, I’ll restrict part of my content to paid subscribers. As such, the current price (which was set lower on purpose, since it was voluntary) will change. If you choose to support me before then, you’ll get a 50% discount on the yearly plan. I spend countless hours working to bring you the best content I can, so I appreciate your understanding. Don’t worry — I’ll still publish plenty of free articles as well.

I’m also working on adding extra perks to make the subscription even more valuable.

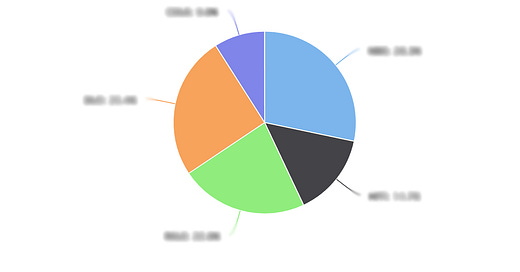

My Current Portfolio

Nebius Group (NBIS) – 28.3%

Average cost: $25.67/shareDLocal (DLO) – 25.4%

Average cost: $10.11/shareRocket Lab (RKLB) – 22.6%

Average cost: $4.82/shareHigh Tide (HITI) – 14.7%

Average cost: $1.69/shareCadeler S/A (CDLR) – 9.0%

Average cost: $20.28/share

YTD Performance: -24.8%

However, it's worth noting that I hold my stocks in €. With EURUSD up ~10% YTD, my returns are being significantly impacted by FX fluctuations.

Performance Since Inception (01/01/2024): +102.6% vs. SPY +12.7%

→ I’m outperforming by a wide margin. ✔️

Changes Since Last Update

1) Re-entered High Tide (HITI)

I re-entered HITI at $1.69/share the week after selling it (just like I said I would). That move — temporarily selling HITI to buy NBIS in the high $19s and DLO in the $7.80s — paid off. I not only secured great deals on both, but also re-bought HITI at a lower price than before, slightly improving my average cost. Paid subscribers were alerted immediately.

This isn’t something I usually do — I actually tend to avoid these kinds of moves — but as I explained in my last portfolio update, I really wanted to take advantage of those opportunities and didn’t have any cash available in my brokerage account. Fortunately, it worked out.

Since then, HITI is already up ~35%. The price action has been unusually strong compared to the broader market, which makes me wonder if SNDL is slowly increasing its stake to prepare for a hostile takeover. That would likely be positive for the stock price in the short term, but I don’t want it to happen because I’m hoping to see the multibagger potential of HITI play out over time.

2) Added More Nebius Group (NBIS)

Today, I bought more NBIS at $21.45/share. I originally planned to do it yesterday when it dipped into the low $20s, but I had a family dinner and the market had already closed by the time I remembered.

Still, I think this is one of the best opportunities out there, if not the best. I know there are plenty of bargains after the recent market correction — and I’ll keep covering several of them — but as you know, I’m a highly concentrated investor. I prefer to focus my portfolio on names that I believe offer asymmetric risk-reward over the next 3–5 years. My goal isn't to minimize volatility, it’s to maximize long-term returns.

Last week brought several important updates on Nebius that further strengthened my conviction. I broke them down in this thread (make sure to follow me on X):

https://x.com/mvcinvesting/status/1912231262342766745

Important Reminder: Your portfolio should always reflect your own needs, goals, and risk tolerance. I’m still young, and my approach might not be suitable for everyone. This is just me sharing what I do — not financial advice.

Final Thoughts

I can’t wait for my holdings to report their earnings results to cover everything in detail for you, so make sure to subscribe to get instant access to my reviews.

Given how strong last year was for me (+173% overall returns), a 24.8% drawdown in 2025 isn’t too concerning — I was ready for this kind of scenario. Thankfully, I have a deep understanding of the businesses I own, so short-term volatility doesn’t affect my conviction. Regarding the FX impact, which accounts for almost half of my losses so far this year, I’m not worried either, as its effect should revert over time.

As I mentioned before, we could very well see more downside if the U.S. doesn’t make meaningful progress toward reducing the uncertainty surrounding the current trade war and its effects on inflation and the global economy. That said, I still believe the best approach for long-term investors is to steadily buy the dip in the companies they have the strongest conviction in, especially those that are unaffected or minimally impacted by tariffs. That’s exactly what I’m doing. We don’t need to catch the bottom to achieve outstanding returns. Market corrections like this are opportunities to accumulate shares of our favorite businesses at far more attractive prices.

Stay tuned for more updates.

Thanks for reading, and thank you for your incredible support since the beginning!

Do you post daily updates and adds/trims to your paid subscribers?

Hi, I’m probably late with this, but anyway - do you still have discount on your subscription?

You are doing really good job here with stocks analysis.

Thanks