Today, Nebius Group (NBIS) released its Q1 2025 results.

As you know, this is the largest position in my portfolio, so it was definitely the one I was most looking forward to reviewing.

In this article, I’ll break down everything you need to know about the Earnings Report.

Financial Highlights

Before diving into the numbers, let me first reiterate what I was looking for in this report:

“After receiving several questions about what I’m expecting, here’s my Earnings Preview.

Let’s start with what doesn’t matter:

I’m not concerned about whether NBIS beats or misses Q1 consensus estimates for revenue, EBITDA, or EPS. Why? To start, there are only three analysts covering the stock, so each estimate carries disproportionate weight. Second, and more importantly, the ARR ramp-up happened during Q1, meaning revenue recognition this quarter will largely depend on the timing of those contracts. As a result, these numbers may not reflect the true trajectory of the business.

What does matter to me:

1) March ARR guidance of “at least” $220M:

This figure was provided on the last earnings call, based on already signed contracts and with more potential deals in the pipeline.

I’d be very disappointed if NBIS doesn’t meet this number. It's their own guidance — not a Street estimate.

2) Year-end ARR guidance ($750M–$1B):

I’d like to see this guidance at least reaffirmed. Based on the company’s GPU fleet and current expansion plans, a raise is possible — but given that we’re only in May, I wouldn’t be surprised to see management remain cautious.

(This guidance was already raised in December, from the previous $500M–$1B range provided in October.)”

Now, here’s what the company delivered:

Revenue: $55.3M vs. $57.7M est.

Adj. EBITDA: $(62.6M) vs. $(94.4M) est.

EPS: $(0.39) vs. $(0.45) est.

While Q1 revenue came in slightly below expectations, profitability metrics were materially better than anticipated. But again, that’s not what matters most.

March ARR came in at $249M, exceeding the $220M+ guidance (+175% QoQ and +684% YoY, absolutely mindblowing)

April ARR reached $310M, showing an impressive +25% MoM growth

Year-end ARR guidance was reaffirmed at $750M–$1B

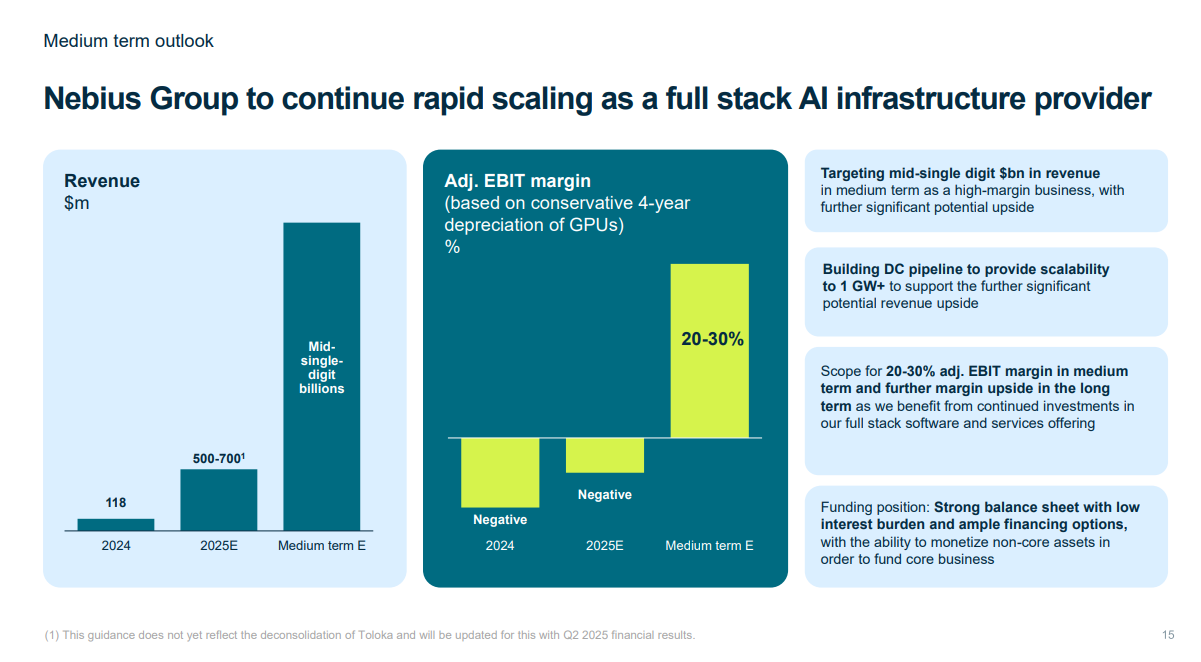

FY2025 Revenue guidance of $500M–$700M

Adj. EBITDA turning positive in H2 2025, with the core business expected to be breakeven as soon as Q3

Mid-term Revenue guidance: “Mid-single-digit billions”

Mid-term Adj. EBIT margin target of 20–30%, with a long-term goal of 30%+

“You know, the reality is that there are scenarios where we could grow more aggressively. Andre and his team are focused on building out the entire infrastructure pipeline, which could enable us to deliver more than 1 GW of capacity in the midterm. If we do that, we could exceed the midterm guidance we’ve provided. We’ll be opportunistic and pursue opportunities as they arise. I think the key drivers of incremental growth beyond our midterm guidance will be increased adoption by enterprise-level customers and larger, longer-term contracts.”

In other words, the already strong mid-term guidance could be conservative.

Importantly, the company is targeting 30%+ long-term EBIT margins while using a 4-year depreciation schedule on GPUs — which is more conservative than CoreWeave’s 6-year horizon. Even under these prudent accounting assumptions, NBIS still expects to deliver exceptional margin performance at scale.

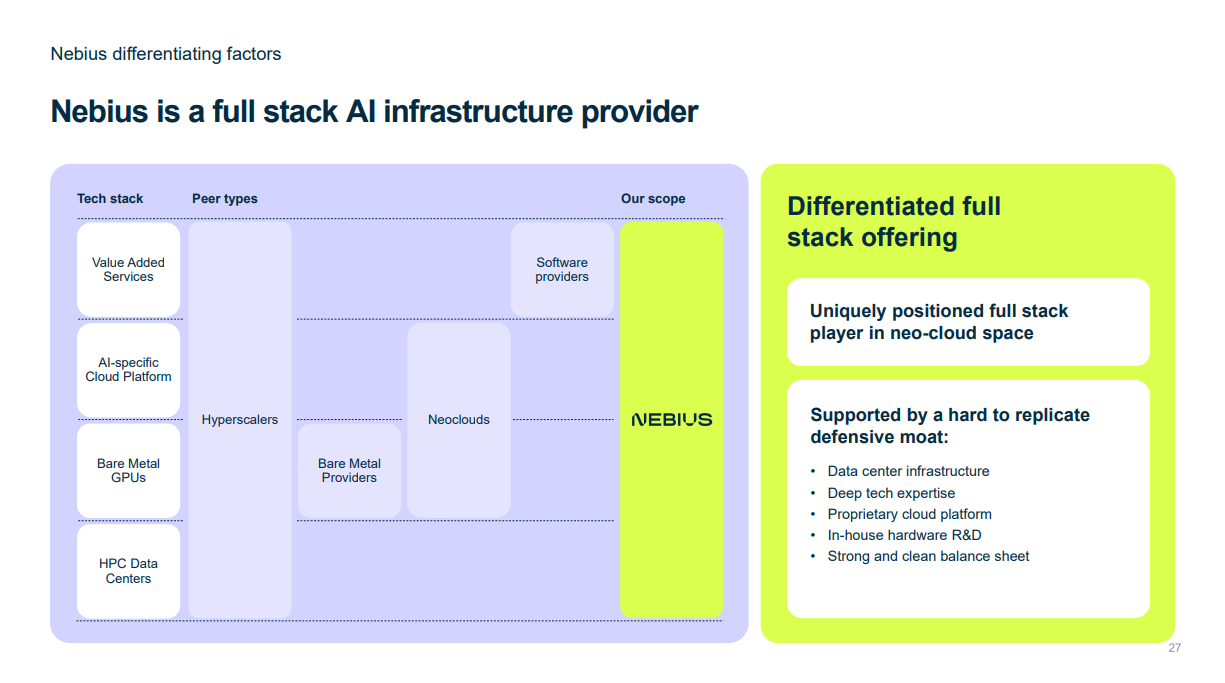

That’s because this isn’t just a neocloud or GPU lessor — Nebius offers software and platform services that sit on top of the infrastructure stack. This vertically integrated model is a key competitive differentiator, bringing in stickier customers and enabling AWS-like profitability at scale.

Cash Position: $1.44B

Debt: None — resulting in low interest burden

“We anticipate maintaining relatively low levels of debt, which means we’ll be able to reinvest a significant portion of our revenue to drive value creation in our core AI infrastructure business.”

Capex for the remainder of 2025: $1.55B

The company remains disciplined and transparent about its capital structure. Management stated clearly that dilution will be avoided as much as possible (but is inevitable at some point), and they plan to leverage subsidiaries to raise non-dilutive funding.

One example:

“Should ClickHouse have a liquidity event in the near-to-mid term, this would provide us with significant capital to invest into our core business.”

Nebius holds a 28% stake in ClickHouse, which is currently valued at $6B and might potentially IPO in the future, creating a potential cash windfall.

Another key asset is Avride, a fast-growing subsidiary that management believes is worth several billion dollars:

“We are actively exploring strategic investments and partnerships to help accelerate its growth.”

As Founder & CEO Arkady Volozh put it:

“There’s no other company in this sector that can raise potentially billions of dollars in this non-dilutive way.”

The opportunity is HUGE and Nebius has the technology, talent and funding flexibility to successfully capture it.

If you want to understand the various competitive advantages Nebius holds in more detail, you can read my full Deep Dive here.

Current Infrastructure and Expansion Plans

Nebius made significant strides in scaling its AI infrastructure during Q1 2025. The company's GPU fleet currently consists mostly of NVIDIA H200s, complemented by H100s. Looking ahead, Nebius plans to begin deploying the next generation of chips — including NVIDIA B200s in Q2 and both Grace Blackwells and Blackwell Ultras in the second half of the year. These upgrades are expected to substantially increase the company’s total compute capacity by the end of 2025.

At the same time, Nebius has been rapidly growing its data center footprint across multiple regions. Over the past three quarters, the company has evolved from a single site in Finland to a globally distributed network with multiple strategic locations. Key milestones include:

Iceland: A new colocation site launched in March 2025.

Kansas City, U.S.: Came online in April 2025, now fully operational and soon to be running B200 GPUs.

New Jersey, U.S.: Announced in March 2025, this custom-built facility is under active construction and follows Nebius’ proprietary efficiency-driven design standards.

The company continues to evaluate additional sites globally. As Arkady Volozh noted, Nebius will begin development on a new site in Israel, with more locations likely to be announced soon:

“We are actively exploring new sites in the U.S. and around the world, and we expect to provide more news on this soon.”

Nebius expects to reach at least 100 MW of contracted data center capacity by the end of 2025, a substantial increase from its prior guidance of 60–100 MW shared just seven months ago. This tells me that the $750M–$1B ARR guidance for the end of the year will be easily achieved — and has a strong chance of being surpassed.

Looking further ahead, management expects to significantly grow capacity in 2026.

The company's aggressive buildout is not just about scale, but about enabling a differentiated offering. As management explained:

“With our expanding capacity footprint and global sales support, we are now able to serve customers 24/7 with a truly tailored approach. Our high-level experts on both sides of the Atlantic, combined with our advanced software platform, go far beyond commoditized GPU-as-a-service offerings. Our customers recognize that we’re building an AI-specialized cloud with hyperscaler-level capabilities.”

Right now, most of Nebius’ customers are the wave of new AI-native companies that have emerged over the past couple of years — and continue to emerge every month. However, the company is already preparing for the next major sector, which has not yet contributed to revenue: the cutting-edge frontier AI labs and large-scale model developers.

“We haven't tapped this market yet, but we're doing a lot to be ready to serve them and help them grow faster. In order to support these customers, we will need significantly larger and more powerful data centers. And we’re already preparing for that. That’s why we have a pipeline in place to reach over 100 gigawatts of data center capacity. We're not there yet — but we will be soon.”

Looking further ahead, a third and potentially even more promising wave of customers is expected to come from the enterprise sector:

“The third sector — maybe the most promising in terms of long-term growth — is the enterprise market. Today, AI has only reached a small fraction of corporate clients. Everyone talks about it, but this is the segment where most of the value from AI is expected to be created. Our full-stack solution and higher-level services are highly relevant to this audience. This market is naturally more global, because real industry players — real enterprises — are based in countries all around the world. That’s where our European and global infrastructure will be in high demand. And outside of a few hyperscalers, we are one of the very few AI cloud providers with the ability to serve enterprise clients across multiple geographies. I believe this will be the most promising sector for us in the near future.”

Finally, a fourth sector is emerging — one that Nebius is keeping a close eye on: national AI initiatives.

“The fourth sector we’re watching carefully is the growing market for national AI projects. We’re hearing more and more about them, and we see a massive opportunity there. We plan to build our AI factories in various countries and regions — including the U.S., Europe, the Middle East, and beyond. Overall, these four sectors illustrate that we’re still in the very early innings of the AI infrastructure market. Demand will be massive across industries and geographies — and Nebius will be there to serve it.”

Building and Improving the Full-Stack AI Cloud

One of Nebius’ key differentiators — and a major driver of future growth — is its full-stack software layer, built specifically for the unique demands of AI workloads. Unlike traditional infrastructure providers, Nebius didn’t bolt software on top of generic hardware — it built everything from the ground up, with AI in mind.

The stack is composed of three tightly integrated layers:

Hardware management — Since Nebius designs its own hardware, it also builds the software tools that monitor and optimize it. This ensures performance is tightly controlled and highly efficient.

Core cloud platform — A fully virtualized environment that mirrors the best of what hyperscalers offer, giving customers robust, flexible access to compute, networking, and storage.

AI application layer — This layer includes pre-configured AI tools and services, simplifying workflows for customers and reducing time to value.

These layers work together to help customers — from AI-native startups to established enterprises — spin up GPU clusters quickly, manage compute resources efficiently, and optimize for performance. For example, proprietary orchestration systems let Nebius deploy thousands of GPUs in just days, enabling customers to get models into production faster.

In Q1 alone, Nebius shipped nearly 50 new software features across its AI Cloud and AI Studio products. Key updates included a new Slurm-based cluster orchestration system with automatic recovery, proactive system checks, and issue detection — all designed to reduce downtime and speed up recovery. Improvements in object storage also led to faster read/write speeds, directly improving training run times.

Nebius also made strides in third-party integration, allowing customers to seamlessly bring in platforms like Metaflow, DStack, and SkyPilot with minimal friction. This positions Nebius as a natural extension of existing AI workflows — not a replacement.

Importantly, this software layer is much more than a technical asset. It’s a critical component of Nebius’ long-term strategy for driving high-margin, value-added revenue. While current revenue contribution from software may still be small, it's already essential to customer retention and platform stickiness. Most managed customers rely on Nebius’ software solutions, including managed Kubernetes, Slurm, and advanced monitoring tools.

The AI Studio platform — Nebius’ inference-as-a-service layer — is also showing early promise. With over 60,000 registered users and growing, it's well-positioned to become a meaningful contributor to margins in the future.

Customers continue to choose Nebius because of its software-driven advantages, which include:

Lightning-fast GPU cluster orchestration;

Deep observability and system monitoring tools;

Enterprise-grade uptime (up to 99.98%);

And hands-on support, with direct access to engineers when needed.

Behind it all is a world-class team of engineers. Nebius has one of the best engineering teams in the industry — talent that competitors simply can’t replicate overnight.

“We’re building something that goes far beyond a classic bare-metal offering. Our engineers are the best of the best, and what they’re building — across hardware, software, and services — is world-class. It would take years for others to catch up.”

As customers increasingly demand more from their AI infrastructure partners — not just raw compute, but reliability, speed, and simplicity — Nebius’ software layer stands out as one of the strongest, yet most underrated, advantages in the entire space.

Subsidiaries

Avride

Q1 marked another quarter of meaningful progress for Avride — Nebius’ autonomous mobility arm. After launching delivery robots across university campuses and urban centers in the U.S., Avride is now pushing forward into autonomous vehicle platforms and robotaxi services.

In March, Avride partnered with Hyundai to co-develop a full AV platform, including redundant safety systems like braking and steering. Hyundai will handle vehicle production, allowing Avride to focus on software and integration.

The collaboration paves the way for Avride to scale its AV fleet, starting with 100 IONIQ 5 vehicles in 2025 and expanding in the following years.

A pilot robotaxi service with Uber in Dallas is expected to begin testing by the end of 2025.

Meanwhile, its delivery robots continue to gain traction:

In January, Avride launched at Ohio State University via a Grubhub partnership — now handling 1,200+ deliveries/day.

Coverage in Jersey City, Austin, and Dallas expanded, with more local restaurants onboarded.

International interest is also emerging, with an initial deployment in Tokyo through a partnership with Rakuten — a potential gateway into Japan’s AV market.

Looking ahead, Avride is preparing to launch at more campuses in Q3 to coincide with the academic semester.

Toloka

Nebius took a major step this quarter to unlock value in Toloka, its data infrastructure platform powering generative AI development.

In May, Toloka secured a strategic investment led by Bezos Expeditions, with participation from Shopify CTO Mikhail Parakhin. This round positions Toloka to scale rapidly while giving it greater governance independence.

While Nebius relinquishes majority voting control, it retains a major economic stake, ensuring it benefits from Toloka’s upside without needing to fund its expansion.

Toloka’s performance in Q1 was strong:

Revenue more than doubled YoY, driven by new enterprise clients and expanded contracts with major frontier AI labs.

All major contracts were renewed, reinforcing Toloka’s role as a trusted data partner.

Its customer base now includes Anthropic, Amazon, Microsoft, Shopify, and Recraft.

TripleTen

Nebius’ tech reskilling and edtech arm, also reported strong growth:

Q1 revenue grew 144% YoY, with student enrollments rising nearly 50% across the U.S. and Latin America.

The company benefited from the late-2024 rollout of bootcamps in Cybersecurity and UX/UI Design.

Customer acquisition costs remained stable, even as the company invested further in brand and reach.

TripleTen recorded its first B2B revenue during the quarter — a key milestone that diversifies revenue and taps into enterprise demand.

The business also rolled out AI-enhanced learning tools to boost engagement and outcomes, expanding its relevance across different learner profiles.

ClickHouse

Nebius still holds a 28% stake in ClickHouse, a leading real-time analytics database company. Although upcoming funding rounds — expected to value ClickHouse at $6B — could dilute this position, the strategic intent is clear: management views this stake as a capital-raising lever that can be tapped when needed to fund the core business while minimizing equity dilution.

Other General Updates

New CFO Appointed

Nebius appointed Dado Alonso as its new Chief Financial Officer, effective June 1. She brings over 25 years of international experience from companies like Amazon, Booking.com, and OLX. She replaces Ron Jacobs, who was instrumental during the company’s restructuring.

Tariffs

The company doesn’t expect global tariffs to significantly impact its expansion plans or cost structure in the near term, though it continues to monitor the situation closely.

Contract Structure

Contract durations range from a few months to multi-year agreements. With the rollout of Blackwell GPUs, Nebius expects to lock in more long-term contracts due to stronger demand for next-gen compute.

I expect future announcements of large contracts with major companies — such as OpenAI, Meta, Google, or Microsoft — to be strong potential catalysts for the stock.

NVIDIA Partnership

Nebius continues to have a long-standing and strategic partnership with NVIDIA that spans product development, capital investment, and go-to-market initiatives. Key elements of the relationship include:

1) Capital Investment

NVIDIA participated in Nebius’ December 2024 capital raise, demonstrating confidence in the company’s technical capabilities and long-term vision.

2) Blackwell Platform Rollout

Nebius is set to be one of the first vendors globally to launch cloud infrastructure powered by GB300 and NVL72 chips from NVIDIA’s new Blackwell Ultra AI factory platform. These next-generation systems are expected to redefine price-performance in AI compute, and Nebius aims to lead in early adoption.

3) Technical Collaboration

The companies are working closely on NVIDIA’s open-source inference framework, Dynamo, which is designed to optimize performance across large-scale AI systems. This collaboration ensures that Nebius’ infrastructure stays on the cutting edge of AI efficiency and compatibility.

4) Reference Architectures and Cloud Partner Program

Nebius is one of only five cloud providers selected to deliver reference architectures under NVIDIA’s cloud partner program. These architectures are designed to guarantee enterprise customers receive at least $1 of performance per $1 spent, a key performance benchmark in the AI infrastructure market.

5) Joint Go-to-Market Motion

Nebius and NVIDIA are tightly aligned in bringing solutions to market, especially as AI adoption accelerates across both startups and enterprises. The partnership helps Nebius support customers with infrastructure that is not only powerful but also certified and validated by one of the top chipmakers in the world.

6) Positioning for the Future

As NVIDIA continues to expand its ecosystem through platforms like DGX Cloud and other AI marketplaces, Nebius is positioned as a key partner — helping enterprises and developers monetize AI faster, more reliably, and more cost-effectively.

Final Thoughts (What Am I Doing?)

If you own NBIS and aren’t happy with this quarter’s results… I’m sorry, but you probably don’t fully understand what you’re holding.

Everything came in exactly within my expectations, and my investment thesis remains very much on track.

I’ll be writing a new article soon to update my Valuation Model for the company. Stay tuned, and don’t forget to subscribe to get it firsthand.

For paid subscribers, here’s an update on my position and my plans: