Today, I initiated a new position in my portfolio in what I consider to be an absolute bargain with the potential to more than double within the next two years.

Here’s why.

Every article I write is available for free.

If you decide to voluntarily pay for the subscription, I truly appreciate your support!

Great news! I'll soon be launching an exclusive group chat for paid subscribers. Your continued support makes it possible for me to do what I love, and I’m committed to offering you even more value beyond the free research you already receive.

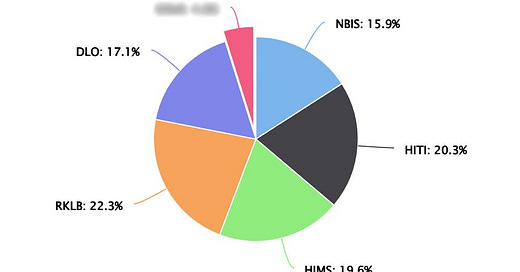

My Current Portfolio

• Rocket Lab (RKLB): 22.3% – Average cost $4.82/share

• High Tide (HITI): 20.3% – Average cost $1.86/share

• Hims & Hers (HIMS): 19.6% – Average cost $10.07/share

• DLocal (DLO): 17.1% – Average cost $10.96/share

• Nebius Group (NBIS): 15.9% – Average cost $30.69/share

• Cadeler S/A (CDLR): 4.8% – Average cost $20.32/share

As you may have noticed, my newest holding is Cadeler S/A (CDLR). To make this addition, I trimmed a bit more of my High Tide (HITI) position. The reasoning remains the same as in my last portfolio update — it has nothing to do with my confidence in HITI, which is still high.

Almost three months ago, I wrote an article outlining the investment thesis for Cadeler S/A — you can find it here.

In this update, I’ll focus on why I believe CDLR is significantly undervalued at its current price.

Recent Earnings Report

If you’ve read my deep dive on CDLR, you’ll remember that my 2025 assumptions implied €200M in EBITDA, reflecting a 40% margin.

Well, yesterday, the company reported its Q4 2024 and full-year results — and they were stunning.

2024 Results:

2024 Revenue €249M, up 128% YoY

2024 EBITDA €126M, up 193% YoY

2024 EPS €0.19, up 217% YoY

Record Backlog €2.5B

Outlook for 2025:

Revenue €485–525M vs. €490.2M est.

EBITDA €278–318M vs. €299.3M est.

This implies a 59% EBITDA margin, far exceeding my expectations, and another year of nearly doubling revenue — this time through entirely organic growth.

Demand for Cadeler’s services remains significantly higher than what the market can supply, giving the company strong pricing power and enabling impressive profit margins.

Additionally, synergies from the 2023 merger with Eneti have started to materialize, but the company believes there’s still significant room for improvement through 2026 and beyond.

Everything is going well — new vessels are being delivered safely, within budget, and mostly ahead of schedule.

Yet despite this execution, CDLR’s valuation remains ridiculously cheap.

Let’s understand why I think the stock could double within the next two years.

Valuation

As shown below, analysts expect CDLR to generate €723.8M in EBITDA by 2027.

The best part? By then, the company will have already moved past its peak CapEx cycle, meaning FCF conversion is expected to reach ~50%.

Even with a conservative 5x EBITDA multiple (~10x FCF), CDLR would trade at a €3.6B valuation in 2027 — an upside of ~120% from today’s price.

But let’s be honest — a company with 60% EBITDA margins deserves a much higher multiple. I wouldn’t be surprised to see it trading at 10x or even 15x EBITDA, which would turn it into a multibagger within just a couple of years.

Even if you value Cadeler based on 2025 expected numbers, the company is trading at a Fwd EBITDA multiple of 5.5x and a Fwd P/E ratio of 11x. For a company expected to double revenue organically this year while expanding its already huge margins, that’s an absolute bargain IMO.

Why Is It So Cheap?

One of the hardest parts of investing is avoiding value traps.

It’s rare for a stock to be incredibly cheap without a valid reason.

In Cadeler’s case, I believe the reasons behind its current cheapness are negligible, and that’s exactly why I see it as a buying opportunity.

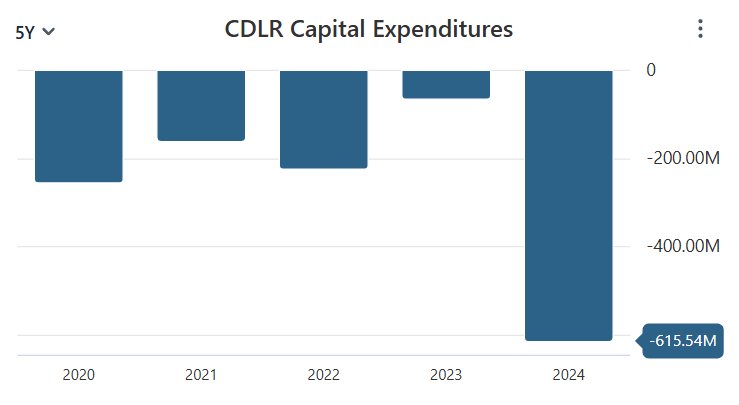

1st - Intense CapEx Cycle

CDLR is currently at the peak of a heavy CapEx cycle to expand its fleet of next-generation vessels. As a result, even though its margins are strong, the company is burning cash.

I’ve seen this happen several times — when a company is at the peak of a CapEx cycle, its multiples often face pressure. But once the cycle ends and the benefits begin to materialize, the market tends to react accordingly.

In this case, I firmly believe these investments are strengthening Cadeler’s leadership position in the offshore wind farm industry. The company will not only significantly increase its capacity but also widen the gap against competitors.

By 2026, once Operating Cash Flows start to cover CapEx investments and the company turns FCF positive, I expect a re-rating that could cause a significant spike in the stock’s price.

2nd - Market Sentiment Toward Renewable Energy

The market has shown little love for renewable energy companies, and this negative sentiment has only worsened since Donald Trump won the U.S. election.

While I understand the reasoning behind this sentiment, most of Cadeler’s business is in EMEA, with only two projects in America this year. Management has stated that any potential demand issues from Trump’s presidency would be easily offset by demand from other regions — especially given the current demand-supply imbalance in the offshore wind market worldwide.

One of the best times to invest in a particular sector or region is when everyone calls it 'uninvestable.'

All in all, I believe this is yet another case of the market being poisoned by the virus of short-termism. CDLR’s fundamentals have improved substantially over the past few years, and that trend is expected to continue. I see this as an asymmetric opportunity for investors willing to hold for at least two years.

Conclusion

As I always say, if I need to build a DCF model to assess whether a company is cheap, it usually means the opportunity isn’t that great.

That’s definitely not the case here. If Cadeler meets expectations moving forward, it’s a no-brainer at its current price.

I plan to increase my position in the coming weeks, which will increase my exposure to Europe and reduce my portfolio’s beta. As I mentioned in my last portfolio update, I want to protect the downside after an outstanding 2024, where I achieved a 173% overall return — this decision aligns with that goal. Plus, I’ve always wanted to own a Nordic company, and the time has finally come.

You can also expect another full article on Cadeler S/A (CDLR) soon.

Stay tuned and don’t forget to subscribe to get instant alerts!

Hi, thank you for the disclosure. You are not apprehensive about this sector/industry ? Pretty much everyone else, besides Europe is cutting financing to sun/wind energy renewable projects

Great find!

What are your thoughts on:

a. Sequential growth this year - do you expect QoQ growth from Q3 to Q4 (analysts are forecasting a sequential decline)?

b. Any thoughts on the revenue CAGR for 2026-27? Should we expect them to deliver 25-35% YoY in 2026 and 2027 - and why?

Thanks.