Hims & Hers (HIMS): Q1 2025 Earnings Review

Yesterday, HIMS reported its Q1 2025 results.

Despite beating expectations across most metrics, the stock is down about 7% in pre-market trading.

In this article, I’ll break down everything you need to know about the Earnings Report.

Financial Highlights

Revenue: $586M (+111% YoY) vs. $538.9M consensus

This marks the strongest revenue growth ever for HIMS, driven largely by explosive demand for compounded GLP-1s. While the company expects a meaningful deceleration in this category as commercial semaglutide comes off shortage, revenue is still projected to grow >60% YoY in 2025.

Revenue excluding GLP-1s: “Growth of nearly 30% YoY”

A sharp deceleration from previous quarters, likely contributing to the post-earnings stock selloff. However, the slowdown stems from a strategic reallocation of marketing spend toward weight loss products in anticipation of the semaglutide shortage ending. With the transition complete, HIMS can now refocus on its broader portfolio — suggesting core revenue growth could accelerate from here.

“Rotation takes time to do efficiently, so we chose to reduce overall spend as opposed to recalibrate weight-related spend to other categories after the end of the semaglutide shortage in February.”

At the same time:

“We're seeing more subscribers come to our platform through organic and other lower-cost channels.”

Subscribers: 2.366M (+38% YoY)

Monthly Online Revenue per Avg Subscriber: $84 (+53% YoY)

A substantial increase, again, primarily driven by GLP-1 offerings. However, HIMS guided that this number will moderate going forward as users transition from its compounded GLP-1s.

Q2 Revenue Guidance: $540M vs. $567M consensus

Another factor contributing to the selloff is that this marks the first time HIMS has missed guidance and projected a sequential decline in revenue. This is clearly tied to the resolution of the semaglutide shortage, and it was unrealistic to expect the company to sustain triple-digit growth without the outsized contribution from compounded GLP-1s. As such, I wouldn’t draw overly negative conclusions from this guidance miss.

Gross Margin: 73% vs. 77% consensus (down from 82% YoY)

While certain efficiencies continued to improve — particularly through economies of scale driven by increased volume at affiliated pharmacies and lower medical consultation costs as a percentage of revenue — gross margins declined due to a higher mix of revenue from compounded GLP-1s. With the semaglutide shortage now resolved, this trend is expected to reverse, and the CFO stated during the earnings call that gross margins should improve in Q2.

Adj. EBITDA: $91.1M vs. $61.8M est. (+182% YoY)

GAAP EPS: $0.20 vs. $0.12 est.

Operating Cash Flow: $109M (+322% YoY)

Free Cash Flow: $50.1M (+321% YoY)

Reiterates FY2025 Revenue guidance of $2.3-2.4B vs. $2.323B est. (+56-63%)

Raises FY2025 Adj. EBITDA guidance to $295-335M vs. $296.6M est. (+67-90%)

Every GAAP operating expense category continued to decline as a percentage of revenue, highlighting the strong efficiency of HIMS’ business model and its impressive ability to unlock operating leverage at scale.

On marketing efficiency, management noted:

“We benefited from efficiencies related to new product launches and improving organic customer acquisition trends, which more than offset higher spend driven in part by our first Super Bowl commercial.”

While some quarter-to-quarter volatility is expected, the company remains confident in its ability to drive 1 to 3 percentage points of marketing leverage per year.

As a result, HIMS managed to double its net profit margin while simultaneously doubling its revenue year-over-year, leading to a fourfold increase in GAAP EPS over the past twelve months — an exceptional performance by any standard.

The same momentum is evident in its cash flow generation. While FCF wasn’t as high as in prior quarters, it still grew by 321% YoY, and operating cash flow reached a new all-time high. The only reason FCF didn’t follow suit was due to a deliberate increase in Capex aimed at strengthening infrastructure. These investments are strategically aligned with the company’s long-term vision and will reinforce HIMS’ competitive advantages and leadership in the sector.

Given the company’s strong balance sheet and highly efficient business model, allocating capital toward long-term infrastructure — even at the expense of short-term margins — appears to be a prudent and value-accretive decision.

Examples of recent Capex investments designed to enhance infrastructure and support the company’s long-term goal of serving tens of millions of subscribers:

Expanded internal fulfillment footprint from 400K to nearly 700K sq. ft. in Arizona

Upgraded automation equipment to enable personalized and scalable precision medicine

Built out sterile fulfillment capacity to support new categories like low testosterone therapy and menopause support

Investing in diagnostic lab capabilities to enhance personalization and lower consumer friction

In summary, these infrastructure investments reflect HIMS’ clear intention to build a durable, defensible platform capable of scaling efficiently over the long term. Rather than optimizing for short-term gains, the company is positioning itself to capitalize on massive future demand across multiple high-growth categories — a strategic approach that underscores both management’s discipline and the strength of the underlying business model.

Target for the next 5 years

HIMS introduced its long-term financial targets for 2030:

Revenue of at least $6.5B

Adjusted EBITDA of at least $1.3B

To put this into perspective, it’s worth recalling what happened the last time the company issued long-term guidance.

At the end of fiscal 2022, HIMS shared its 2025 targets: at least $1.2B in revenue and $100M in adjusted EBITDA. Thanks to exceptional execution, the company hit those targets a full year ahead of schedule — and is now on track to deliver nearly 2x the revenue and 3x the EBITDA originally projected for that year.

However, it’s important to note that now, the bar is even higher. The 2030 outlook spans a longer time frame (five years) and starts from a much larger revenue base, which makes the ambition clearly higher than in 2022. Yet, the implied 22% revenue CAGR and 20% EBITDA margin demonstrate the scale of the opportunity and reflect substantial potential upside for long-term shareholders — provided the company continues to execute with the same discipline it has in recent years.

“We expect the majority of our investment in the coming years to be organic, but we'll continue to ensure that our financial position affords us the flexibility to opportunistically accelerate our roadmap through strategic acquisitions.”

Management’s confidence in these long-term goals is underpinned by several key factors:

Both legacy and newer categories are growing robustly

Personalization has meaningfully improved retention, with a 20-point increase in some segments

Core category penetration remains in the single digits, leaving significant room for reinvestment in growth

Finally, Founder & CEO Andrew Dudum emphasized the unique advantage of building a unified platform:

“When you have a unified brand for men and another for women, you gain the opportunity to build dozens of entirely different businesses under the hood — each with its own care model, treatments, customers, and marketing channels. That diversity is what truly gives this business its long-term strength.”

Five Key Growth Levers

To support its ambitious 2030 targets, Hims & Hers has outlined five core growth levers that will drive the next phase of its growth trajectory. Each lever is designed to deepen the company’s moat, enhance its long-term value proposition, and unlock massive market potential:

1. Deepening Personalization and Precision of Care

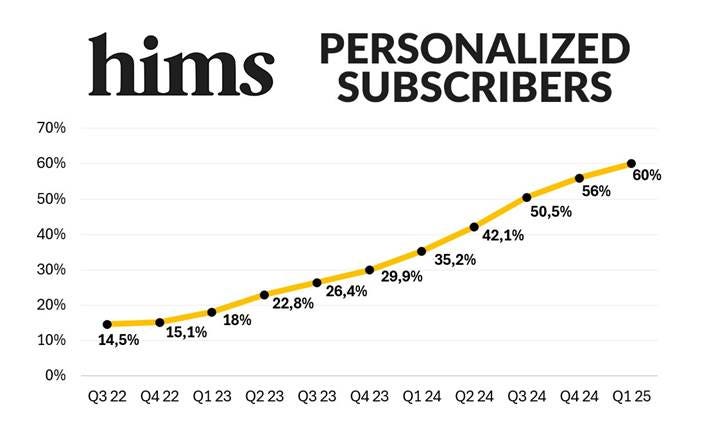

HIMS continues to build its moat in consumer healthcare by personalizing treatment at scale. Over 60% of current subscribers now use a personalized solution, and more than 70% of new users opt for one right from the start.

This is more than a trend — it’s a flywheel: the more subscribers choose personalized care, the more (and better) data HIMS collects, enabling it to develop even better solutions and experiences.

In legacy categories like dermatology, personalization now reaches over 80% of users, driving retention gains of nearly 20 points.

In oral weight loss, personalization helped grow subscribers by over 300% YoY in Q1. This solution is even more important than GLP-1s IMO.

In Sexual Health, the platform is shifting away from “on-demand” solutions to daily, customized regimens. These changes have already improved first-year retention by nearly 10 points and the percentage of customers using daily solutions to 40% — a key signal for higher long-term customer lifetime value.

HIMS is investing in diagnostics, automation, and wearable integrations to move from hundreds to thousands of personalized offerings, each backed by real-time biomarker data and clinical insights.

“We believe that personalization reflects consumers’ desire to balance side effect concerns through personalized dosages, access broad form factors, and address multiple conditions with a single solution.”

2. Expanding into The Next Generation of Specialties

HIMS is extending its platform into new categories that are both clinically underserved and emotionally resonant. These include low testosterone therapy, menopausal support, longevity, sleep, and preventive care — such as early cancer detection.

The acquisition of an at-home diagnostics company will enable frictionless testing across key biomarkers (e.g., heart, hormone, liver, thyroid, prostate), unlocking broader access to proactive care and helping users not only treat illness but optimize their long-term health trajectory.

As part of its broader infrastructure strategy, HIMS is also making a meaningful investment in peptide innovation — a space that’s rapidly evolving across multiple therapeutic areas like pain management, recovery, and longevity. Today, most peptide-based therapies remain accessible only to a small, extremely wealthy subset of the population. HIMS sees a clear opportunity to democratize this innovation.

Just like it did with personalized dermatology and weight loss, the company is now building the infrastructure — including a proprietary peptide manufacturing facility — to bring these cutting-edge therapeutics to the masses at an affordable, hyper-personalized scale. This facility is expected to play a vital role in the future platform as peptides become a more prominent part of the company’s proactive care portfolio.

Essentially, HIMS has always been driven by its vision of providing healthcare that’s convenient, affordable, transparent, and deeply personalized. Over the next few years, in addition to continuing on that path, the company aims to evolve into a fully integrated proactive care platform:

"Generally, from a cultural standpoint, all of us are being awakened and want to take more proactive care. We've seen parents pass away from preventable diseases, we've seen grandparents age. Data is making this easier. Testing is making this easier. Proactive health is making this easier.

There's now a cultural desire not only to treat yourself when you're sick, but actually to try to get ahead of your ultimate lifespan. I would suspect that in the next two to five years, this will grow to be very mass market."

HIMS expects to launch hormone-driven categories — such as low testosterone and menopause — by year-end. This could be a significant catalyst to compensate for the growth deceleration coming from less GLP-1 sales.

3. Enhancing Platform Capabilities Through Proprietary Data and AI

The company aims to elevate its precision of care without sacrificing convenience. With 2.4M active users and growing, HIMS is sitting on a rich dataset that enables continuous improvement.

AI tools like MedMatch will become smarter, helping providers select better treatments.

Coaching, therapy tools, nutrition guidance, and other content-based features will strengthen user engagement and drive behavioral change.

As these tools scale, expect greater stickiness, improved health outcomes, and a more robust platform flywheel.

This creates a future where healthcare is not only reactive but intelligent and adaptive — tailoring interventions to each user’s evolving needs.

4. Strategic Partnerships with Blue-Chip Healthcare Players

The recent partnership with Novo Nordisk marks a pivotal moment for HIMS. It validates the platform’s clinical credibility and opens the door for future alliances with leading pharmaceutical and biotech firms.

The collaboration allows for broader access to GLP-1 medications and demonstrates trust from a major pharma player.

This “blue-chip” mindset ensures compliance, fosters trust, and positions the company as a top-tier distributor and service layer for next-gen healthcare delivery.

“This collaboration also signals something important — trust from a major pharmaceutical leader. It sets the blueprint for future partnerships that will enhance our reach and relevance. Over time, we expect broader collaboration across the industry.”

When asked about the potential litigation risk associated with the end of the semaglutide shortage and HIMS’ continued offering of personalized compounded GLP-1s, here’s what Andrew Dudum said:

"We've said this from the beginning: in everything we do, we aim to be extremely blue-chip and play by the rules. When it comes to compounding and the personalization exemption, the regulations are straightforward and clear. So, we continue to expect personalized semaglutide to remain available on the platform. It's something we discussed early on with Novo. That said, we believe its use should be limited to cases where providers feel it is clinically necessary. The ability to offer hyper-personalization for side effect mitigation is something we will continue to support on the platform."

At first, he seemed confident that Novo Nordisk is aware of the specific circumstances under which HIMS offers these solutions — a positive sign in terms of reducing litigation risk. However, after a few more specific questions, Andrew’s responses became less certain IMO. He even acknowledged the gap by saying: “Will our organizations ever align on that perfectly? Probably not.”

To be honest, I think Andrew understands that the primary reason HIMS has a short interest of over 30% is the combination of litigation and regulatory risks — which is why he’s emphasizing how this partnership significantly reduces both. I’m a bit skeptical about how deep the partnership actually is. Saying they “are developing a broader roadmap together” might be an overstatement, especially since Novo Nordisk has also partnered with other telehealth players like Ro and LifeMD. That said, the partnership clearly lowers litigation risk regardless.

Still within the context of collaborating with blue-chip healthcare players, it seems Eli Lilly isn’t particularly interested in partnering with the company:

"We have no partnership with Eli Lilly. While Mounjaro and Zepbound are available on the platform, it's not through a direct partnership. We’ve had conversations with their organization and will continue to engage with their leadership. We haven’t been able to bring those offerings (LillyDirect) onto the platform yet, but we’ll keep pushing and fighting on behalf of consumers to expand access."

This doesn’t surprise me, given how vocal Eli Lilly has been against compounders.

5. International Expansion

Finally, HIMS sees significant whitespace beyond U.S. borders. Its model — is convenient, accessible, customized, affordable, and transparent healthcare — is not bound by geography.

Early success in the UK has boosted confidence in its ability to scale globally.

Over the next five years, expect a mix of organic international launches and strategic M&A to bring the platform to new markets.

As consumer demand for personalized, accessible care accelerates globally, HIMS aims to be the category-defining brand.

Regarding a potential interest in working with health insurance providers:

"No, I have very little interest in that. There are a few reasons why, but mainly because of how complicated and inefficient it is for consumers."

I completely agree with Andrew Dudum that accepting insurance wouldn’t make sense for HIMS, especially since a core part of its value proposition has always been providing care without the need for insurance. That said, it does make me somewhat skeptical about how well the model would translate to countries with more accessible healthcare systems that don’t face the same issues as the U.S. Nonetheless, given HIMS’ capital-light business model, expanding into other English-speaking markets like the UK, Canada, or even Australia shouldn’t pose significant risk, even if it’s not as successful as the company expects.

Final Thoughts (Am I Re-entering My Position?)

As of May 1, I’ve begun restricting part of my content to paid subscribers. That’s why the final section of this article is behind a paywall.

This week, I’m also launching a private Discord server to further enhance the value of the subscription — feel free to join us!