High Tide (HITI): Investment Thesis Explained 2.0

This article was originally posted on X as a thread on December 1, 2024.

In this article, I'm providing an updated analysis of High Tide’s investment thesis.

It’s my largest position and has just hit a new 52-week high. However, I truly believe this is just the beginning.

Here’s everything you need to know about the company.

Background - How High Tide became the leading cannabis retailer in Canada

The beginning: Raj Grover, the founder and CEO who owns ~9% of the company and has never sold a single share (not even when it was trading 5x higher than it is today), comes from an entrepreneurial family and had already experienced success with several smaller businesses before establishing High Tide. During a business trip to India in search of opportunities in fashion accessories or body jewelry, Raj stumbled upon the potential of cannabis consumption accessories. Recognizing the margin arbitrage opportunity, he shipped $10,000 worth of consumption accessories from New Delhi to Canada and sold everything overnight. After replicating this success a few more times, Raj decided to open a store. This marked the beginning of High Tide's story.

In 2009, Raj opened Smokers’ Corner with an initial investment of less than $50,000 and grew it into a multimillion-dollar empire. At that time, there were only two or three competitors with unappealing stores. Raj believed that by creating a differentiated store in a smart location, he could easily capture market share, and he was right. By leveraging his established roots in Indonesia, Thailand, China, and India, he was able to not only provide a better customer experience but also offer much cheaper products.

Cannabis legalization in Canada: Always looking to stay ahead, Raj seized the opportunity when the Prime Minister of Canada announced that recreational cannabis would soon be legalized. With an existing customer base of cannabis users, it made perfect sense for Raj to expand into selling cannabis itself. He realized that if he only sold accessories, he would eventually lose customers to shops that offered both cannabis and accessories.

After nine years of focusing on consumption accessories and accumulating nearly $10M in retained earnings, Raj raised $18.5M for the first time in 2018 and ventured into the equity markets, marking the beginning of High Tide's journey as a publicly traded company. With easier access to capital when compared to its peers, High Tide expanded its footprint across Canada, highlighted by the significant acquisition of its competitor Meta in 2020, which increased the number of stores from 37 to 67.

The strategy shift that changed everything: Around the same time, High Tide began acquiring e-commerce businesses selling accessories and CBD-related products (mostly oils) with higher margin profiles, a pivotal decision for the company. From acquiring several brands in the U.S., such as Smoke Cartel, FABCBD, Daily High Club, DankStop, and NuLeaf Holdings, to later acquiring BlessedCBD in the UK, High Tide leveraged its market power to enhance margins and diversify its revenue streams.

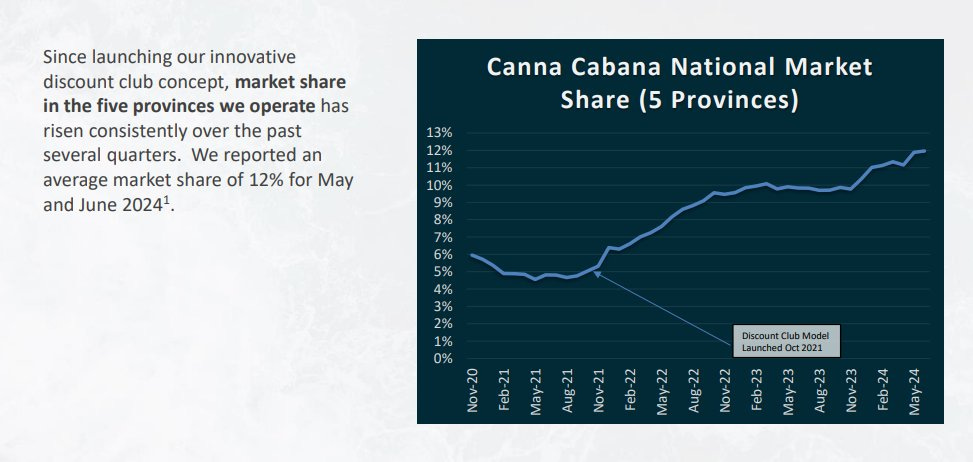

In the summer of 2021, High Tide was accepted for listing on the Nasdaq, marking a significant milestone. Later that year, a transformative decision was made: High Tide launched a discount club model for its retail stores in October 2021. With consolidated margins higher than any competitor due to the previously mentioned CBD-related acquisitions, High Tide could offer cannabis at remarkably low prices, attracting loyal members and rapidly gaining market share.

Although this discount model initially involved selling cannabis at a loss, the move proved to be incredibly successful. High Tide’s market share increased from less than 5% to over 12% in less than three years, despite only representing about 5% of the total cannabis retail store count. Today, the discount model program has more than 1.55M members and continues to grow each quarter (+41% YoY last reported).

Being the first-of-its-kind discount model was the key differentiating factor that propelled High Tide to become the leading cannabis retailer in Canada. No competitor could match their prices, and Raj targeted cannabis users who consumed regularly and were highly price-sensitive.

When I first started investing in High Tide, one of its closest competitors was Fire & Flower Holdings, which ultimately went bankrupt following this price war. There are many more examples of competitors that went bankrupt following this (Four20, Tokyo Smoke, etc), showing how strong HITI has become in the sector. And the consolidation of the market in Canada is just starting.

This strategy also significantly diminished the illicit market, further strengthening High Tide’s market share.

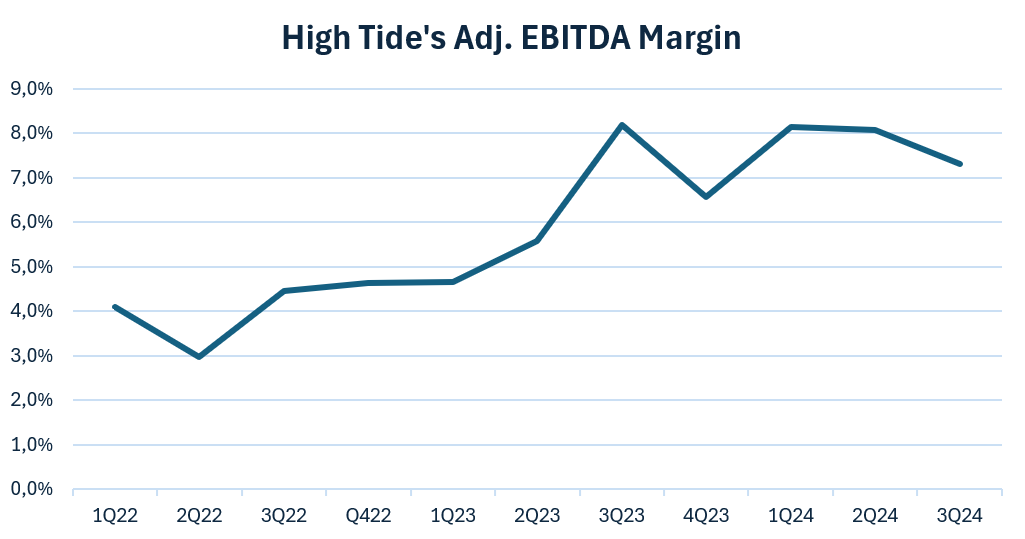

After capturing market share, it was time to turn profitable.

While Raj sacrificed margins to achieve this, economies of scale and several initiatives aimed at improving margins allowed High Tide to become positive free cash flow again in 2023 (4.3% margin TTM as of last quarter), as well as positive net income in the most recent quarterly results, with a consolidated leadership position stronger than ever.

Overall, High Tide took a calculated risk to become the leader in the country, and it proved to be incredibly successful. This success was only possible due to the CEO's extensive experience in the sector and deep understanding of the cannabis consumer, surpassing that of any other management team.

What's next for High Tide? The best is yet to come

While the focus on becoming FCF+ led to a notable deceleration in revenue growth, HITI is now returning to its high-growth strategy.

Despite cannabis being legal for over five years, there's still significant market potential to capture in Canada.

A recent regulatory change in Ontario now allows one company to operate up to 150 recreational cannabis stores, doubling the previous cap of 75. This change is benefiting large retail chains like High Tide. Raj Grover has outlined plans to open 20-30 stores this year (already opened 26 so far), capitalizing on the opportunity and targeting the high presence of the illicit market in the region.

Moreover, the Canadian market is experiencing significant consolidation, allowing High Tide to expand its market share organically and through acquisitions at depressed multiples. For example, High Tide recently acquired a store for 1.5x last quarter's annualized Adj. EBITDA. The CEO mentioned that he constantly receives phone calls from independent operators asking to be acquired, as it's their only alternative to bankruptcy. However, the company has been methodical, not only in the multiples paid but also in selecting complementary and strategic locations.

Every month there are dozens of cannabis stores closing in Canada because they simply can't compete with High Tide.

Over the next year, the company is expected to reach a 15% market share, up from 12% today.

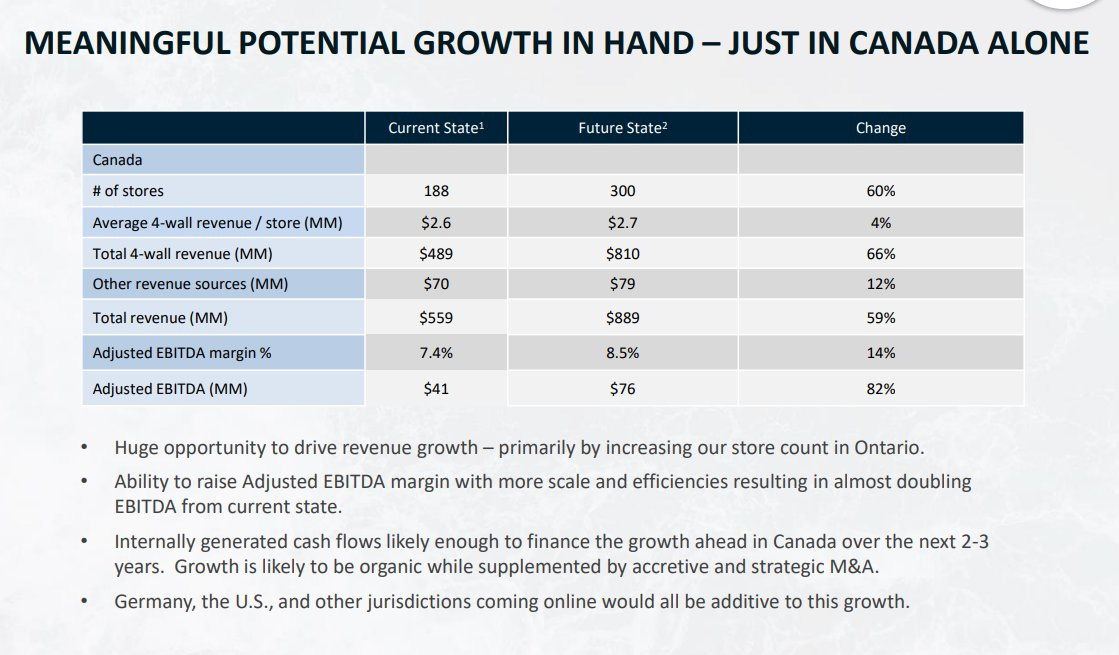

Considering its potential opportunity over the next 2–3 years in Canada alone, the company is expecting to reach 300 stores and generate at least C$76M in Adj. EBITDA, with strong FCF conversion. Notably, these estimates are conservative, as Raj consistently adheres to the philosophy of underpromising and overdelivering.

If you look at the chart below, you might ask, "How is the company returning to its high-growth strategy if its growth has been essentially flat over the past few quarters?"

Well, the growth in the number of stores is still being offset by:

1) The overall retail cannabis sales in Canada have been declining due to macroeconomic conditions and a slight resurgence of the illicit market in certain areas (as mentioned in the last earnings call). Despite these challenges, High Tide continues to capture market share and has even accelerated the pace at which it is expanding its market share, as independent operators struggle to compete with illicit market prices. This is why its growth remains positive rather than negative. Importantly, recent data indicates that Canadian retail cannabis sales have started rebounding, providing a potential tailwind for future revenue.

2) While brick-and-mortar stores have managed to grow under these conditions, the company's e-commerce segment (which sells CBD oils, consumption accessories, etc.) has been underperforming for some time. This has kept the overall company growth nearly flat. Excluding this segment, High Tide’s revenue increased 10% YoY last quarter. These CBD brands were crucial a few years ago for sustaining the initial launch of the company's discount club model in B&M stores. However, they are now becoming a hurdle, offsetting the growth of the core business. At this point, the e-commerce segment represents just 6.5% of total revenue, so its impact will inevitably diminish. As such, I'm not concerned. It’s also important to note that Raj Grover recently stated that High Tide is preparing to launch “an exciting and innovative range of offerings” to accelerate momentum in this segment.

Looking ahead, over the next 2–3 years, I expect the company to achieve high-teens growth based on its Canadian footprint alone.

The new paid membership is further solidifying High Tide’s position as the leader in Canada.

High Tide is becoming the Costco of Cannabis.

After the success of its free discount model, which gathered over 1.5M members in under three years, the company launched ELITE, a paid membership with even better offers. The rollout began slowly, but membership is now growing at a record pace — 203% YoY last quarter.

It's worth noting that this growth is happening while the subscription price is being raised.

Although the absolute number is still relatively small, the conversion rate of regular club members to ELITE ones is getting better every quarter. You only need to make a small purchase for the membership price to pay for itself, it's exactly like Costco.

Last quarter, the percentage of ELITE members compared to regular ones grew from 1.7% to 3.7% YoY.

The long-term vision is for High Tide to be the Costco of cannabis, driving strong and predictable cash flows and strengthening High Tide's competitive edge.

I believe this is one of the catalysts that will help the company further improve its bottom-line margins.

White-label products will also play a crucial role in improving High Tide’s margins, but this will take time.

Currently, only 2.5-3% of SKUs are white-label products, but the company aims to reach 20-25% of all store offerings in the long term.

This is a key catalyst that will strongly contribute to a gradual increase in gross margins.

The company is holding the line on margins given the resurgence of the illicit market in Canada (200+ illicit stores have opened this year, especially in Regina). This is the primary reason for the overall market's decline in sales. In areas where the illicit market has grown more significantly, High Tide has recently reduced margins by 5-7% to remain competitive. However, this is not expected to be a long-term concern, especially as provincial governments begin to act (e.g., a $31M bill approved in Ontario to combat the issue).

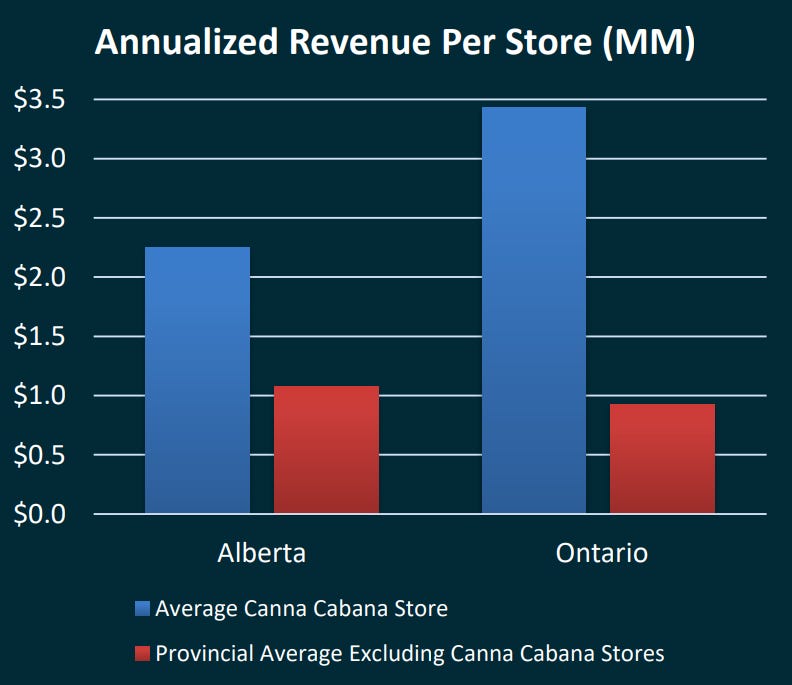

High Tide’s Store Economics are much better than those of any competitor.

The average Canna Cabana store nationally was on a $2.6M annual revenue run rate in June 2024 vs. $1.0M for peers in the five provinces in which we operate.

• Average 4-wall gross margin: 25%

• Average 4-wall EBITDA margin: 12%

• Average cost to build a new store: $260,000

• Average payback period: 10 months

This low-cost model allows HITI to continue expanding organically by using its free cash flow, rather than relying on external funding.

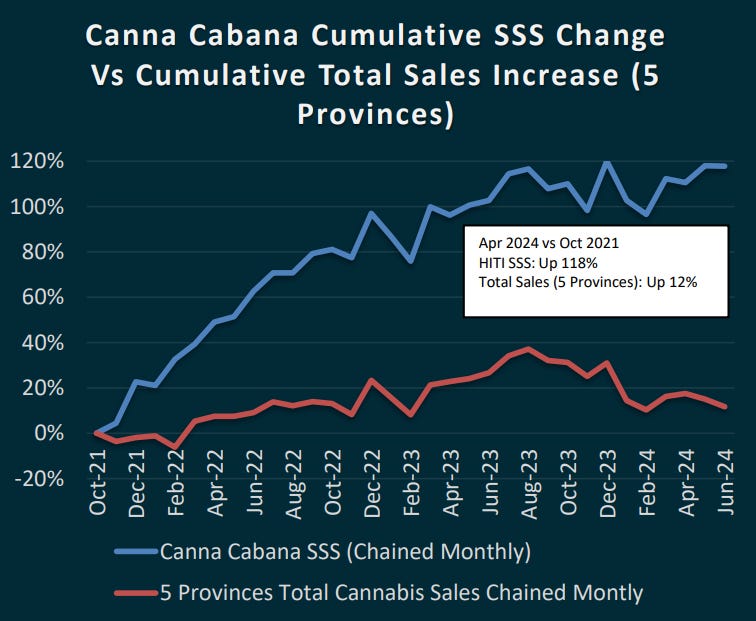

High Tide’s same-store sales have increased by 118% since the end of FY2021, when the discount club model was launched.

In contrast, total sales across the five provinces where it operates are up only 12% during the same period, implying the average operator’s same-store sales are down 21%.

Its competitors are being completely outpaced.

High Tide’s impressive retail metrics:

• Canna Cabana had a shrink rate of just 0.4% last quarter (super low compared to other retailers).

• G&A as a percentage of revenue of just 4.4% over the last year – down from 6.0% a year prior.

• Typically 18 days of cannabis inventory on hand.

Efficiency is key.

Below you can find HITI’s annualized sales per sq. ft. compared to those of other well-known names, such as Costco, Lululemon, Walmart, Target, and more. Over time, people will come to realize how good High Tide's business model is.

High Tide is the only cannabis company able to secure non-dilutive financing. This happened recently, but it wasn’t the first time.

This is remarkable given the reluctance of lenders to fund cannabis businesses in Canada, where many companies have faced bankruptcies as capital dried up, including sizeable players backed by billionaires.

This financing comes with strict covenants, though. Smart dilution may be necessary from time to time to differentiate from competitors and strengthen the company’s long-term position, but it is never done unnecessarily.

The Founder & CEO Raj Grover, the largest shareholder, is the most affected by any dilution that happens. He has already said that, at this depressed price, it will only happen if it's accretive to High Tide’s margins and complementary to its portfolio of stores/brands.

It's also worth noting that, according to Raj, High Tide will never be overleveraged. His father was a small business owner and always taught him to prepare for the 'what ifs'.

SNDL might be the biggest threat to High Tide, but I'm not worried due to their poor management team.

While SNDL’s strategy of acquiring distressed businesses at depressed prices seems smart, they often struggle to turn these businesses profitable. In contrast, High Tide targets failing businesses with promising locations for a turnaround, not just because they’re cheap.

SNDL's attempts to diversify into various segments, like liquor, have diluted their focus and effectiveness. They're not even a cannabis company anymore, with most of its revenue coming from liquor sales.

Their reporting practices also raise concerns, with inconsistent KPI reporting when things don't work out as well as they expected, and potential SEC issues.

Despite their aggressive cash position, their mismanagement makes them less of a threat.

Despite being a retailer with relatively low margins, High Tide’s gross and FCF margins (~8% peak so far) have room to grow.

Cannabis prices in Canada are just starting to stabilize, and High Tide is waiting for full market stabilization before aggressively launching white labels. While many independents are closing and the market is consolidating, High Tide isn’t raising prices yet to avoid aiding competitors. The long-term strategy is to leverage pricing power gradually.

When I asked the CEO if High Tide’s FCF margins were nearing a peak, the response was clear: No, there are still many growth opportunities. As the market consolidates and High Tide’s market share increases, they anticipate further improvements in both gross and FCF margins, plus new areas to explore with scale and other initiatives.

Potential International Expansion

High Tide has never been better prepared to replicate its business model internationally.

In my last article about the company, I mentioned that Germany could be just around the corner. However, that’s no longer the case. The German coalition has collapsed, and elections are now scheduled for March, with the conservative party likely to win.

My thoughts:

• The downside is that we’ve lost a significant catalyst for the company’s top-line growth.

• However, there are a few ways to look on the bright side:

1) This expansion wasn’t priced in, so the stock will likely not react to this news. No analyst had included Germany in their estimates, so High Tide is still as undervalued as it was before this.

2) The company will remain focused on Canada, which has been performing very well and is supported by its FCF generation. There’s also potential for expansion into the U.S. if rescheduling occurs. Expanding into both Germany and the U.S. simultaneously would require more capital than High Tide can currently afford, meaning they’d likely need to use their ATM offering program to raise funds.

3) Although it isn’t entering the recreational cannabis market in Germany yet, neither is any other company. The market will still be there, and perhaps in a few years, we can enter with a much stronger foundation to support that expansion.

All in all, it doesn’t break my investment thesis. I had already discussed this risk before, so it doesn’t come as a surprise to me.

Ongoing developments in the U.S. might give High Tide the green light to expand there.

Significant changes are on the horizon for the U.S. cannabis sector. The potential rescheduling of cannabis from Schedule I to Schedule III could open doors for U.S. cannabis companies to list on major exchanges like Nasdaq or NYSE, making it easier for institutional investors to get involved. The only reason High Tide hasn't entered the U.S. market yet is to avoid compromising its Nasdaq listing, so this would finally open doors for the Canadian leader.

Note: For those who don’t know, U.S. cannabis companies can’t be listed on the NYSE or Nasdaq, only on the OTC markets. Since HITI only sells cannabis in Canada (and only sells CBD products or consumption accessories in the U.S.), there’s no issue. This is also one of the reasons why institutional ownership in the sector is so low.

High Tide, with its vast e-commerce base of over 3M U.S. customers and profitable operations, is poised to leverage these developments. Raj Grover’s strategic approach as a second-mover allows him to avoid pitfalls and strategically open stores in key states. The company is ready to capitalize on its strong foundation and scale efficiently, aiming to secure significant market share with well-chosen locations and a clear expansion strategy.

Most U.S. operators struggle to turn a profit even with gross margins in the 40-50% range, while HITI is both FCF and net income profitable with a gross margin below 30%.

While the company doesn’t depend on the U.S. market to continue growing, this presents an additional catalyst for its upcoming growth trajectory.

Regardless of whether this expansion happens quickly or not, these developments will attract a wave of new investors to the sector and contribute to an overall expansion in multiples.

Since Trump’s victory, there has been widespread panic about cannabis stocks. However, I believe this reaction is overblown, and Trump is not bad for the sector at all.

Yes, Kamala Harris had promised to legalize marijuana if elected, so it's understandable why the market leaned toward her victory. But when you break it down, the main catalysts for cannabis stocks remain the rescheduling of cannabis and the SAFE Banking Act. Back in September, Donald Trump publicly voiced his support for both these developments.

Since his election, Trump has also made several pro-cannabis appointments to his team, including Robert Kennedy Jr. as U.S. Health Secretary. These choices suggest a more favorable environment for cannabis reform under his administration than many initially assumed.

I believe cannabis stocks are at — or very close to — the peak of pessimism, making this an excellent time to consider building exposure. However, most companies don't prioritize creating shareholder value, with High Tide standing out among them. It demonstrated strong relative performance after the U.S. elections, largely because it doesn’t rely on new legislation to drive its growth and profitability. This resilience positions it well for the future, regardless of political outcomes.

Valuation - The most superior cannabis business, yet the cheapest

Retail investors in Canada alone have lost over $130B since the 2017 bubble popped, so I understand why everyone is wary of this sector.

But I have demonstrated how High Tide is different from the most well-known cannabis companies like Canopy Growth, Tilray Brands, and others. High Tide generates strong FCF and has a track record of consistently impressive execution.

Most importantly, it has a highly aligned management team that cares about shareholders, which is rare in the sector.

The fact that this sector is at its peak of pessimism is what makes it possible for us to buy High Tide at such a cheap valuation.

It's also worth mentioning that, unlike the other names mentioned, High Tide went public late in the game and was not part of the bubble in 2017-2018. That's why it is so underfollowed and why most people don't even know about it.

Let's check the numbers.

HITI generated CAD $22M in FCF over the last 12 months, so it is currently trading at 16x LTM FCF. It's worth noting that this was the first full year of FCF profitability, so this number should improve significantly from here.

But since most cannabis companies are not FCF-positive, let's use EV/EBITDA as a proxy.

HITI is trading at ~7x its NTM Adj. EBITDA. Importantly, its Adj. EBITDA from these last 12 months increased 41% from the previous year. It's mind-blowing that it can trade at such a low multiple.

I'm expecting the company to generate C$90M in Adj. EBITDA in 2027, which, with a 15x multiple, would provide almost 300% returns from its current valuation. This estimate excludes any potential international expansion, which I believe will happen soon in the U.S.

The disparity is huge when we look at other Nasdaq-listed cannabis stocks. For instance, Tilray Brands is trading at close to 30x, Aurora Cannabis at 12x (this one has been turning its business around, but it's more focused on medical/premium cannabis), and Canopy Growth isn't even EBITDA-positive.

High Tide is the best-performing cannabis company and one of the very few that is already generating both FCF and net income, yet it remains the cheapest.

Faster growth + better margins + a superior management team + a winning business model + the lowest valuation = a complete bargain, at least in my view.

While most investors are avoiding this sector due to the well-known companies that destroy shareholder value, I'm taking advantage of this opportunity by investing in what I consider a hidden gem.

Signs of the Bottom Being Behind Us

1st - The recent acquisition of Nova Cannabis by SNDL at a low valuation multiple might have highlighted how undervalued HITI is. Nova Cannabis was one of the few competitors to High Tide, but under SNDL’s ownership, it has lost direction. This acquisition occurred at an EV/TTM Revenue multiple of 0.55-0.6, while HITI, a more established and superior business, was trading at 0.4x. Similarly, HITI’s EV/TTM Gross Profit multiple of 1.4x contrasts sharply with Nova's 2.4x. This disparity indicates that HITI is undervalued, and the market is already recognizing this.

I talked about this when the acquisition was announced, and in the meantime, HITI’s multiples have already caught up to those.

2nd - Following Trump's victory, causing the entire cannabis sector (including MSOS, CGC, TLRY, etc.) to drop significantly, HITI’s performance remained strong. Despite the sector-wide double-digit decline, HITI has maintained a notably higher value compared to its pre-news levels. This resilience suggests that High Tide is too cheap to ignore, and the market is catching on.

Before finishing this thread, I'd like to highlight this:

HITI has less than 10% institutional ownership, while over 75% of the market is owned by institutions.

Peter Lynch often talks about this. If you want to achieve multibagger returns, find a hidden gem before the institutions do. This is the case here, in my honest opinion.

I'm not selling it with 100% or 200% profit, as I believe it has the potential to become a billion-dollar business soon. Of course, this assumes that execution continues as it has been.

I guess that's it! Thank you so much for reading.