DLocal (DLO): Updated Valuation Model and Why I'm Buying More

Two months ago, I published a Deep Dive on DLocal (DLO), outlining my full investment thesis and explaining why I was initiating a position in the company.

You can read it here:

Today, I’m revisiting and updating my valuation assumptions to estimate DLocal’s intrinsic value — this time using a very conservative approach due to the current market environment.

But first, let’s go over what has happened with the company since my last article.

What Has Happened Since My Deep Dive?

Another Short Report

Since Muddy Waters released the first short report in 2022, many short sellers have realized how easy it is to target DLocal. The company operates with dozens of currencies and reports results that are sometimes complex to analyze — making it a convenient target. These short reports are often filled with overcomplicated jargon, designed to appear insightful while actually offering little substance.

Recently, the New York Supreme Court dismissed the lawsuit filed against DLocal in 2022. The lawsuit claimed that DLocal reported payment volumes in a misleading way that gave the false impression of skyrocketing growth. However, the judge concluded that DLocal had clearly disclosed how those figures were calculated. All other claims were also dismissed.

Just like this case, I believe the other reports are nothing burgers.

Q4 Earnings Report

• TPV growth accelerated to 51% in Q4 (45% in FY2024). At constant currency, it grew 81% YoY.

• TPV retention rate of 140% in 2024:

"But on top of that, and that’s why we believe we can deliver that consistent high TPV growth (over the long term), we do see a pickup in the percentage of volume that will come from new merchants."

• Continued improving transaction approval rates and reducing processing costs.

• Achieved significant efficiencies by renegotiating with processors and brokers, enhancing hedging strategies to minimize currency losses, and optimizing structures and flows for tax efficiencies.

• New revenue streams coming soon:

"We're investing in our product development capabilities to generate additional growth vectors for dLocal. These will come from new categories such as stablecoins and APMs, just to name a few. We're already focused on new products that will launch this year and in the future, generating additional mid-term revenue streams."

• Year marked by an admittedly weak first quarter which was then followed by progressively stronger QoQ performance, and the continuation of an investment cycle aimed at achieving greater scalability for our business over the long run.

• Africa & Asia grew from 12% to 27% of total gross profit in two years, with the remainder still coming from Latin America.

• Net take rate decreased from 1.2% to 1.1% QoQ, primarily driven by the growth of Tier 0 merchants, change in payment mix in Mexico and Brazil, and higher expatriation costs in South Africa. It was also negatively affected by the ramp-up of the standalone payment orchestration option launched at the end of Q3, which on a positive note allowed for the recovery of volumes in Brazil versus the prior quarter. To offset this, the company continues to push into higher take rate markets and verticals which over the long term should partially offset take rate compression.

• Adj. EBITDA / Gross Profit continues to improve QoQ (now at 68%), despite ongoing investments in engineering, operations, and licensed portfolio expansion.

• Net income to FCF conversion remains strong at 109% in Q4.

• 2025 Guidance: Pretty strong IMO, but the market doesn't seem to like the expected decrease in take rates. $DLO has always operated in markets with particularly high take rates, so as the business deepens its relationships with Tier 0 merchants, this trend is expected. I think their strategy of prioritizing not losing large customers due to pricing makes perfect sense in the long term. This should be offset by growth in higher take rate verticals and new revenue streams from upcoming product launches later this year. Despite this, the Adj. EBITDA / Gross Profit ratio is expected to continue improving.

• FX impacts are excluded from guidance:

"If the trends we’ve seen in Q1 hold up, then that’s potentially a tailwind."

• Take rate compression is expected to slow in the medium term:

"We anticipate some new products entering the market that should generate incremental take rate."

• I appreciate Pedro Arnt’s long-term approach:

"We really see the importance of not getting caught up in short term worries about take rate, but the importance of continuing to gain scale to drive down processing costs over the long run, winning merchant contracts in markets where we compete in an RFP or where they ask us to add a market, understanding that over time you can then leverage those relationships across more and more markets. And again, I go back to the sustained TPV growth over a long period of time, we think is the single most important metric of success right here."

• On competition:

"Are competitive dynamics stronger than they were two, four, or six years ago in some of our largest markets? Probably, yes. But based on disclosed growth rates of our largest competitors in Latin America, it appears we are still winning market share and outgrowing them in the region."

I genuinely believe the market overreacted to DLocal’s latest earnings report. The long-term investment thesis remains intact, and prioritizing TPV growth to avoid losing a few large customers is the right call.

The decline in the average take rate reflects DLocal’s growing importance to Tier 0 merchants — partners that are essential for driving more stable, diversified growth across multiple markets over time. Strengthening those relationships looks like a smart strategic move.

All in all, I’m using the dip as an opportunity to increase my position, and I’ll adjust my valuation model accordingly.

New Partnerships

• DLocal has announced a strategic partnership with Temu, the global e-commerce platform known for its affordable products.

This collaboration enhances the shopping experience for millions of customers across 14 emerging markets in Africa, Asia, and Latin America by offering seamless and secure payment options tailored to local preferences.

In my opinion, this partnership is another strong validation of DLocal’s competitive advantage — not just because Temu is a major merchant, but because Temu already works with Adyen in more developed markets. Yet, it chose DLocal to support its expansion across several emerging regions.

This reinforces a key point I made in my Deep Dive: while DLocal competes with global payment giants like Stripe and Adyen, its solutions are specifically built to thrive in the complex regulatory environments of emerging markets. That’s a value proposition that merchants genuinely appreciate when expanding into these regions.

If you haven’t yet, make sure to read my Deep Dive for more context.

• DLocal announced a partnership with Belmoney to improve cross-border remittances in key emerging markets, with plans to expand into China.

In 2024, remittances were DLocal’s fastest-growing vertical, with approximately 100% year-over-year TPV growth.

"By integrating with dLocal’s network, we can significantly lower costs, improve transaction speeds, and provide a better cross-border payments experience for both senders and recipients." — Bruno Pedras, Founder & CEO at Belmoney

• DLocal and Coda launched a global strategic partnership to expand gaming payment streams in emerging markets.

The collaboration boosts payment coverage, helping gaming publishers monetize more effectively across 11+ regions — led by Pix transactions in Brazil.

• Lastly, and although a smaller deal, DLocal partnered with Airtel to expand mobile money payment options for Google Play users in Kenya.

This initiative simplifies payments for users without credit cards, enabling a broader demographic to access Google Play services.

By leveraging Airtel’s mobile money infrastructure, DLocal continues to improve payment accessibility and drive digital growth in Kenya.

CFO Transition

On March 25, DLocal announced that Mark Ortiz will step down as Chief Financial Officer due to an unforeseen health issue that requires his full attention.

The market typically doesn’t respond well to changes in key leadership roles, but in my opinion, this doesn’t impact the investment thesis at all. If it were Pedro Arnt, I’d be concerned — but that’s not the case here.

Health always comes first, and I truly wish Mark a smooth and speedy recovery.

Attempt to Interview CEO Pedro Arnt

I’m excited to share that I’m in the process of trying to secure an interview with DLocal’s CEO, Pedro Arnt.

As you may know from my previous article on the company, Pedro is one of my favorite business leaders. This would be an incredible opportunity, both as a shareholder and as an investor overall.

After reaching out to the company’s Head of Investor Relations, she responded:

“We will check internally regarding the possibility of an interview and get back to you as soon as we can.”

Fingers crossed for a positive outcome!

How Tariffs Impact DLocal

As a digital payments processor, DLocal is not directly affected by tariffs on physical goods. However, currency fluctuations matter.

Currently, a weaker U.S. dollar benefits DLocal, as it earns in emerging-market currencies but reports in USD*. In the long term, if tariffs contribute to higher inflation and interest rates in the U.S., the dollar could strengthen, reversing this benefit. That said, FX fluctuations are a common headwind for the company.

*I expect tailwinds in both Q1 and Q2 of this year.

Importantly, a potential slowdown in global trade could dampen cross-border transactions, indirectly affecting DLocal’s total payment volume. For now, however, the company remains well-positioned.

It’s also worth noting that the new tariffs applied to the countries where DLocal operates came in at 10% — the lower end of expectations.

Final verdict: Short-term tailwind, long-term potential headwind, but not a concern for the investment thesis

Something I would really love to see is an expansion of the previous buyback program, which has probably already ended or is close to ending. DLocal has a strong cash pile and solid FCF generation, so this is the perfect time to aggressively buy back shares, as it would make a big difference in the FCF/share evolution over the next 5 years.

Updated Valuation Model

In my previous Deep Dive on DLocal, I explained why I see tremendous upside over the next five years using a few assumptions.

As you know, I always say: if I need to build a DCF model to figure out if a company is cheap, then it’s not cheap enough.

Still, in this updated model, I’ll take an even more conservative approach to estimate DLocal’s intrinsic value.

Now that the company has reported its Q4 and FY2024 results, let’s start from there:

2024 TPV was $25.6B, up 45% YoY and 81% YoY at constant currency (just imagine what this could look like with potential tailwinds).

My previous assumptions implied a 30% CAGR in TPV through 2030, which I still believe is reasonable. However, given the current macro environment, I’m lowering that to 25% CAGR to stay ultra-conservative.

Starting from $25.6B in 2024, this would result in TPV of $97.7B by 2030.

Since 2019, DLocal has consistently generated 3–5% of TPV in revenue, with 3% being the low end, recorded in 2024 (their worst margin year ever).

I previously assumed a 3% average take rate in my model. But while take rates have stabilized, Tier 0 merchants (who contribute lower take rates) now account for a bigger portion of revenue. So, to be even more cautious, I’m lowering this to 2.75%.

Revenue in 2030 = 2.75% of $97.7B = ~$2.69B

2024 was also DLocal’s worst year ever in terms of margins — FCF margin came in just above 12%, whereas in the past it has reached 30%+.

I previously assumed a 24% FCF margin by 2030, expecting margin expansion as operating leverage kicks in. While I still believe that's realistic, I’ll now lower this assumption to 18% — again, staying very conservative.

FCF in 2030 = 18% of $2.69B = ~$483M

Just to highlight: this estimate is roughly half of what I had in my prior model. I truly believe I’m being very conservative here.

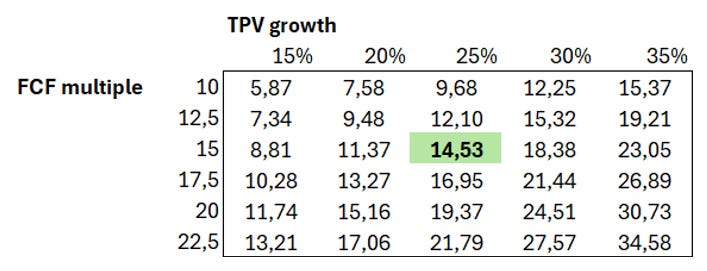

Using a 15x FCF multiple (the lower end of my previous range), we arrive at a $7.25B valuation by 2030.

PRICE TARGET:

Applying a 15% discount rate (to reflect emerging market risk), we get a Price Target by the end of 2025 of ~$14.50/share — an ~80% upside from the current share price.

Keep in mind that I tried to be as conservative as possible — in reality, I believe the upside is much larger than this, and that it may very well deliver over 30% CAGR over the next 5 years (as my previous valuation model suggested).

Beyond these estimates, I’ve excluded any potential reduction in share count, which is highly likely to further enhance FCF/share growth. Shares outstanding decreased by ~3.3% YoY last quarter, and I would expect this trend to continue. However, I am not factoring this into my estimates.

I also developed a few Sensitivity Analyses to explore how changes in these assumptions would impact the Price Target. Feel free to take a look:

I could’ve run one or two more stress tests, but I think it’s clear enough that the worst-case scenario in each case is very close to — or even above — the current stock price, which suggests that downside potential is minimal.

Importantly, I maintained a 15% discount rate across all scenarios — a very conservative figure compared to the 8–12% range typically used by most analysts.

Final Thoughts

All in all, DLO remains a high-conviction holding in my portfolio, and I’ve been taking advantage of this dip to buy more shares. I was already adding after the 30%+ crash following the Q4 results — a huge overreaction IMO — and I’m buying even more during this tariff drama, as I don’t believe the company’s operations will be much affected. In fact, this may even act as a short-term tailwind for upcoming earnings reports.

While I believe the downside is minimal, never forget that in the current market environment, everything can be dragged down further — so be sure to manage your risk appropriately. In my case, I’ll probably keep lowering my cost basis — I started my position in the $13s, so this dip is a blessing I’m taking full advantage of.

As always, thank you so much for reading and for your support!

DISCLAIMER: Like any investment, DLO faces several risks. Make sure to check my Deep Dive on the company to understand what I consider to be the most important ones.

Important Communication:

In a few weeks, I’ll start restricting part of my content to paid subscribers. As such, the current price (which was set lower on purpose, since it was voluntary) will change. If you choose to support me before then, you’ll get a 50% discount on the yearly plan. I spend countless hours working to bring you the best content I can, so I appreciate your understanding. Don’t worry — I’ll still publish plenty of free articles as well.

Thank you for the clear thesis! This does seem like a huge opportunity with a very strong management.

I'm still trying to figure out valuation and growth prospects.

How is "take rate" defined? Is it Gross profit / TPV?

If so, it seems that it has been steadily declining:

2021: 2.73% ($202m / $7.4b)

2022: 1.91% ($202m / $10.6b)

2023: 1.56% ($277m / $17.7b)

2024: 1.15% ($295m / $25.6b)

2025 Q1: 1.05% ($85m / $8.1b)

Are these figures correct?

If no, what are the correct definitions/figures?

If yes, why do you expect them to reach a 2.75% take rate in 2030, as it seems competition is intensifying? (and guidance for 2025 suggests further contraction of take rate, as guidance for TPV growth is higher than gross profit at 35%-45% and 20%-25% respectively)

Great article mate. I wish I had pulled the trigger before earnings, however, the earnings report did solidify my conviction so I guess I should be grateful still that I can get in now.

The dividend decision, after reacting the same as you initially, is actually ridiculously bullish long term. The best thing about it? We get paid out regularly for holding a stock that is growing fast with minimal capex. It was the last thing that spurred me to start a position despite it running from $8 to $12 in a short amount of time. I love their thinking outside the box approach

As always, I am immensely grateful to have found multiple stocks to put in my long term portfolio, largely in part due to your research…great work as always