Yesterday, DLocal (DLO) reported its Q1 2025 earnings — and it was a blowout quarter.

The company beat expectations across the board, sending the stock up as much as 25% in pre-market trading.

As the second-largest position in my portfolio, I couldn’t be more pleased with its performance.

In this article, I’ll break down everything you need to know from the earnings report.

Financial Highlights

• Total Payment Volume (TPV) came in at $8.1B, +53% YoY, with a Net Retention Rate of 144%. On a constant currency basis, TPV growth was even stronger at +72% YoY.

• Revenue reached $216.8M, beating the consensus estimate of $209.9M. This represents +18% YoY growth, a meaningful acceleration from +8.8% YoY in the previous quarter. In constant currency, revenue growth hit an impressive +36% YoY.

LatAm continues to be the primary revenue driver, accounting for 75% of total revenue, while Africa & Asia contributed the remaining 25%. However, in terms of gross profit, the split was slightly more balanced, with 70% from LatAm and 30% from Africa & Asia.

“We continue to benefit from the increasing geographic diversification of our operations. This diversification, as highlighted in previous quarters, enables the company to sustain strong growth momentum, even in the face of short-term challenges in certain markets.”

This geographic diversification is an important trend for the long term, as it helps mitigate both customer and country concentration risk. One of the key takeaways from DLocal’s volatile 2024 was how vulnerable the company was to isolated disruptions in certain markets or from individual merchants. While there’s still a long way to go, it’s encouraging to see consistent progress toward a more balanced revenue base.

• Gross margin was 39%, improving from 34% YoY

• Adjusted EBITDA was $57.9M, easily topping the $47.5M estimate. That’s a 57% YoY increase, with an Adjusted EBITDA margin of 27% (vs. 20% YoY).

Efficiency also improved meaningfully, with Adj. EBITDA / Gross Profit at 68%, up from 58% a year ago.

• GAAP EPS came in at $0.15, ahead of the $0.12 estimate.

Net income rose 163% YoY, with net margins expanding from 10% to 22%.

• Free Cash Flow totaled $40M, up +200% YoY.

Notably, this strong FCF came despite increased Capex, as the company continues to invest heavily in technology, product development, and innovation. Even amid this ongoing investment cycle, DLocal is delivering impressive operational efficiency.

DLocal also reaffirmed its full-year guidance:

Revenue: $933M–$1.01B (vs. $939M consensus)

Adj. EBITDA: $227M–$246M (vs. $239.4M consensus)

Despite continued investments in technology — particularly in AI and automation — to strengthen its infrastructure, optimize efficiency, expand its service offerings, and elevate service quality, DLocal reported an impressive quarter across most metrics.

It's important to note that investments in technology and operations are expected to increase throughout the remainder of the year.

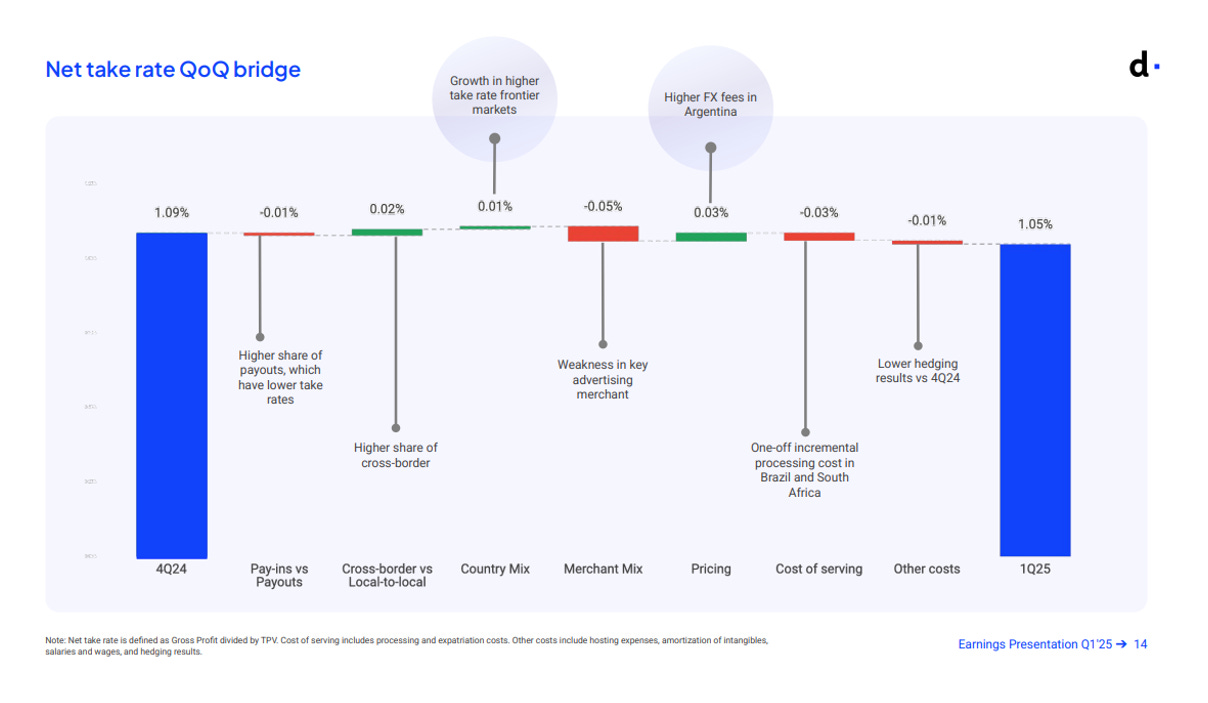

The Only Weak Spot: Take Rate – But It’s Stabilizing

The only negative datapoint this quarter was the net take rate, which declined by 4 basis points QoQ. Management attributed this primarily to:

Weakness in a key merchant in the advertising sector (likely META or Google)

A one-off cost increase in Brazil

These headwinds were partially offset by:

Higher FX fees in Argentina

Increased cross-border volume

Strong growth in frontier markets

Pedro Arnt also highlighted that smaller markets typically have higher take rates than larger ones like Brazil or Mexico, where take rates have been under pressure. A good example is Chile, which posted particularly strong results. As DLocal continues to shift its volume mix toward higher-margin geographies, take rates should stabilize — or even improve.

Additionally, other mitigating factors could emerge later this year:

“I think you'll see as the year progresses, we're feeling better about our innovation pipeline. So our ability to push new products and services that ideally help us monetize better.”

In short, while the dip in take rate is worth noting, I’m not concerned at this stage — especially if it’s the trade-off for the company’s impressive TPV growth, which underscores its strengthening leadership position.

One Final Note

It’s important to remember that Q1 2024 was one of the weakest quarters in DLocal’s history, which flatters the YoY comparisons. That said, this quarter was objectively strong. Part of my investment thesis was that the market overreacted to temporary challenges last year, and Q1 2025 is a clear sign of recovery. However, investors should be realistic — margin expansion going forward will likely moderate from this rapid pace.

As of March 31, 2025, DLocal held $356M in cash and cash equivalents and no debt, giving it ample flexibility to continue investing in growth while maintaining a healthy balance sheet.

Tariffs as a Potential Tailwind

As I’ve mentioned before, tariffs — while broadly perceived as a market risk — may actually represent a strategic tailwind for DLocal.

In their own words:

“At the same time, global trade dynamics are evolving. The ongoing discussions around tariffs and the fragmentation of traditional trade models are creating opportunities for both emerging markets and dLocal. The shift to a more multilateral and diversified focus is prompting developed economies to engage with emerging markets more strategically and with greater urgency — an environment that plays directly into dLocal’s mission of empowering global merchants to localize and optimize their payment strategies in these high-growth regions.”

This shift is meaningful. As trade policies become more fragmented and complex, companies are being forced to diversify away from legacy models that rely heavily on one or two major economies. That’s accelerating engagement with emerging markets — a trend that aligns perfectly with DLocal’s core value proposition: enabling global merchants to offer localized, seamless payments in high-growth regions.

It’s true that tech giants and mega-cap companies have already adopted alternative payment rails and localization strategies. But the vast majority of global merchants — especially mid-sized ones — are still behind. As tariffs reshape the flow of goods and services, the need for infrastructure that can handle complex, multi-country payment scenarios is growing fast. This translates directly into a larger TAM for DLocal.

When markets sold off sharply over concerns around Trump’s proposed tariffs and their ripple effects on global trade, I saw that moment as an opportunity. DLocal was already a high-conviction position in my portfolio, but I increased my exposure because I believed it could actually serve as a hedge against deglobalization risks.

Tariffs may be disruptive in many sectors — but for DLocal, they could very well be a catalyst.

Dividends Announced

In a move that caught me by surprise, DLocal announced an extraordinary cash dividend of $0.525 per common share, amounting to a total cash outlay of $150M.

Ex-dividend date: May 27

Payout date: June 10

Starting in 2026, DLocal will begin paying regular dividends with a 30% FCF payout ratio.

The shift to dividends isn’t due to a lack of growth potential. It’s a response to the nature of DLocal’s business model:

“The beauty of our business model is that we can grow without throwing capital at it.”

DLocal operates an asset-light, high-margin business that doesn't require heavy CapEx to scale. They’ve already returned $100M to shareholders in both 2023 and 2024 via buybacks, and this dividend is simply a continuation of their approach to distributing excess capital — not a sign of stagnation.

In fact, Pedro Arnt was clear about the company’s ongoing investment focus:

“It’s another investment year. I don’t know if the market loves that, but we know it’s what we need to do. We are investing back into the business, and then there’s significant natural leverage in the business.”

Additionally, this won’t limit their ability to pursue M&A:

“There are a lot of opportunities to find good assets at now attractive valuations that could be interesting add-ons to what we’re doing.”

While I personally would have preferred another buyback program — especially given its potential to boost long-term FCF per share — I found the company’s rationale for this dividend well thought out:

“After careful consideration of our capital allocation strategy, we concluded that a dividend policy aligns with our long-term objectives. Our company expects to generate consistent cash flows over time, which will suffice to meet our strategic goals, including possible inorganic growth through targeted M&As, increases in Capex when required, and investments in larger business development deals.

When evaluating the most efficient way to return capital to investors, we — along with our advisors — determined that a dividend was the optimal choice, given the current limited liquidity in our stock. A buyback program would have further constrained liquidity and potentially impacted the stock’s performance.”

This last point is particularly important. With only 67.25M shares in the public float, DLocal already has a very thinly traded stock for a company valued at over $3B.

A $150M buyback at current prices could have reduced the float by nearly 20% — creating even more liquidity constraints and potentially exposing the stock to greater volatility or manipulation, especially considering how often DLocal has been targeted by short sellers.

As a reminder, the reason why DLocal has such a small float is that over 76% of shares are held by insiders and General Atlantic, with the co-founders still owning about 35% of the company. This decision tells me they’re probably not looking to sell anytime soon — and now, with regular dividends starting in 2026, there’s even less incentive for them to do so.

Final Thoughts

Some investors are reading too much into this move, suggesting that paying dividends implies slower growth ahead. But that logic doesn’t apply here.

In DLocal’s case, it’s simply about capital efficiency. They’re generating more cash than they need, and with the float already small, buybacks could have an unexpected effect. Returning capital via dividends makes more sense in this specific context.

As I often say: there are no universal rules in investing — context is everything. In this case, the context is clear: DLocal is a fast-growing, asset-light, cash-generative company that now happens to be returning capital via dividends instead of buybacks because the latter could disrupt its stock’s liquidity.

It’s that simple. Investors tend to overcomplicate things — but this time, the story is straightforward.

Technology Update

In Q1, DLocal made significant progress on its long-term vision of becoming a more intelligent, efficient, and scalable payments infrastructure — driven by a strong push into automation, AI, and performance optimization.

Automation & AI: Driving Scalable Efficiency

DLocal continued to double down on AI and automation, not just as buzzwords, but as core pillars of its operating model. This quarter’s initiatives focused on eliminating manual processes, reducing error rates, and improving merchant experience:

AI-Driven Operations: Machine learning models were deployed to improve efficiency in customer support and compliance, allowing faster response times while automating critical monitoring functions.

Chargebacks & Refunds: Automation helped boost merchant win rates in chargeback disputes and significantly sped up refund processing, contributing to a smoother end-user experience.

Faster Integrations: A redesigned onboarding system now allows new merchants to integrate in just hours — down from several days — without compromising on compliance or performance.

Improved Settlement Flows: A revamped merchant settlement platform drastically reduced manual work, improving accuracy and enabling faster fund availability.

These changes are not only improving the day-to-day efficiency of DLocal’s operations, but also laying the groundwork for long-term operational leverage.

“Over the mid-term, these results should deliver operational leverage and enhanced capabilities as we progressively integrate these technologies across the entire organization. We anticipate these efforts will lead to a noticeable slowdown in mid-term hiring growth, improved operational leverage, and ultimately a more robust and scalable business.”

Performance Optimization

In parallel, the company sharpened its focus on conversion rate optimization — critical to boosting both TPV and revenue without increasing customer acquisition costs. Among the highlights:

Smart Request Strategies: DLocal’s machine learning model that dynamically modifies payment requests based on acquirer behavior delivered a 1.2 percentage point uplift in conversion rates.

Smart 3DS Rollout: In select African markets, the deployment of Smart 3DS technology enhanced security for high-risk transactions and drove a 6-point improvement in conversion rates.

Network Tokenization: Progress continued in Latin America, where tokenization support in Argentina, Colombia, Uruguay, and Peru helped increase conversion rates — by 1.6 percentage points in Colombia and 1.4 in Argentina, for example.

These improvements not only enhance merchant satisfaction but also reinforce DLocal’s differentiation in fast-growing, underpenetrated markets.

Regulatory Advantage: Expanding the Licensing Footprint

DLocal also made strategic progress in expanding its regulatory footprint, further strengthening its moat. In Q1, the company secured:

Two new licenses in Argentina (as an aggregator and payment facilitator)

One new license in Chile (as a cross-border sub-acquirer)

These licenses increase DLocal’s flexibility and control in key regions, making it easier to onboard new clients and roll out new services while maintaining compliance in complex, fast-evolving regulatory environments.

Essentially, this technology-led approach reflects exactly what Pedro Arnt set out to do when he joined: invest in innovation and infrastructure to deepen DLocal’s value proposition for merchants, even at the cost of short-term margins (in this case, we didn’t even see a sacrifice of profits). It’s a strategy built around resilience, long-term scalability, and ultimately, higher shareholder returns.

New Partnerships

DLocal’s focus on innovation, customer-centric solutions, and strategic expansion across emerging markets continues to drive deeper engagement with existing merchants while attracting new ones.

This quarter, several key developments reinforced the company’s ability to grow share of wallet and strengthen long-term relationships with global clients.

Here are a few highlights:

Final Thoughts

All in all, DLocal’s investment thesis remains firmly on track.

Even in the midst of an investment cycle, the company continues to drive meaningful gains in operational efficiency — demonstrating the power of its asset-light model and disciplined execution. The structural appeal of the business remains intact: a massive and expanding TAM, favorable secular trends, attractive margins, robust FCF generation, and a solid moat across the sector.

As a market leader with a growing innovation pipeline, the company is strategically positioned to capture disproportionate upside in high-growth emerging markets. The confirmation that ongoing trade fragmentation and tariff uncertainty could actually benefit the business only reinforces one of the original reasons why I made DLocal my second-largest position.

The announcement of a dividend came as a surprise, and while I personally would have preferred further buybacks, it’s by no means a thesis-breaking move – especially as the justification makes perfect sense. If anything, it reflects the sheer strength of DLocal’s cash flows and the company’s discipline in capital allocation.

Above all, what gives me the most confidence is Pedro Arnt’s unwavering focus on enhancing DLocal’s value proposition for merchants. This ongoing effort is deepening the company’s competitive moat and positioning it perfectly to capitalize on long-term opportunities across its markets.

I’ll leave you with a quote from the earnings call that perfectly captures the upside potential:

“Exiting this year, we should be able to allow the natural leverage of the model to begin to flow-through. If you overlay to that everything that's happening on the AI front and automation, particularly to help you improve cost structures, and I tried to address this in the prepared remarks, I think it's positive in terms of our ability to return to margin levels we've had in the past, and eventually even surpass those when you take more of a mid-term view...”

This is HUGE.

If DLocal can return to — and ultimately exceed — its historically high margin profile, the stock could be a clear multibagger.

It will require flawless execution, but if there’s anyone I trust to pull it off, it’s Pedro Arnt.

Disclaimer: As of this writing, M. V. Cunha holds a position in DLocal (DLO) at $10.11/share.

That's it! Thank you so much for reading.

Don’t forget to subscribe for more content like this.

There is a small UK bank ( called Crown Agents Bank - parent company is CAB Payment Holdings PLC) that has some overlap with what DLocal does. Due to some poor recent execution and African currency headwinds the share price is rock bottom (CABP.L on the London Stock Exchange). I have thought for a while that it would make a good purchase for DLocal. It buys DLocal a banking licence and would strengthen operations in Africa and Asia where CABP is strong. Any thoughts?

Company did do well in Brazil and Mexico market in last couple years. How do u like the potential competition with Meli and others?