In this article, I break down the investment thesis for one of the most underfollowed small-cap stocks in the market.

Every article I write is available for free.

If you decide to voluntarily pay for the subscription, I truly appreciate your support!

Great news! I'll soon be launching an exclusive group chat for paid subscribers. Your continued support makes it possible for me to do what I love, and I’m committed to offering you even more value beyond the free research you already receive.

If you haven’t been living under a rock, you know the cost of living has skyrocketed worldwide over the past few years.

Tiendas 3B (TBBB) has become a lifeline for Mexican families. Founded with the mission of providing high-quality products at the lowest possible prices, the company has grown into the country’s leading hard discount retailer.

The Origins of Tiendas 3B

In a world where inflation and rising costs make everyday expenses more challenging, affordable retail solutions have become more crucial than ever. One company that has successfully addressed this need in Mexico is Tiendas 3B. With its commitment to offering high-quality products at unbeatable prices, the brand has transformed the discount retail landscape in the country. But how did this retail powerhouse come to be? The answer lies in the vision of Anthony Hatoum, who recognized an opportunity to bring a globally successful business model to Mexico and revolutionize the way people shop.

Anthony Hatoum is a businessman and civil engineer of Lebanese descent. Before entering the retail industry, Hatoum built a strong career in investment banking and consulting, working with prestigious firms such as JP Morgan and McKinsey. His expertise in finance and retail strategy enabled him to identify high-potential business opportunities in emerging markets.

However, what truly set him apart was his exposure to BİM, Turkey’s leading discount supermarket chain. While working with BİM, he saw firsthand how a low-cost, high-efficiency retail model could thrive in emerging economies. Observing the company’s success in Turkey, Egypt, and Morocco, Anthony Hatoum realized that Mexico shared similar economic conditions that made it an ideal market for the hard discount model.

The Birth of Tiendas 3B

In 2004, Anthony Hatoum arrived in Mexico with a clear mission: to establish a retail brand that would offer "Bueno, Bonito y Barato" (Good, Nice, and Cheap) products to Mexican consumers. Despite not speaking Spanish at the time, he was determined to bring this concept to life.

By 2005, the first Tiendas 3B store opened in the State of Mexico. The business model focused essentially on:

Eliminating unnecessary intermediaries to reduce costs.

Offering a carefully selected range of high-demand products.

Developing private-label brands that offer more affordable alternatives to national brands.

Prioritizing operational efficiency to maintain low costs.

Using a centralized distribution system for optimized inventory management.

The response from consumers was overwhelmingly positive, proving that there was a strong demand for this type of retail experience.

Tiendas 3B quickly gained momentum, thanks to an aggressive expansion strategy. Unlike traditional supermarkets that expand gradually, the company strategically placed distribution centers (DCs) to support clusters of stores. Each new DC allowed it to immediately supply multiple locations, ensuring efficiency from day one.

What began as a single store in 2005 has grown into a national retail giant. Today, Tiendas 3B has over 2,600 locations and 16 DCs across Mexico, with a strong presence in states such as Hidalgo, Puebla, Tlaxcala, Morelos, Guerrero, Michoacán, Querétaro, Veracruz, and Guanajuato.

The company’s expansion shows no signs of slowing down, as it continues to serve millions of Mexican consumers looking for quality products at accessible prices. With its proven business model and commitment to affordability, Tiendas 3B remains a dominant force in Mexico’s retail sector.

Why Are Tiendas 3B So Affordable? More Details About The Business Model

Tiendas 3B has transformed grocery shopping in Mexico by offering high-quality essentials at unbeatable prices. Its business model is designed to maximize efficiency, minimize costs, and pass savings directly to consumers, allowing it to build a loyal customer base while maintaining sustainable profitability.

But how does the company manage to keep its prices so low?

A Limited Yet High-Impact Product Assortment

Unlike traditional supermarkets that stock thousands of items, Tiendas 3B carries only a carefully curated selection of approximately 800 SKUs that meet the daily needs of its customers. This approach results in higher sales per SKU, lower inventory costs, and increased negotiating power with suppliers. The product range is divided into three key categories:

Branded Products: Recognized national and international brands offered at the lowest sustainable market price. These products attract foot traffic but have been accounting for a decreasing portion of total sales, as private labels gain momentum due to their more attractive cost-quality ratio for customers (and better margins for TBBB).

Private Label Products: High-quality alternatives to national brands, developed in-house and sourced from over 100 trusted manufacturers. These products have been accounting for an increasing portion of total sales, reinforcing Tiendas 3B’s value proposition. Tiendas 3B has the most developed private label offering in Mexico, providing an ideal balance between price and quality.

Spot Products ("Los Irrepetibles"): Limited-time offers on food and non-food items such as clothing, electronics, and household goods, changing every two weeks to keep the shopping experience fresh and engaging.

A Business Model Designed for Efficiency

Tiendas 3B operates on a hard discount retail model, which prioritizes affordability and operational simplicity. Its efficiency-driven strategy relies on:

High Product Turnover: With a limited number of SKUs, inventory moves quickly, ensuring fresh products and lower storage costs, which results in strong cash flow generation.

Decentralized Operations: The company is organized into regional clusters, each managed by a regional director and supported by a distribution center serving ~150 stores. DCs are vital for Tiendas 3B, ensuring frequent store replenishment, reducing stockouts, and lowering logistics costs by optimizing delivery routes. They support expansion by enabling efficient operations in new regions and help managing inventory by preventing excess stock and minimizing waste. Additionally, DCs improve supplier efficiency by streamlining bulk shipments and distribution.

Lean Cost Structure: The company operates with lower gross margins than traditional retailers, translating into lower prices for consumers. Nonetheless, due to the efficiency of its business model, this does not impede the company from generating FCF.

SKU-by-SKU Optimization: "Our stores are designed to handle more SKUs, but we are extremely disciplined in deciding what ‘more’ means. If a completely new category meets our criteria of high rotation and high value for money, we utilize the extra space to expand our SKU count. Otherwise, we remain highly selective. For every new SKU we add, we evaluate the weakest one and remove it. This approach might seem counterintuitive, as increasing sales by simply adding more SKUs appears easy. However, we consider the bigger picture. Our priority is maintaining efficiency across the board, ensuring high inventory turnover, and making sure that every product on our shelves delivers strong value for money."

The Virtuous Cycle of Cost Leadership

The success of Tiendas 3B is driven by a self-reinforcing cycle of efficiency and scale:

Lower operating costs allow for lower prices.

Lower prices attract more customers.

Higher sales volumes per SKU increase buying power with suppliers.

Better supplier terms further reduce costs, restarting the cycle.

Sourcing & Supply Chain Efficiency

Tiendas 3B's high purchasing power strengthens supplier relationships, allowing for better payment terms and lower purchasing costs. In 2022, the company purchased from 293 suppliers, with the largest supplier accounting for just 4.2% of purchases and the top five suppliers making up 18.4%. This diversification reduces dependency and enhances supply chain resilience.

Private label products are developed in-house, with Tiendas 3B's purchasing team overseeing every step — from supplier selection to packaging design and marketing. The company invests in quality control, conducting regular laboratory tests and factory audits to maintain high standards.

Pricing Strategy & Competitive Advantage

Tiendas 3B's pricing strategy is designed to attract and retain value-conscious shoppers:

Prices are on average 13.9% lower than Bodega Aurrera and 7.3% lower than Tiendas Neto.

Private label products offer even greater savings, with some items priced up to 47% cheaper than national brands at competing stores.

The company strives to keep prices stable and be the last retailer to raise prices and the first to lower them, ensuring customer loyalty.

Pricing decisions are made weekly by a Product and Pricing Committee, allowing for swift adjustments based on competitive analysis and consumer demand.

Note: Data is from 2022 but remains similar to today.

All in all, the company’s business model is simple but highly disruptive. In an economic landscape where purchasing power is shrinking, Tiendas 3B provides a lifeline to millions of consumers — delivering quality, affordability, and convenience like no other.

Hard Discount vs. Convenience Stores: Two Very Different Models

Many people still mistake hard discount retailers for bigger convenience stores, but they serve different purposes:

Price Strategy: Hard discount stores focus on everyday low prices with no promotions, whereas convenience stores have higher prices but frequent deals.

Product Selection: Hard discount retailers offer a full grocery selection, while convenience stores focus on quick-grab items like snacks and drinks.

Private Label vs. Big Brands: Hard discount chains emphasize private-label products to keep costs low, while convenience stores mainly stock well-known brands at premium prices.

Shopping Experience: Hard discount stores are built for stocking up, with larger aisles and shopping carts, whereas convenience stores are designed for quick stops.

Operating Hours: Convenience stores are often open 24/7, while hard discount stores have fixed hours, similar to supermarkets.

Due to these differences, Tiendas 3B's direct competitors are other hard discount retailers like Waldo's, Tiendas Neto, Bara, and Abarrotes Willys, with Tiendas 3B leading due to its first-mover advantage.

Same-Store Sales: It’s Clearly Working

Tiendas 3B has two major revenue drivers: new store openings and same-store sales growth. While store expansion fuels the company’s rapid footprint expansion, the performance of existing stores has been equally impressive.

The company’s same-store sales growth has been consistently strong, with an impressive CAGR of over 15% in the past few years. This sustained momentum highlights the effectiveness of Tiendas 3B’s business model and operational efficiencies.

Standardized, Efficient Store Model

The company has developed a standardized store format that enhances operational efficiency and scalability. Most of its stores fall within a size range of 300 to 450 square meters, allowing for streamlined inventory management, optimized staffing, and a consistent shopping experience. Additionally, the store layout prioritizes visibility and accessibility, making restocking and loss prevention more efficient.

The company’s low-cost model is further reinforced by its ability to secure favorable lease agreements. With rents averaging only 2% of sales, Tiendas 3B can operate profitably without requiring premium locations, as its stores prioritize accessibility over high-foot-traffic areas.

Strategic Store Locations

Tiendas 3B tailors its store placements to fit both urban and non-urban settings. In urban areas, stores are embedded within neighborhoods, making them highly accessible for daily shopping trips. In rural and suburban areas, the company places stores near major intersections or local commercial hubs to maximize foot traffic.

The company’s geographic expansion has been disciplined, focusing on high-density regions to ensure efficient logistics and distribution.

The Secret Sauce: Word-of-Mouth Marketing

Unlike many retailers that rely on heavy advertising to drive traffic, Tiendas 3B benefits from exceptionally strong word-of-mouth marketing. Customers are highly satisfied with the store experience, leading them to enthusiastically recommend the brand to friends and family. Online reviews consistently highlight the store’s affordability, convenience, and product selection, creating a powerful organic growth engine. This natural customer advocacy helps sustain high foot traffic and reinforces the company’s strong same-store sales performance.

"When we ask ourselves what the fundamental driver is, the answer is the continuous improvement in the value we offer to customers. As I mentioned in our last earnings call, if you compare our basket today to what we offered five years ago, you'll see a significant improvement in its attractiveness to customers. That, essentially, is the fuel that continues to drive increased same-store sales across the board and across all store vintages. As long as we maintain this momentum, I don’t see a slowdown."

Growth Strategy

Tiendas 3B has grown at an extraordinary pace. The company strategically expands by:

Targeting densely populated areas where demand for affordable groceries is high.

Minimizing upfront capital expenditures per store.

Leveraging negative working capital dynamics, ensuring self-funded growth.

Achieving fast break-even times, making each new store profitable quickly.

With over 2,600 stores in operation and an estimated potential for at least 17,000 more, TBBB is far from reaching its growth ceiling.

Profitable Growth

Tiendas 3B’s business model has demonstrated sustainability and resilience across various economic cycles. The company maintains low operating costs as a percentage of sales, benefiting from economies of scale, stringent cost discipline, and strategic use of technology to improve efficiency. Additionally, closer integration with private label suppliers further enhances cost efficiency. This operational structure is expected to support future expansion with only marginal incremental costs, reinforcing the company’s ability to drive profitability while growing its footprint.

Disciplined Geographic Expansion with Low Investment Per Store

The company continues to expand its store network rapidly, prioritizing locations that are convenient for customers, most of whom access stores on foot. Expansion efforts follow a disciplined approach, ensuring that supply and distribution capabilities remain efficient. Standardized store formats and operational requirements help keep capital expenditures per new store low, enabling Tiendas 3B to fund its aggressive expansion strategy without significant financial strain.

Private Label Offerings

Private label products play a key role in Tiendas 3B’s strategy to provide higher value-for-money alternatives to branded products. Increased penetration of private label sales is expected to drive stronger customer loyalty, support sales growth, and improve margins by giving the company greater pricing and supply chain control.

Expanding “Los Irrepetibles” Sales

Approximately 50 spot products are introduced every two weeks, offering customers a treasure hunt experience with high-value pricing. Since these items are not replenished once sold out, they drive urgency and repeat visits.

Tiendas 3B is also testing the selective introduction of higher-ticket spot products to assess customer acceptance and price elasticity. The company plans to expand its spot product purchasing division to strengthen sourcing capabilities and optimize purchasing power, which could further enhance sales performance.

Introducing New Product Categories and Services

To meet evolving consumer needs, Tiendas 3B is actively testing and introducing new product categories. Recent initiatives include the addition of beauty products, with plans to expand offerings in ice creams, fresh meats, and frozen meats. Internal analyses indicate strong demand for these categories, which could drive incremental sales and improve customer wallet share.

Beyond product expansion, Tiendas 3B is leveraging its growing store network to enhance its service offerings. The company currently facilitates utility and service payments and mobile top-ups, among other services. Given the high frequency of customer visits, there is potential to further expand service offerings, creating additional revenue streams while improving customer convenience.

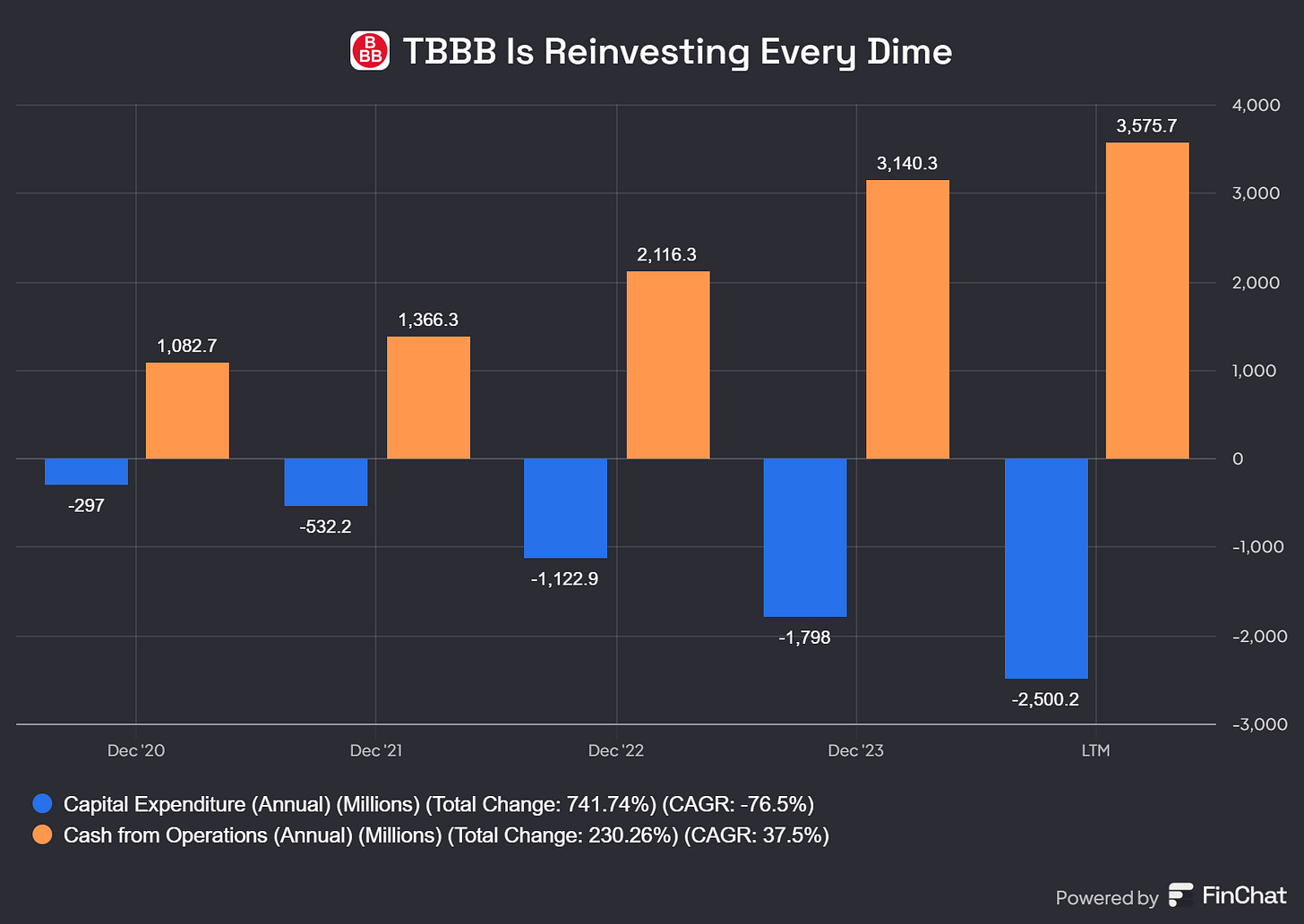

Reinvesting Every Dime

One of the core pillars of Tiendas 3B’s success is its disciplined approach to reinvestment. The company operates with a shared economies-of-scale model, where efficiency gains are partially allocated to expanding margins and partially passed on to customers.

Tiendas 3B continuously identifies ways to enhance operational efficiency, with multiple cost-saving initiatives running at any given time. These range from improving truck maintenance programs and optimizing delivery routes to enhancing ordering systems and response times. Even small adjustments — such as using lidless storage boxes — translate into substantial labor cost savings, reinforcing the company’s lean operating model.

“As we get larger, the opportunities for efficiency improvements grow, and we continue to dilute costs with a larger revenue base.”

Technology also plays a key role, with ongoing investments in automation and data-driven decision-making helping to reduce labor hours and improve reporting accuracy.

Strong Balance Sheet

Tiendas 3B maintains a robust financial position, with no debt aside from lease liabilities tied to store locations. This clean balance sheet provides flexibility and resilience in navigating economic uncertainties, something that gains even more importance when considering the company’s negative working capital strategy (to be explained later).

Long-Term Focus: Customer Value Over Margins

Unlike many retailers that prioritize margin expansion, Tiendas 3B prioritizes affordability and customer retention. Management views gross margin fluctuations as part of a broader strategy:

“If we do see a decrease in gross margins, then we're most likely going to reap the benefit in increased sales and gaining more customers. So, this is a trade-off that we're doing on a constant basis and something that's very dynamic.”

Nonetheless, TBBB’s gross margins have been gradually increasing every year.

Accelerating Store Expansion

With the belief that the market can sustain up to 20,000 Tiendas 3B locations over time, the company remains focused on expanding its footprint.

Ultimately, Tiendas 3B reinvests every dollar back into growth. As management succinctly put it:

“What I can tell you is that we — and as you've seen from our track record — we reinvest everything back into growth.”

Given this strategy, valuing the company based on free cash flow alone would be misleading, as reinvestment remains the priority over short-term cash generation. We'll touch on this in the Valuation section.

Summarizing The Factors That Contributed To Its Success

Despite competing with well-established and global retail giants, the company has leveraged a set of competitive advantages that have allowed it to thrive and maintain impressive growth.

1. Experienced Leadership

Anthony Hatoum, the company’s Founder & CEO, leveraged his background in investment banking and consulting, along with firsthand experience at BİM, Turkey’s top hard discount retailer, to develop a well-structured plan for Tiendas 3B. Recognizing Mexico’s suitability for the model, he conducted in-depth market research upon arriving in 2004, directly engaging with consumers. His disciplined approach enabled Tiendas 3B to scale rapidly from a single store in 2005 to over 2,600 today, establishing it as Mexico’s leading hard discount retailer.

2. Rapid Store Expansion

Tiendas 3B has demonstrated an exceptional ability to scale, which is a crucial element of its first-mover advantage. Since opening its first store in 2005, the company has expanded rapidly. By the end of Q3 2024, Tiendas 3B operated 2,634 stores across Mexico and had 16 distribution centers. The speed of its expansion has been remarkable, with 392 net new store openings in 2022, 396 in 2023, and over 420 expected in 2024.

This aggressive expansion strategy has positioned Tiendas 3B as the fastest-growing retailer in Mexico in terms of sales growth, significantly outpacing incumbent retailers.

3. Same-Store Sales Growth (The Power of Word-of-Mouth and Customer Loyalty)

Tiendas 3B’s strong same-store sales growth is a testament to its operational strength and deep customer loyalty. While rapid store expansion has fueled its success, the company’s ability to retain and grow its customer base has been equally important. By consistently offering competitive pricing, high-quality products, and a seamless shopping experience, Tiendas 3B has built strong trust with consumers.

A key driver of this loyalty is its no-questions-asked, no-receipt-needed money-back guarantee, which encourages customers to try its private-label products with confidence. This trust-based approach, combined with increasing average ticket sizes and transaction volumes, has reinforced Tiendas 3B’s reputation and fueled organic growth through word-of-mouth recommendations. As a result, the company has successfully expanded into higher-ticket items and new product categories while maintaining its core value-for-money proposition.

4. A Highly Efficient, Scalable, and Self-Financed Retail Model

Tiendas 3B’s success is driven by a combination of strategic financial management, cost-efficient operations, and a decentralized organizational structure that enables rapid expansion while maintaining profitability. A key pillar of its business model is its ability to operate with negative working capital, achieved through maintaining low inventory days and securing favorable supplier payment terms. By prioritizing high-turnover items and limiting its product assortment to a carefully curated selection of one-brand, one-size products, the company optimizes inventory efficiency. This negative working capital cycle allows Tiendas 3B to use cash generated from operations to finance its growth, reducing reliance on debt or external funding and providing a significant competitive advantage over traditional retailers.

In addition to its financial efficiency, Tiendas 3B’s lean operational model is designed to minimize costs and maximize productivity. Unlike conventional supermarkets that carry thousands of SKUs, Tiendas 3B focuses on a limited selection, simplifying logistics and reducing overall expenses. The company continuously improves its cost structure, with sales expenses as a percentage of total revenue declining each year, staying significantly lower than traditional grocery stores that rely on higher gross margins to sustain operations. To further optimize efficiency, the company employs practical cost-saving measures, such as selling products directly from the box to reduce stocking time and labor costs. Its logistics operations are also highly optimized—store deliveries are designed so that a single truck driver can unload products in less than 30 minutes, significantly lowering labor expenses and improving overall supply chain efficiency. By maintaining a low-cost structure, Tiendas 3B can pass savings on to customers, offering highly competitive pricing while still achieving positive operating profits despite its low gross margins.

Another key differentiator is Tiendas 3B’s decentralized and nimble organizational structure, which enables efficient decision-making and rapid scalability. The company operates through 15 independent regions, each managed by a regional director with the authority to open new stores and oversee operations without requiring approval from headquarters. This decentralized approach reduces bureaucratic bottlenecks and allows the company to respond swiftly to market changes, ensuring operational flexibility. As a result, Tiendas 3B can efficiently scale its footprint by opening new regions and stores with minimal delays while maintaining high levels of operational efficiency.

5. Significant Purchasing Power

As Tiendas 3B’s sales have grown, so has its purchasing power. The company’s model, which focuses on a relatively small number of SKUs, allows it to negotiate better prices with suppliers. By concentrating its purchases on high-rotation items, Tiendas 3B can secure competitive pricing and favorable payment terms. The company has also fostered strong relationships with suppliers, which enables it to pass savings on to customers in the form of lower prices.

In addition to its purchasing power, Tiendas 3B works closely with private label suppliers to help them negotiate better terms on raw materials, further reducing costs and enhancing the value proposition for customers.

"Fundamentally, as we scale, we continue to reap cost benefits across the board in purchasing, and that won’t stop. As we grow and collaborate more closely with our suppliers — whether private label or branded goods — we secure better terms, creating a win-win for everyone."

6. Barriers to Entry for New Competitors

Tiendas 3B’s success has also created significant barriers to entry for potential competitors. The Mexican grocery retail market is highly competitive, with established players like Walmart’s Bodega Aurrera setting the upper limit on prices. New entrants would need to contend with Tiendas 3B’s established presence and pricing advantage, which would be difficult to replicate.

The company’s ability to maintain low gross margins while offering competitive prices is a key barrier that makes it hard for new players to enter the market and compete on an equal footing.

7. Strong Unit Economics

The company’s unit economics reflect its ability to scale profitably. By Year 3, the average store generates Ps.24.7 million in annual sales with a 9.5% four-wall profitability margin. This translates to a 60% cash-on-cash return, with a targeted payback period of just 25 months. These robust financial metrics underscore the sustainability of the company’s growth strategy.

Tiendas 3B’s disciplined expansion and focus on operational efficiency ensure that each new store vintage performs better than its predecessors. This compounding effect on same-store sales, combined with rapid new store openings, positions the company for continued long-term success.

According to Anthony Hatoum, the ROIC of each store should continue to improve:

"Unless there is a significant increase in CapEx costs for any reason, the trend points toward improving returns. This is because each new vintage of stores is outperforming previous ones.

Two key factors drive this improvement. First, the Tiendas 3B brand is now better known, allowing new stores to start stronger since customers already recognize who we are and what we offer. More importantly, our value proposition continues to improve. The products and prices we offer today are significantly better than five years ago, and this ongoing enhancement fuels same-store sales growth and accelerates the ramp-up of new store vintages.

As long as this trend continues, the return on invested capital for each store should keep improving."

Market Opportunity: Low Penetration of Hard Discount Retailers in Mexico

Despite Mexico’s large and growing economy, the hard discount retail model remains significantly underpenetrated compared to other international markets where this format has seen substantial adoption. According to Nielsen, hard discount grocery stores accounted for only 2.3% of total grocery sales in Mexico in 2022, a stark contrast to 23.6% in Germany, 33.6% in Poland, and 24.1% in Turkey. The success of the model in these markets demonstrates its potential, yet Mexico remains largely untapped.

Why Mexico Presents a Strong Opportunity for Hard Discount Expansion

1. Large and Growing Addressable Market

The size and spending power of Mexico’s consumer base make it a compelling market for hard discount retailers:

Mexico’s grocery market is expanding – The formal grocery sector, with projections indicating a 7.6% CAGR through 2027, reaching $179B in sales.

The low-to-middle-income segment is dominant – About 80% of Mexico’s population falls within this socioeconomic bracket.

A significant share of household spending is on essentials – Households in the second to ninth income decile allocate nearly 48.4% of their annual budget to categories such as food, beverages, tobacco, personal care, household cleaning, and over-the-counter medicines — all of which are key product categories in hard discount stores.

Hard discounters thrive in markets where consumers prioritize affordable, high-rotation essential goods, making Mexico an ideal target for expansion.

2. Favorable Demographics Supporting the Discount Model

Demographic trends further reinforce the opportunity for hard discount expansion:

Mexico’s population is large and growing – With 129M people, it is the second most populous country in Latin America, and its growth rate of 1.1% per year surpasses that of the U.S. (0.6%) and the EU (0.1%).

A young, value-conscious consumer base – Mexico’s median age of 29.3 years is lower than in Brazil (33.2), Chile (35.5), and the U.S. (38.5), making its consumers more price-sensitive and receptive to value-driven formats.

Increasing urbanization and store accessibility – Mexico’s urban population continues to expand, with Tiendas 3B estimating room for at least 17,000 additional stores in urban areas with populations of 10,000+ residents.

In addition to these demographic factors, there are favorable tailwinds supporting Mexico’s consumers that are likely to drive demand for hard discount retailers:

Consistent real wage growth – Since 2018, Mexico’s minimum wage has seen substantial growth, with an 18.6% CAGR increase over the past five years. This growth has surpassed inflation, resulting in higher disposable income for lower-income households. The increase in wages makes hard discount stores even more appealing to consumers looking to maximize their purchasing power.

High remittances fueling spending – In 2022, remittances sent to Mexico hit a record $58.5B, representing a key driver of consumption among low- to middle-income households. As remittances continue to supplement household income, consumer spending is expected to rise, particularly in essential categories like those offered by hard discount retailers.

Hard discounters have historically succeeded in countries where consumers seek high-value, low-cost essentials, particularly in urban and densely populated areas — conditions that Mexico meets.

3. Room for Market Expansion in Mexico

Unlike Germany, Poland, or Turkey, where hard discounters command over 20% of grocery market share, Mexico remains a highly fragmented retail landscape with limited hard discount presence:

The traditional (informal) retail channel remains dominant – A significant portion of Mexico’s grocery market still relies on small local grocers and specialty food stores, which lack the cost efficiencies and pricing power of hard discount chains.

One dominant player, but no strong hard discount competition – Walmex leads the modern grocery channel, with over 30% market share, largely through its Bodega Aurrera discount format. However, other major players have yet to fully embrace the hard discount model, leaving a large whitespace opportunity for specialized discounters like Tiendas 3B.

Tiendas 3B’s ability to scale efficiently and offer essential goods at the lowest possible prices positions it to disrupt Mexico’s grocery landscape in the same way Aldi and Lidl reshaped Europe’s.

4. Proven Success of Hard Discount Models in Other Markets

The development of hard discount retail in Germany, Poland, and Turkey shows how the model thrives even as economies evolve:

Germany – Aldi and Lidl introduced hard discounting after World War II, during a period of economic hardship. Despite strong economic growth in the following decades, discount retailers expanded their market share as consumers continued to seek value.

Poland – After the fall of the Soviet Union in 1990, Poland’s grocery market was fragmented, similar to Mexico today. Biedronka, Aldi, and Lidl capitalized on the opportunity, growing hard discount penetration to 33.6% of the grocery market.

Turkey – BIM and A101 introduced hard discounting in 1995, when GDP per capita was $9,963 — comparable to Mexico’s economic conditions today. Despite rising incomes, hard discount stores gained popularity, reaching 24.1% of grocery sales.

These success stories highlight how hard discount formats appeal to value-seeking consumers across different economic cycles, suggesting Mexico’s long-term potential for adoption.

With a growing population, strong macroeconomic fundamentals, and a heavily fragmented grocery sector, Mexico represents one of the most attractive markets for hard discount expansion globally. Tiendas 3B is well-positioned to lead this transformation, tapping into a multi-billion-dollar opportunity in one of the world’s most promising grocery retail markets.

Potential International Expansion

Although the company has never mentioned it, a future international expansion could be a logical next step once Tiendas 3B reaches maturity in Mexico.

Several Latin American countries, such as Colombia, Peru, and Chile, have low penetration of hard discount retailers, presenting a potential opportunity for Tiendas 3B to replicate its successful business model across other Hispanic markets. Given its cost-efficient operations and proven scalability, the company could establish a strong presence in these regions.

While there have been no official indications from management regarding international expansion, it would make strategic sense once Tiendas 3B reaches a saturation point in Mexico and seeks new growth opportunities, but that will likely take many years.

Before ending this section, here’s a quote from TBBB’s Founder and CEO, taken from his IPO letter:

“In 2004, out of many countries I evaluated, I chose Mexico to start a Hard Discount grocery business. Whatever the metric I considered important for the business to thrive, Mexico always placed in the top three. So Mexico won. Having raised the funds to get started, I moved with my family to Mexico City in September 2004. At the time, I barely spoke Spanish and only knew a handful of people.

It helped to come in fresh and not assume you knew much. I asked a lot of questions to try to understand the Mexican consumer. I went to many neighborhoods in Mexico City, stood in the street with a clipboard and stopped anyone carrying shopping bags to ask them questions about their shopping habits and decisions. Surprisingly, most people talked to me (with my assistant translating), and when I asked, many agreed to host me in their homes for in-depth interviews. These talks with potential customers were invaluable. They allowed me to refine what we would ultimately offer in our first store, which opened in March of 2005. 2,200+ stores down the road, our customers are still telling us what is important to them and we are still listening.

My passion has always been to build things. I studied civil engineering. And I found that I love building businesses. From my previous startups, I have learned that: your business idea has to have at least one strong and sustainable competitive advantage, you have to pull together the strongest team that you can afford and that believes passionately in the idea, and you have to build a strong foundation from day one, one on which you can build that large business you are dreaming of. And that is what we did, our small initial team working out of a two-room office.”

Valuation

This is probably the only reason I haven’t started a position in TBBB — I wouldn’t call it a bargain at its current valuation. However, I don’t consider it expensive either — it’s likely close to its fair value. That said, I still believe the company has the potential to deliver strong results over the long term.

Let’s take a closer look.

As I explained, since TBBB reinvests every dime into CapEx to fund new store openings, using FCF metrics to value the company doesn’t make much sense. Instead, I believe the best approach is to assess it through Operating Cash Flow (OCF).

As shown in the chart below, TBBB is currently trading at around 17x OCF, which is near its median multiple. However, given that the company was listed on the NYSE only a year ago, historical comparisons have limited usefulness.

When comparing this multiple to comparable firms, TBBB may appear overvalued, but I believe its superior fundamentals justify a premium.

That said, based on its same-store sales trajectory and planned footprint expansion, I believe TBBB is well-positioned to compound revenues at at least 20% CAGR over the next decade. However, let’s focus on the next five years, as forecasting beyond that becomes increasingly uncertain.

Assuming a 20% CAGR over the next five years, TBBB would generate just over $173B MXN in revenue by 2030. Currently, the company converts around 6-7% of revenue into OCF, but this figure has been gradually improving. With further efficiency gains, I believe it’s reasonable to assume OCF will reach 9% of revenue — translating to $16.6B MXN (~$800M USD) in OCF by 2030.

Applying a 10x P/OCF multiple gives us an $8B USD valuation. However, given the likelihood of Mexican peso depreciation against the USD, I believe it’s prudent to apply a 20% discount to account for FX risk, bringing the valuation down to $6.4B USD.

Since its inception, TBBB has had zero dilution. Assuming that continues, this $6.4B valuation in 2030 would imply a CAGR of ~16.4% from today’s stock price.

All in all, TBBB’s valuation could be attractive if your investment horizon is 5+ years, assuming the company maintains its strong execution. However, at current prices, I don’t see it as a clear bargain for those seeking a multibagger in the next 2-5 years.

Yes, it’s a great company with the potential to outperform the market over the long run, especially considering my conservative estimates. However, as a highly concentrated investor, I don’t see it as a “no-brainer” at this valuation.

That said, TBBB will remain on my watchlist, as I firmly believe Anthony Hatoum has built an impressive company that could become a durable compounder.

Note for new readers: As a highly concentrated investor, I follow a simple philosophy: If I need to build a DCF model to determine whether a company is cheap, then it’s not cheap enough. I only buy a stock if I consider its valuation a “no-brainer.”

Insiders Alignment

As you know, I prioritize companies where the Founder remains the CEO and largest individual shareholder, and that’s exactly the case here.

Anthony Hatoum, the Founder & CEO of Tiendas 3B, holds ~10% of the company.

From what I’ve heard from Anthony, I appreciate his focus and determination in executing simple strategies with precision. Unfortunately, I couldn’t find any recent interviews with him, but based on the few earnings calls the company has held since its inception, it’s clear that he knows what he’s doing.

Additionally, Sami Khouri (Director and Board member) owns ~4% of TBBB, bringing total insider ownership to nearly 15%. Both Anthony and Sami participated in a recent secondary (non-dilutive) offering as sellers of shares, meaning their ownership decreased last month.

Risks To Mention

Investing in Tiendas 3B presents several risks, many of which stem from broader economic factors, industry-specific challenges, and market dynamics within Mexico. While the company is well-positioned for growth, it is important to understand the various risks that could impact its ability to execute on its strategies and drive value for shareholders.

1. Economic Sensitivity and Consumer Spending

Tiendas 3B's business model is heavily influenced by consumer spending, which is directly tied to the broader economic environment in Mexico. A downturn in the economy — whether due to domestic factors, such as inflation, or global events — could lead to reduced consumer purchasing power. Even a small dip in wages or disposable income could impact demand for discounted products. The company’s reliance on the low-to-middle-income segment, which is particularly price-sensitive, heightens its vulnerability to fluctuations in economic conditions.

Moreover, currency fluctuations and interest rate changes in Mexico could exacerbate the challenges of maintaining consistent sales and profitability. A sudden spike in the cost of imported goods could push prices higher, putting pressure on both margins and consumer demand, particularly in a competitive, price-driven market like Mexico’s.

Here’s what the Founder & CEO has to say about occasional Fx headwinds:

"It's business as usual for us. Our stores continue to open, and our sales trends will keep rising."

"All manufactured goods in Mexico have highly dollarized variable costs. The non-dollarized component is primarily labor-related. Take diapers, for example — we sell diapers. The super absorbent powder, cellulose, and elastic bands are all priced in dollars. Even the machines used to manufacture them were purchased in hard currency at some point. The non-dollarized portion consists mainly of labor costs and, to some extent (with a delay), energy costs. If you ask me for an exact percentage, it would be difficult to pinpoint, but the underlying forces driving these costs are similar across nearly every product."

And about consumer spending:

"In response to your second question about what's happening in the market, yes, we've heard that consumers may be feeling some tightness in their wallets. However, we haven't seen any impact on 3B. We continue to perform very strongly. The hard discount model is particularly attractive during recessions, and once we acquire those customers, they are unlikely to leave when the market improves."

2. Competitive Landscape and Market Pressures

The retail industry in Mexico, particularly the discount sector, is highly competitive, with multiple players fighting for market share. Walmart’s Bodega Aurrera and other supermarket chains already dominate the space, while local convenience stores remain a strong presence. As a relatively new player in the market, Tiendas 3B will face competitive pricing pressures, which could limit its ability to maintain the low-cost advantage that has driven its success so far.

Moreover, competition is not just limited to physical stores. The growing popularity of e-commerce and digital shopping platforms in Mexico introduces a new layer of complexity. As online shopping expands, brick-and-mortar stores could face declining foot traffic, further amplifying the need to continuously adapt store formats and operations to stay relevant.

Here's what the Founder & CEO has to say about competitors:

"Regarding your question about Neto and other competitors — you asked several questions, but focusing on Neto, we currently have around 1,500 Neto stores located near our own. Despite this, our performance remains extremely strong. We welcome competition and are confident that our value proposition is stronger than most. By consistently offering the best value for money, we continue to attract more customers, increase the number of transactions, and drive higher basket sizes over time.

It's difficult to isolate a specific 'Neto effect' from the broader strong trend in our same-store sales and overall store performance. However, pragmatically speaking, if you walk into a Tiendas 3B and then into a Neto, it's clear where customers would prefer to shop. I'll leave it at that."

3. Political and Geopolitical Risks

As Mexico is closely tied to both the U.S. and global economies, political shifts and changes in trade agreements could impact Tiendas 3B’s operations. For example, changes to the United States-Mexico-Canada Agreement (USMCA) or a shift in Mexico's trade relationships could complicate cross-border supply chains and pricing strategies.

4. Working Capital Management

Tiendas 3B operates with negative working capital, which means it depends on its ability to quickly turn over inventory and manage cash flow effectively. While this has enabled the company to maintain a lean operational structure, it also means that Tiendas 3B is vulnerable to cash flow disruptions or capital raising challenges. In particular, if the company faces slower-than-expected growth, it may struggle to cover operating expenses, invest in expansion, or service its debts, putting pressure on its financial stability.

Note: This is a great example of why understanding the context behind the numbers is crucial. A few years ago, I would have seen the negative working capital as a huge red flag for liquidity risk. However, I now recognize how this operating cycle strategy enhances efficiency and ultimately drives shareholder value.

Overall, I believe the company’s execution has been flawless in mitigating every risk mentioned here, especially given how recession-resistant this sector is.

Conclusion

Tiendas 3B has carved out a dominant position in Mexico’s hard discount retail space by delivering unbeatable value to consumers while maintaining an incredibly efficient business model. Its rapid store expansion, disciplined cost structure, and growing private-label portfolio provide strong tailwinds for long-term growth. With a proven track record of same-store sales growth and a scalable model that thrives on operational excellence, Tiendas 3B is well-positioned to capitalize on Mexico’s underpenetrated hard discount market.

However, while the company’s fundamentals are stellar, valuation remains a key consideration. At its current price, TBBB is not a screaming bargain, and as a highly concentrated investor, I’m only looking for “no-brainers”. For now, TBBB will remain on my watchlist. While I’m not ready to pull the trigger at current valuations, I have no doubts that this company has the potential to be a long-term compounder. If the right entry point presents itself, I’ll be paying close attention.

That’s it! Thanks for reading.

Great analysis! Thank you so much for sharing!

I think one of the most relevant points to look at in the future is whether the stock options will be exercised or not... I understand that they would involve ~60% more shares, which makes me think that all the great potential for future growth will be capitalized more by the owner and not so much by the minority shareholders (big risk!)...

On the other hand, FEMSA (owner of Bara) has proven capabilities to open more than 1,000 stores per year (as in the case of Oxxo) and US$10 billion in cash! They will be a great competitor if they decide to do so!

Thank you again for sharing!

impressionante deep-dive