Roughly two weeks ago, I wrote an article about two underfollowed small-cap stocks that were on my watchlist and asked you to choose one for a detailed Deep Dive.

Your choice was Alvotech (ALVO) — a very interesting European company operating in an underappreciated area within healthcare that’s poised to explode in the coming years.

That said, here’s a full breakdown of the investment thesis for ALVO.

Origins

Alvotech was founded in 2013 in Reykjavík, Iceland, by Róbert Wessman, a serial entrepreneur with a long and successful track record in the global pharmaceutical industry. Wessman had already established himself as a major force in generics through his leadership at Actavis — which he transformed from a small Icelandic firm into a global generics powerhouse, now part of Teva — and later as the Founder and CEO of Alvogen, a multinational generics company operating in over 30 countries. With Alvotech, he turned his focus to the next frontier in pharmaceutical access: biosimilars.

At the time of Alvotech’s founding, the biosimilar industry was still in its infancy. But Róbert Wessman saw an opportunity to challenge the high cost of biologic drugs by building a company solely dedicated to biosimilars — highly similar versions of already-approved biologic therapies. Unlike most of its peers, Alvotech was designed from day one to be fully vertically integrated. It invested early in its own development, clinical, regulatory, and manufacturing capabilities, building a high-end biosimilars facility in Reykjavik that meets both FDA and EMA standards.

Initially backed by the Aztiq Group, the Founder's private investment firm, Alvotech operated quietly for several years as it developed its platform and pipeline. It formally separated from Alvogen, though it maintained close strategic and commercial ties. The company later underwent a restructuring to support its public listing. In August 2021, Alvotech Lux Holdings S.A.S. was incorporated in Luxembourg as the new group holding company. On June 15, 2022, the entity became a public limited liability company under Luxembourg law, and soon after, Alvotech went public on the Nasdaq under the ticker ALVO via a SPAC merger with Oaktree Acquisition Corp. II.

Although Alvotech S.A. is the listed entity, it operates exclusively through Alvotech hf., the Icelandic subsidiary that owns and runs the company’s core business. Today, Alvotech is a global biosimilar player with a robust pipeline, strategic partnerships across major markets, and a clear founder-led identity rooted in a long-term vision of improving global access to affordable biologic medicines.

Business Model

Understanding Biosimilars

To understand Alvotech’s business model and long-term opportunity, it’s essential to first understand biosimilars — a fast-growing yet often misunderstood segment of the pharmaceutical landscape.

Biologics, the original reference products that biosimilars aim to replicate, are large, complex medicines derived from living cells. They’re used to treat serious, chronic conditions like cancer, rheumatoid arthritis, Crohn’s disease, and autoimmune disorders. These drugs have transformed patient care — but their complexity also makes them extremely costly, with annual treatment costs often exceeding $100,000.

Enter biosimilars: highly similar versions of approved biologic drugs. Though not exact copies (due to the biological complexity of the source material), biosimilars must demonstrate — through a rigorous development process — that they are clinically indistinguishable from their reference product in terms of safety, efficacy, potency, and quality. Most biosimilars even match the original biologic’s amino acid sequence, but regulators accept minor variations as long as they have no meaningful clinical impact.

Unlike generics — which are exact chemical replicas of simple small-molecule drugs (like ibuprofen or statins) — biosimilars are modeled after large, structurally complex biologics. Because of this complexity, true replication is scientifically impossible. The biosimilar development process is more akin to reverse-engineering an iPhone without access to the original schematics. It requires advanced analytical tools, sophisticated manufacturing, and detailed clinical trials to prove equivalence.

The Value Proposition: Biosimilars offer one of the clearest cost-saving opportunities in healthcare today. They can lower drug costs by 30–70%, improving access for patients while reducing the burden on payers and public health systems. These savings create room in healthcare budgets to fund next-generation therapies and drive innovation elsewhere.

With major biologics like Humira, Stelara, Eylea, and Prolia either already off-patent or approaching loss of exclusivity, the biosimilar market is poised for an inflection point. According to IQVIA, the global market is forecasted to grow at a 17% CAGR, reaching $126B by 2032. And yet, the competitive landscape remains surprisingly underpenetrated: of the 62 biologics with expired patents, 14 still have no biosimilar competition — and only 10% of biologics with near-term patent expiry have a known biosimilar in development.

The upside is large — but the path is long and requires capital. While a generic drug can often be brought to market in under two years for less than $10M, biosimilars typically take 6–9 years to develop, with investment per molecule ranging between $100-300M. Success demands more than capital: it requires advanced biologics expertise, regulatory coordination across global markets, and long-term planning across multi-year product cycles.

This complexity weeds out many ‘would-be’ competitors — but it’s also what makes the opportunity so compelling for companies like Alvotech, who have already made the heavy upfront investment and are now positioned to scale globally.

Regulatory Landscape

The development and commercialization of biosimilars are governed by a complex web of global regulations — with particularly stringent oversight in key markets like the United States and Europe. These frameworks are designed to ensure that biosimilars meet the same standards of safety, purity, and efficacy as their reference biologics. But while this regulatory rigor protects patients, it also creates significant challenges — and opportunities — for companies like Alvotech.

The U.S. Framework (FDA)

In the United States, biosimilars fall under the jurisdiction of the Food and Drug Administration (FDA) and are approved through a pathway established by the Biologics Price Competition and Innovation Act (BPCIA). The regulatory journey typically begins with preclinical studies, followed by the submission of an Investigational New Drug (IND) application, which must be approved before human trials can begin.

From there, the biosimilar undergoes multi-phase clinical trials conducted under strict Good Clinical Practice (GCP) standards. These trials often include head-to-head comparisons with the reference biologic to demonstrate biosimilarity — meaning there are no clinically meaningful differences in safety, efficacy, or immunogenicity.

Once the necessary data is collected, the sponsor must submit a Biologics License Application (BLA) under Section 351(k) of the Public Health Service Act. This BLA must include detailed analytical, nonclinical, and clinical data — as well as extensive information on the manufacturing process. The FDA also inspects manufacturing facilities for compliance with current Good Manufacturing Practices (cGMP) and may require lot release testing, post-marketing commitments, or Risk Evaluation and Mitigation Strategies (REMS).

While the FDA aims to review standard BLA submissions within 10 months, the clock can be reset due to major amendments, requests for additional information, or external disruptions. Approval is never guaranteed — some applications undergo multiple review cycles, and complex cases may be escalated to FDA advisory committees for expert input.

The European Union (EMA)

In Europe, biosimilars are regulated by the European Medicines Agency (EMA) under a centralized approval pathway, which has been in place since 2005 — making the EU a pioneer in biosimilar regulation. The EMA requires detailed comparability exercises, including structural and functional analysis, pharmacokinetic studies, and often clinical trials. Approval results in an authorization valid across all EU member states.

United Kingdom (MHRA)

Post-Brexit, the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) now governs biosimilar approvals independently, though its requirements remain largely aligned with EMA standards. This means biosimilars may need to go through separate submission and approval processes in the UK and EU — creating an added layer of complexity for global developers.

Rest of World

Other major markets — including Canada, Japan, Australia, and South Korea — each have their own regulatory frameworks. While some align closely with the EMA or FDA models, others include unique clinical data requirements, differing expectations around local trials, or variations in post-marketing surveillance. In emerging markets, biosimilar regulations are still evolving, with some countries lacking clear pathways or enforcing inconsistent standards — which can either delay entry or provide strategic first-mover opportunities.

Even after market approval, biosimilar companies must navigate a vast regulatory landscape covering labeling, advertising, adverse event reporting, supply chain transparency, data privacy laws, and anti-kickback statutes (especially in the U.S.). These obligations require sustained investment in legal, compliance, and pharmacovigilance infrastructure.

All in all, this regulatory complexity acts as a double-edged sword. On one hand, it serves as a formidable barrier to entry, deterring undercapitalized or inexperienced competitors. On the other, it introduces substantial regulatory risk. Development timelines can be derailed by shifting guidelines, stricter-than-expected requirements, or negative feedback from regulatory bodies. For a company like Alvotech, long-term success hinges not just on science and scale, but on the ability to consistently navigate this high-stakes regulatory environment across multiple jurisdictions.

That said, it's important to note that governments around the world are increasingly focused on reducing the cost of treatments for the conditions these biosimilars target. In that sense, their interests are somewhat aligned with those of the companies developing such solutions. However, this alignment doesn’t always translate into streamlined processes. Bureaucratic hurdles, evolving domestic healthcare policies, and lobbying from originator drug manufacturers can still create significant obstacles.

A Vertically Integrated Biosimilars Platform

Alvotech is one of the only pure-play biosimilar companies in the world — and one of the very few with full, end-to-end control over the entire biosimilar value chain, from cell line development to large-scale commercial manufacturing.

Unlike traditional pharmaceutical companies, which often treat biosimilars as side projects in a broader pipeline, Alvotech was founded with a singular mission: to become a global leader in biosimilars. This focused strategy allows Alvotech to operate with deeper technical expertise, faster development timelines, and a more capital-efficient model than diversified competitors.

At the core of this approach is Alvotech’s vertically integrated platform. All critical functions — including R&D, process development, clinical trials, regulatory strategy, and GMP manufacturing — are handled in-house. This tight integration creates several key advantages:

Faster speed to market, with fewer handoffs and delays

Higher product quality and consistency, from early-stage development through commercial production

Improved gross margins, by cutting out external manufacturing fees

Lower long-term CapEx per molecule, as infrastructure is shared across the portfolio

Importantly, the platform is designed to scale efficiently. Once Alvotech validates a manufacturing and development process for one product, it can layer on new biosimilar programs at relatively low incremental cost — a structural advantage as it prepares to roll out multiple new products over the next several years.

The backbone of this system is Alvotech’s 280,000-square-foot biotech campus in Reykjavik, Iceland. Completed in 2016, this state-of-the-art facility brings together R&D labs, process development suites, quality control units, GMP manufacturing, and corporate headquarters under one roof. Purpose-built for biosimilars, the facility supports full control across the entire production cycle and is fully compliant with international standards, including FDA and EMA regulations.

By keeping production in-house, Alvotech gains the ability to:

React quickly to regulatory or commercial developments

Avoid reliance on third-party CMOs

Maintain consistent product quality at global scale

Retain and develop institutional expertise across the value chain

The company has demonstrated deep expertise across the two most widely used host cell lines in biologics — Chinese hamster ovary (CHO) and SP2/0 — and uses two different methods to grow these cells: fed-batch and perfusion. This flexibility allows Alvotech to mirror the manufacturing approaches of a wide range of originator biologics, a critical factor in meeting the stringent analytical standards required for regulatory approval.

Recently, Alvotech expanded its development platform by acquiring the biosimilars R&D operations of Xbrane Biopharma in Sweden. This acquisition adds a preclinical R&D team, upstream development capabilities, and additional infrastructure in a key EU biotech hub. It also enhances Alvotech’s early-stage development capabilities, particularly in cell line engineering, analytical characterization, and process development.

Importantly, the deal includes a new biosimilar candidate for Cimzia, a tumor necrosis factor (TNF) inhibitor in the same therapeutic class as Humira and Stelara. Cimzia generates over $2.3B in annual global sales, and Alvotech has the opportunity to become the first company to launch a biosimilar version globally by 2028.

In short, Alvotech’s platform isn’t just a manufacturing network — it’s a strategic and valuable asset, enabling it to build, launch, and scale biosimilars faster and more efficiently than most rivals. As the biosimilar market enters a decade of rapid expansion, this integrated model might become a key source of long-term competitive advantage.

Alvotech’s Pipeline

Alvotech takes a disciplined, data-driven approach to biosimilar pipeline development — one that blends commercial strategy with technical feasibility. Rather than chasing every high-selling biologic, the company carefully selects targets where its fully integrated platform can offer a distinct advantage in terms of speed, quality, and cost.

At the heart of Alvotech’s approach is a six-point framework to evaluate each potential biosimilar opportunity:

Competitive Landscape – Assesses the originator drug’s size, growth, brand equity, and biosimilar saturation.

Launch Timing – Focuses on first-to-launch or early market entry to capture share ahead of later entrants.

Portfolio Fit – Ensures a balance of risk, pricing power, and alignment with internal technical capabilities.

Differentiation Potential – Looks for products where Alvotech can gain edge via delivery systems or interchangeability.

Feasibility and Cost – Weighs scientific complexity, clinical study requirements, and intellectual property hurdles.

Partner Insights – Incorporates input from global commercialization partners to align with market demand.

This strategic filter helps Alvotech build a high-quality, diversified pipeline with an emphasis on long-term value creation. The integrated nature of its platform also enables potential expansion into adjacent therapeutic areas, including respiratory and primary care, as manufacturing processes are adapted and scaled.

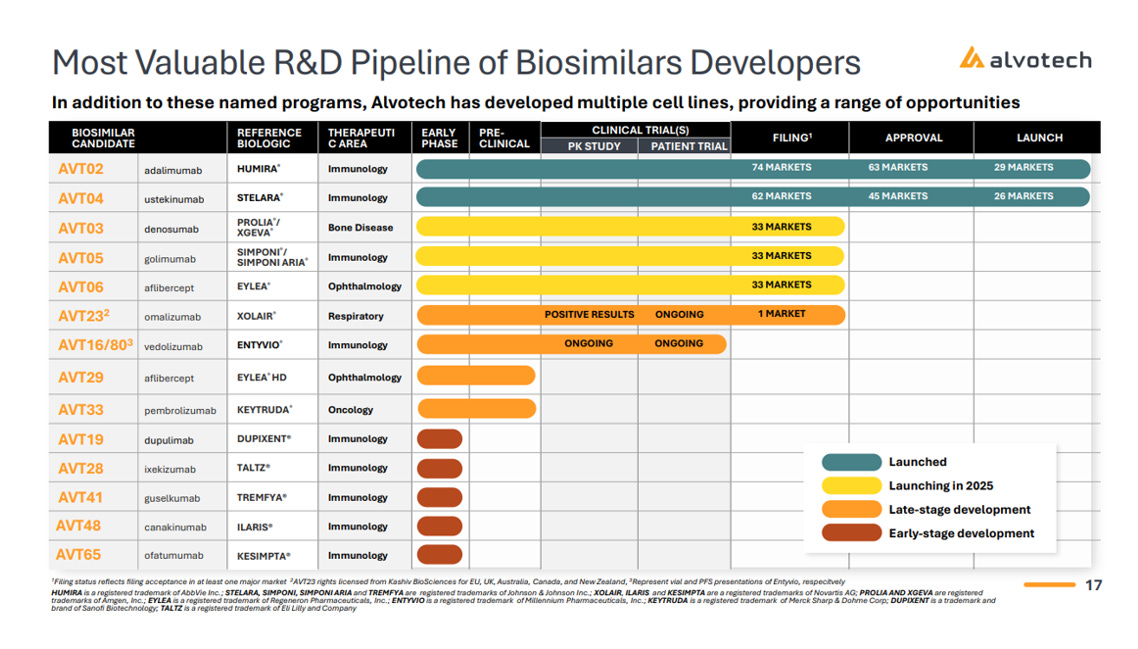

The company’s current pipeline includes two launched biosimilars, three products under regulatory review, and multiple assets in clinical and preclinical stages — spanning high-value therapeutic categories like autoimmune diseases, oncology, ophthalmology, gastroenterology, and bone disorders.

Approved and Commercialized:

AVT02 – Biosimilar to Humira® (adalimumab)

Alvotech’s flagship product, AVT02, is a high-concentration, citrate-free biosimilar to Humira — the world’s former best-selling drug, with ~$9B in global sales in 2024. AVT02 is approved in 55+ countries and marketed in the U.S., EU, Canada, Australia, and other key regions. It is also the first interchangeable high-concentration Humira biosimilar approved by the FDA.

“By the end of 2024, Humira biosimilars reached about 21% share of the U.S. market, according to IQVIA — though actual share may be higher due to untracked private-label sales, including Alvotech’s. With major PBMs excluding Humira from formularies in 2025, biosimilars could capture up to 50% of U.S. market share by year-end.”

This clearly demonstrates how quickly biosimilars can gain market share from branded biologic drugs.

AVT04 – Biosimilar to Stelara® (ustekinumab)

Stelara is a $10.4B biologic targeting IL-12 and IL-23 pathways for autoimmune conditions. AVT04 was developed using the same SP2/0 cell line as the originator and has now received approval in the U.S., EU, Canada, Japan, and other regions. U.S. launch occurred in early 2025.

In Regulatory Review (expected to launch by Q4 2025):

AVT03 – Biosimilar to Xgeva® / Prolia® (denosumab)

A dual-indication asset for bone health and oncology, AVT03 targets osteoporosis and cancer-related skeletal complications. After successful PK and confirmatory studies, the biosimilar is currently under review by both the FDA and EMA.

AVT05 – Biosimilar to Simponi® / Simponi Aria® (golimumab)

This TNF inhibitor treats rheumatoid arthritis and other inflammatory conditions. Alvotech is seeking interchangeability in the U.S., following strong study results and regulatory submissions in both the U.S. and Europe.

AVT06 – Biosimilar to Eylea® (aflibercept)

Eylea is a $9B+ blockbuster for age-related macular degeneration and diabetic eye disease. AVT06 delivered positive confirmatory data in 2024, and regulatory reviews are underway on both sides of the Atlantic.

In Clinical Development:

AVT16 – Biosimilar to Entyvio® (vedolizumab)

Entyvio is used in ulcerative colitis and Crohn’s disease. AVT16 entered confirmatory clinical trials in late 2024 and is one of just two global biosimilar programs currently in the clinic for Entyvio.

AVT23 (ADL018) – Biosimilar to Xolair® (omalizumab)

Acquired through a licensing deal with Kashiv Biosciences, AVT23 targets asthma, chronic urticaria, and nasal polyps. It has completed PK trials and is undergoing confirmatory studies.

Preclinical and Early-Stage Assets:

AVT33 – Biosimilar to Keytruda® (pembrolizumab)

One of the most ambitious assets in Alvotech’s pipeline, AVT33 targets Keytruda — the world’s best-selling oncology drug, with >$25B in annual sales. This is a complex monoclonal antibody program in preclinical development.

AVT19, AVT28, AVT41, AVT48, AVT65 – Biosimilars to Dupixent, Taltz, Tremfya, Ilaris, and Kesimpta, respectively — all currently in early-stage development.

With multiple assets in late-stage review and a steady flow of clinical and preclinical programs, the next 12–24 months are pivotal for Alvotech. Key inflection points include:

Potential FDA and EMA approvals for AVT03, AVT05, and AVT06

Expanded market uptake for AVT02 and AVT04, especially in the U.S.

Entry into new indications like respiratory, ophthalmology, and oncology

Ongoing investment into next-gen biosimilars, including potential interchangeable oncology products

The company’s execution over the next few years will determine whether it can become a top-tier global biosimilar leader.

Commercial Partnerships

Alvotech doesn’t try to commercialize its biosimilars alone. Instead, it has built a global network of strategic commercial partners to bring its products to market — covering over 90 countries across North America, Europe, Asia, Latin America, and the Middle East.

Rather than investing in a costly global salesforce, Alvotech licenses its biosimilars to established pharmaceutical companies with deep expertise in local markets, regulatory systems, and payer dynamics. These partners take care of market access, pricing, reimbursement, branding, and distribution — allowing Alvotech to stay laser-focused on what it does best: developing and manufacturing high-quality biosimilars.

Key Partners include:

Teva Pharmaceuticals (United States)

Dr. Reddy’s (United States, Europe, UK)

STADA Arzneimittel (Europe)

Fuji Pharma (Japan)

Cipla (Australia, New Zealand, South Africa)

Advanz Pharma (EEA, UK, Canada, Australia, New Zealand)

DKSH (Southeast Asia and South Asia)

YAS Holding / Bioventure (Middle East and Africa)

JAMP Pharma (Canada)

Abdi Ibrahim (Turkey)

Kamada (Israel)

MegaLabs, Libbs, Stein, Tuteur, Saval (Latin America)

Each agreement typically follows a two-part structure:

Licensing

Alvotech grants partners exclusive rights to commercialize specific biosimilars in their territories. In return, Alvotech receives a combination of:

- Upfront payments upon signing

- Development milestones (e.g., clinical trial success)

- Regulatory milestones (e.g., filing or approval)

- Commercial launch milestones

- Sales-based milestones tied to revenue thresholds

Supply & Manufacturing

Alvotech retains full control of manufacturing and supplies the finished product to partners. In exchange, it earns revenue via a royalty structure — typically 35–45% of the estimated net selling price, or a predefined floor price, whichever is higher. In some cases, tiered royalties apply if sales surpass certain thresholds.

This approach gives Alvotech predictable, high-margin revenue without having to manage the complexities of local regulatory submissions, payer negotiations, or sales execution.

Here are some of the strategic advantages:

Scales global reach without the overhead of building out international infrastructure

Reduces commercialization risk, especially in fragmented or high-barrier healthcare markets

Accelerates time to market by leveraging partners’ regulatory and reimbursement expertise

Generates non-dilutive capital through upfronts, milestones, and royalties

By aligning with trusted, market-leading partners and structuring mutually beneficial agreements, Alvotech ensures its biosimilars reach patients across the globe — while keeping its own operations lean and focused.

However, competition is intensifying — and distribution will be a key differentiator in the long term. While Alvotech’s strategy of relying on local partners has proven effective for early market access and rapid global reach, it may face limitations as the biosimilar landscape becomes more crowded.

As prices fall and payer systems consolidate around a few preferred suppliers, companies with deeper pockets, direct control over sales, and broader negotiating power may have the upper hand. Alvotech’s reliance on third parties means it gives up a degree of control over branding, market access, and pricing strategy — elements that will become increasingly critical in the fight for share. It’s unclear whether this lean, partner-driven model will be enough to compete with large pharmaceutical players that can leverage their scale to dominate formulary access and tender-based systems.

For now, Alvotech’s approach allows it to move quickly and conserve capital. But over time, as major pharmaceutical companies increasingly enter the biosimilar space, it may need to adapt its strategy to remain competitive.

Competition

Alvotech operates in a highly competitive and dynamic market, where success depends on speed, quality, cost, and scale.

That said, the competitive pressure is intense and growing. Each of Alvotech’s programs faces a wide array of challenges:

AVT02 (adalimumab biosimilar to Humira): Key competitors include AbbVie (the originator), Amgen, Boehringer Ingelheim, Biocon/FujiFilm, Celltrion, Fresenius Kabi, Pfizer, Samsung Bioepis, Coherus, and Sandoz. While many competitors have launched or are developing 50 mg/mL versions globally, only Alvotech, Celltrion, and Sandoz have regulatory approval in the EU for a 100 mg/mL formulation. In the U.S., AVT02 (SIMLANDI) received FDA approval on February 23, 2024, with interchangeability designation and exclusivity for an undetermined period — an important competitive milestone.

AVT04 (ustekinumab biosimilar to Stelara): Competitors include Janssen (the originator), Amgen, Celltrion, Bio-Thera, Formycon, Dong-A/Meiji Seika, Samsung Bioepis, and Biocon. Alvotech has secured settlement agreements with the originator enabling future launches in the U.S., Europe, Canada, and Japan.

AVT06 (aflibercept biosimilar to Eylea): Regeneron, Amgen, Celltrion, Formycon, Altos, Sam Chun Dang, Samsung Bioepis, Sandoz, and Viatris/Biocon are among the competitors. Regeneron is actively defending market share through label expansions and higher-concentration formulations.

AVT03 (denosumab biosimilar to Prolia/Xgeva): Key competitors include Amgen (the originator), Sandoz, Celltrion, Fresenius Kabi, Samsung Bioepis, Gedeon Richter, mAbxience, Biocon, Henlius, and Teva — all of which have disclosed biosimilar development plans.

AVT05 (golimumab biosimilar to Simponi): Janssen (the originator) and Bio-Thera are primary competitors. Janssen is strengthening its market position through label expansion and broader international approvals, which may indirectly support the market opportunity for AVT05.

AVT23 (omalizumab biosimilar to Xolair): Alvotech anticipates competition from Genentech (the originator), Celltrion, and Teva. Genentech is pursuing label expansions to maintain the reference product’s competitive edge.

Even though Alvotech has achieved meaningful regulatory milestones and is positioned to launch in key markets thanks to settlement agreements and differentiated product features like high-concentration formulations or interchangeability, the reality is that biosimilars are fundamentally a scale game. Over time, pricing pressure is inevitable. As more biosimilars to the same reference product come to market, prices will fall — just as they did in the generics industry. Margins may compress, and commercial success will increasingly hinge on payer access, procurement contracts, and the ability to sustain low-cost manufacturing.

Moreover, Alvotech is competing not just with emerging biosimilar players, but with global pharmaceutical giants like Janssen, Amgen, Pfizer, and Sandoz — companies that have greater financial flexibility, global brand recognition, and in-house commercial infrastructure. These incumbents may be better positioned to win large tenders, secure top-tier formulary placement, and absorb pricing pressure.

Alvotech’s current advantages are real — particularly its integrated development platform and early regulatory wins — but the biosimilars business is unforgiving. To stay competitive over the long run, the company will need to continuously innovate while maintaining operational efficiency and expanding selectively into high-margin, underpenetrated therapeutic areas.

Current and Near-term Numbers

Income Statement

As mentioned earlier, Alvotech’s revenue currently comes from just two biosimilars — AVT02 and AVT04 — both of which only recently entered full commercialization globally.

Despite this limited portfolio, 2024 was a breakthrough year. Revenue surged ~427% YoY, rising from $93.4M in 2023 to $492M in 2024. The bulk of that growth was driven by the U.S. launch of AVT02, Alvotech’s biosimilar to Humira, which received FDA approval in early 2024 with interchangeability status.

It’s worth pointing out the company’s ability to leverage operating scale. Alvotech posted its first year of operating profit in 2024 — $69.6M compared to a loss of $354.9M the year before. That dramatic swing highlights the operating leverage embedded in its model: once biosimilars are approved and launched, the cost base doesn’t grow nearly as fast as revenue.

Everything seems to be trending in the right direction — except for one major drag: finance costs. These remain high due to the company’s substantial debt load, which we’ll cover in the next section on the Balance Sheet. For now, it’s enough to say that finance expenses are the main reason Alvotech isn’t yet net profitable.

The company considers several drivers of its margin expansion — mostly tied to increasing product revenue, manufacturing efficiencies, and portfolio scaling — as outlined in the company’s latest presentation:

2025 Guidance and Long-term Outlook

Management expects continued strong growth in 2025 and beyond. Importantly, the company issued a longer-term target of reaching $1.5B in revenue by 2028, with EBITDA margins between 40% and 45%.

Even if Alvotech falls slightly short of these targets, it would still mark a major transformation from where the company is today — and would strongly validate its business model.

Cash Flows

Since its founding, Alvotech has been a cash-burning business, as is typical for biotech companies in the development phase. The cash flow statement still seems to reflect that reality: Operating Cash Flow for 2024 was -$236.8M.

However, if you strip out the effects of working capital changes — largely driven by inventory build-up and receivables related to newly launched products — the picture is much more encouraging. On an adjusted basis, Alvotech would have reported positive operating cash flow of around $104.1M in 2024.

This is a critical turning point.

The company now expects to reach FCF positive in 2025, marking its transition from a development-stage biotech to a self-funding, commercial-stage company. As explained in the most recent earnings call:

“Profit ultimately converts strongly to free cash flow as working capital and capex needs moderate over time as our launches mature and net operating losses reduce cash tax obligations over the near term. With these benefits of our business model, we expect to be free cash flow positive in 2025 and also to accelerate the pace of cash flow generation over the midterm, which will result in rapid deleveraging, providing further options to consider regarding future capital allocation, including the potential for dividends.”

Given the company’s capital structure, this shift to FCF generation couldn’t come at a better time.

Balance Sheet

At first glance, Alvotech’s balance sheet looks too risky. Its liabilities currently outweigh its assets, which could raise solvency concerns. But the story is more nuanced.

The company recently completed a debt refinancing, pushing most of its obligations several years into the future. While the balance sheet remains highly leveraged, the near-term pressure is manageable.

As of now, only $77M in debt matures over the next four years.

The real problem isn’t the timing of the debt — it’s the cost of it. Alvotech’s weighted average interest rate is 12.4%, a steep burden that eats into profitability and distorts the bottom line. These high finance costs are effectively more than cancelling out the operating profits the company is beginning to generate. It’s also likely one of the key reasons the stock continues to trade at such a low valuation, despite strong commercial momentum.

If Alvotech can hit its revenue and cash flow targets over the next 12–24 months, deleveraging should start — giving the company flexibility to refinance on better terms or even return capital to shareholders down the line. But until then, its capital structure remains one of the biggest overhangs on the stock.

Valuation

You already know my mantra: if I need to build a DCF model just to decide whether a stock is cheap, then it probably isn’t cheap enough.

That’s not the case with Alvotech. Based on management’s guidance of reaching $1.5B in revenue and 40–45% EBITDA margins by 2028, the company is currently trading at just ~3.75x its projected 2028 EBITDA. For a business with this level of growth and operational momentum, that multiple looks extremely low.

Let’s keep things simple. If Alvotech hits its 2028 targets and trades at a 10x EBITDA multiple by the end of that year — a conservative figure given its expected profitability and sector peers — the implied return from today’s share price would be around 165%, or an annualized IRR north of 30%.

However, this is just one scenario, and it assumes no equity dilution – highly unlikely given the company’s current financial structure. But even if you haircut the projections or assume moderate dilution, the valuation still appears compelling relative to the company’s potential.

Still, this opportunity comes with very real risks, as we’ll discuss in the next section. If execution falls short of expectations, that upside could evaporate quickly. But if Alvotech delivers — or even comes close — the upside potential could more than compensate for the risks.

Risks to Mention

1. Highly Leveraged Balance Sheet

Alvotech’s capital structure remains one of the biggest overhangs on the stock. With over $1B in debt and a weighted average interest rate of 12.4%, finance costs are still consuming all operating profits. While the recent refinancing improved near-term maturities, a cleaner balance sheet is necessary for meaningful multiple expansion — and that depends entirely on continued execution over the next few years.

2. Regulatory Risks & Approval Uncertainty

The biosimilar approval process is rigorous, region-specific, and inherently uncertain. Alvotech needs to demonstrate not just bioequivalence, but also no clinically meaningful differences compared to reference biologics — an interpretive standard that can delay or derail approvals. Delays from the FDA or EMA, or requests for additional data, could significantly impact commercialization timelines and financial forecasts.

3. Manufacturing Complexity

Alvotech operates a single vertically integrated facility in Reykjavik. While this brings operational control, it also introduces risk: any disruption — whether from regulatory issues, supply chain bottlenecks, or physical damage — could materially affect production and product availability.

4. Limited Product and Market Diversification

As of now, the bulk of Alvotech’s revenue comes from just two products (AVT02 and AVT04), and commercialization is still limited to select geographies. This concentration leaves the business vulnerable to any setbacks tied to those products or markets.

5. Dependence on Commercial Partners

Alvotech relies heavily on partners for distribution and sales across key regions. While this strategy limits upfront commercial costs, it introduces execution risk. If a partner underdelivers, exits the agreement, or runs into regulatory challenges, ALVO's market penetration and revenues could take a hit. In the long run, this structure could prove suboptimal — especially when facing larger competitors with stronger in-house commercial capabilities.

6. Intensifying Competition in Biosimilars

While Alvotech benefits from strong early positioning in several high-value biosimilars, competition in this space is intensifying rapidly. Large pharmaceutical companies and well-funded biotech firms are increasingly entering the biosimilars market, attracted by the long-term growth opportunity. Many of these competitors benefit from deeper pockets, broader commercial infrastructure, and more established regulatory relationships. Alvotech’s first-mover advantage could erode over time, especially if rivals bring biosimilars to market with superior pricing, better supply chains, or stronger commercial partnerships.

7. Potential Dilution

While dilution risk has diminished now that Alvotech is nearing free cash flow positivity and has restructured much of its debt, investors should remain aware of outstanding warrants and the company’s history of equity raises. Future dilution, while more controlled, is still a realistic possibility.

8. Material Weaknesses in Internal Controls

One red flag I can’t ignore is Alvotech’s disclosure of material weaknesses in its internal control over financial reporting. The company admits it lacks sufficient personnel with internal controls expertise, has inconsistently applied key controls, and relies on ineffective IT systems. These weaknesses increase the risk of material misstatements in the financials, whether due to error or oversight.

Yes, this kind of disclosure isn’t unheard of for recently public firms or companies growing hundreds of percent per year — but I personally don’t feel comfortable with it. Strong internal controls are the backbone of reliable financial reporting, and that’s something I can’t give up on.

To its credit, management has launched a remediation plan and brought in external consultants, but until these fixes are fully implemented, tested, and sustained, this remains a serious risk. For me, this isn’t something to ignore, especially as a highly concentrated investor who doesn’t like to face this kind of unnecessary risk.

Note: This type of issue doesn’t automatically break a thesis — it may be resolved quickly and only a matter of amateurism due to the sudden increase in the company’s scale. For example, my largest position, NBIS, also disclosed a similar warning. But in that case, the cause is tied to the corporate restructuring following the divestiture of Yandex’s Russian assets and the formation of Nebius Group, which includes three subsidiaries and a much more complex annual report. That situation has a clearer justification, and the team behind it has decades of experience managing a public company — which makes me far more comfortable. That’s not really the case here. Even more importantly, NBIS’ Founder and CEO revealed that they were unaware they would be publicly listed on the stock market so quickly. They received a phone call on Friday from Nasdaq informing them that they would continue Yandex’s previous listing on Monday under a different ticker, forcing them to rush to meet compliance requirements and prepare investor materials. It’s clear they couldn’t prepare everything perfectly, but they at least stated that all issues should be resolved by Q4 2025 — a level of guidance that ALVO did not provide.

9. Tariff Risk – U.S. and Europe Trade Tensions

Another risk that investors should be aware of is the potential for tariffs on pharmaceutical products imported into the U.S., particularly under Trump’s administration. Since Alvotech manufactures its products in Europe and the U.S. is expected to be its largest commercial market, any new or increased tariffs could materially impact its cost structure.

Higher import costs would not only raise the cost of conducting clinical trials in the U.S. but also reduce gross margins on commercial sales, making Alvotech less competitive. This is especially important considering how crucial it is for the company to reach profitability in the coming years to deleverage its Balance Sheet.

Insiders’ Alignment

Róbert Wessman, ALVO’s Founder and CEO, maintains significant control and financial interest in the company:

Aztiq Pharma Partners, his private investment firm, holds 33.5% of Alvotech’s shares.

Celtic Holdings, a joint venture between Aztiq and UAE-based YAS Holding, owns another 29.8%.

Combined, these two vehicles give him control over more than 63% of the company, aligning his interests closely with long-term shareholders and ensuring strategic continuity.

That said, while I respect his vision and track record, one thing that slightly tempers my enthusiasm is the fact that Wessman also manages other companies. While this diversified involvement can bring synergies and a broader strategic perspective, I generally prefer to see a CEO fully dedicated to one company — especially in a business as complex and execution-dependent as Alvotech.

Final Thoughts

Alvotech is definitely a very interesting company. It operates in a critical and fast-growing segment of healthcare, with a mission that’s genuinely valuable: making high-cost biologic treatments more accessible around the world. I truly enjoyed exploring the company’s business model and the biosimilars sector more broadly — it was a rewarding Deep Dive that taught me a lot of new and valuable insights.

From a valuation perspective, it looks undeniably attractive — especially if management executes anywhere near its long-term targets. Trading at under 4x projected 2028 EBITDA, the stock is priced as if the business has no future, which clearly isn’t the case. But when you look deeper, you realize that this low multiple is at least partially justified by the real and material risks ALVO faces.

If I were a more diversified investor, I’d likely consider building a small position — the upside potential over the next 2–3 years is extremely compelling and could justify taking on the associated risks. But as you know, I’m a highly concentrated investor. I only take large positions when I have very high conviction, and with Alvotech, I’m not quite there. I just don’t think I’d feel comfortable making this a core holding given the risk profile, even though I really like the direction the company is headed.

That said, Alvotech will remain on my watchlist. I’ll be following its execution closely, and if some of the key risk factors start to improve meaningfully, I’ll be ready to revisit the thesis. It’s a name worth keeping an eye on.

Great analysis - thank you!

Mais uma com excelentes fundamentais… Não sei como é que as encontras, mas obrigado por partilhares 😀